General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsBank Stocks Are On Their Longest Losing Streak Ever

S&P 500 Financials Index falls for 12th straight day

Bank stocks just hit a record -- a record of losses.

The S&P 500 Financials Index fell for the 12th straight day Tuesday, the longest losing streak on record. Coming into the year, many cited the tax overhaul and a rising rate environment as reasons for banks to rally. Instead, they’ve endured pressure from a flattening yield curve. The losses also come ahead of the final phase of the Federal Reserve’s annual stress tests and waning consumer confidence.

“They’re facing a rising rate environment, which historically has been fairly positive for banks,” Mona Mahajan, U.S. investment strategist at Allianz Global Investors, said on Bloomberg Television. “What we’re seeing here is the shrinking yield curve is actually not a good sign for the banks. Obviously, they like to borrow short, lend long, and if that yield curve is shrinking, that margin goes down as well.”

The S&P 500 Financials Index fell 0.4 percent to $443.50 as of 12:58 p.m. in New York Tuesday. Citigroup Inc. fell 0.3 percent, while Wells Fargo & Co. dropped 0.8 percent. JPMorgan Chase & Co slumped for the sixth straight day to extend its losses below its 200-day moving average.

Investors are taking note too, yanking cash from the largest exchange-traded fund tracking U.S. financials. The Financial Select Sector SPDR Fund, ticker XLF, has seen eight straight days of outflows, the longest streak in two years. Together, that’s amounted to nearly $1.8 billion in withdrawals from the fund, about 6 percent of its total market cap.

https://www.bloomberg.com/news/articles/2018-06-26/banks-endure-record-streak-of-losses-as-yield-curve-flattens

IronLionZion

(45,674 posts)that many investors are choosing to keep their money in long term bonds which keeps their yields low. The Fed is going to raise rates on short term bonds regardless, it's the only way forward.

The stock rally last year was Trumped up on expectations of tax cuts and less regulations. This year we are seeing idiotic tariffs and trade wars without any impact analysis.

The Trump recession is coming. I would be shifting money to savings and lower risk investments. Let Trumpsters take the loss when it comes in the stock market. They'll blame immigrants and poor people anyway.

OilemFirchen

(7,143 posts)Another feather in Trump's cap.

IronLionZion

(45,674 posts)things will head south shortly afterwards. It has happened every single time.

spanone

(135,952 posts)OilemFirchen

(7,143 posts)The yield curve is practically flat as of today. More concentration on short-term bonds at the expense of long-term will cause an inversion.

spanone

(135,952 posts)OilemFirchen

(7,143 posts)As of yesterday, the 2-year to 10-year gap was at .34%. As recently as four years ago, the gap was close to 3%.

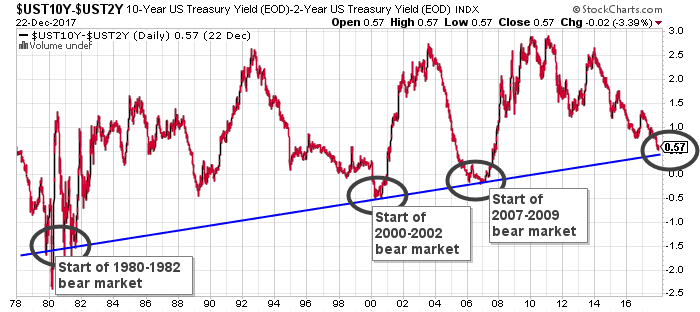

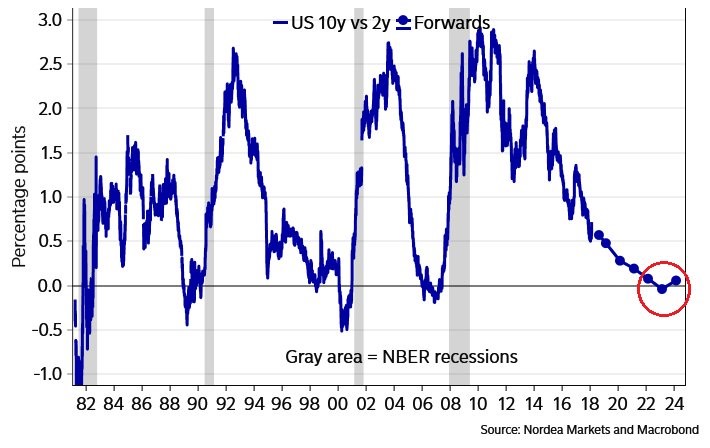

The last time the gap was this flat was 2006. Look at what happened:

ETA: BTW, there was a slight inversion in 2006. You can't see it in the chart above, but you can below. The inversion can be dramatic, as was the case in 1982, but each inversion has, since 1955, led to a recession:

smirkymonkey

(63,221 posts)Freethinker65

(10,118 posts)uponit7771

(90,378 posts)

gratuitous

(82,849 posts)Workers are sure as hell not getting paid more. Lots of businesses are announcing layoffs instead of the promised hiring sprees. Toys R Us is shuttering forever on Friday. And banks are on a losing streak. It's pretty obvious what's happening:

Goddam liberals have ginned up a hoax financial downturn just to make Trump look bad! Uncivil!

Doreen

(11,686 posts)Maybe you should have studied what the consequences would be if you supported what he told you he wanted for you.

Stupid assholes.