Welcome to DU!

The truly grassroots left-of-center political community where regular people, not algorithms, drive the discussions and set the standards.

Join the community:

Create a free account

Support DU (and get rid of ads!):

Become a Star Member

Latest Breaking News

General Discussion

The DU Lounge

All Forums

Issue Forums

Culture Forums

Alliance Forums

Region Forums

Support Forums

Help & Search

General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsThe solution, as it was during the largest economic growth in history, is taxes

ORIGINAL twitter thread:Link to tweet

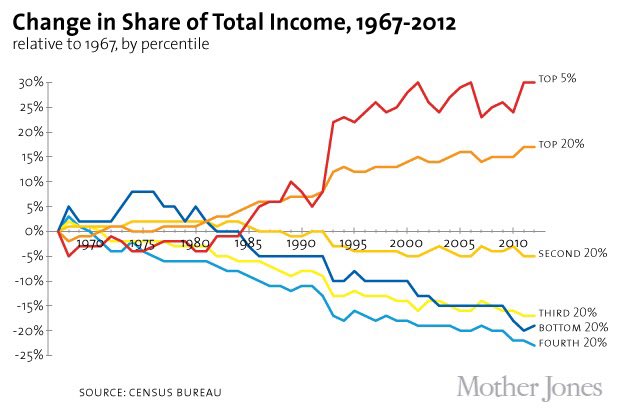

The richest 1% of Americans now makes over 25 times more than the other 99%.

With ballooning cost of health care, education, and cost/living, this is an unsustainable trend.

Philanthropy failed us. The solution, as it was during the largest econ growth in history, is taxes. 1)

With ballooning cost of health care, education, and cost/living, this is an unsustainable trend.

Philanthropy failed us. The solution, as it was during the largest econ growth in history, is taxes. 1)

UNROLLED thread:

The richest 1% of Americans now makes over 25 times more than the other 99%.

With ballooning cost of health care, education, and cost/living, this is an unsustainable trend.

Philanthropy failed us. The solution, as it was during the largest econ growth in history, is taxes. 1)

Watch Michael Dell of Dell Computers made a fool of by MIT economist Erik Brynjolfsson.

Notice that even Heather Long, econ correspondent of WaPo thinks the high tax rate was for “a brief moment in the 1980’s.”

2)

Link to tweet

Davos: on AOC's proposed 70% tax on the ultra wealthy: ‘Name one country where that’s worked’ • MIT Prof: ‘The United States’ • Jan 23 2019 | WEF

The US sustained a higher tax bracket of between 70% & 90% between the mid 1930’s and 1980. It did so while building the largest economic expansion in world history.

Econ inequality narrowed through those years. Families lived, saved, sent kids to college on 1 livable income. 3)

That trend reversed in 1980, when Reagan’s union busting and trickle down tax policy began transferring wealth to the rich. Wages stagnated for all but the top 20%, and funding for education has sharply declined, as cost for healthcare, education, and housing has skyrocketed. 4)

The billionaires of Davos spent the week scoffing at the proposal, favoring the philanthropic foundations they use to fund their own idealogical interests.

For 40 years they’ve failed to meet the economic needs of most Americans, as econ inequality has opened into a chasm. 5)

Perhaps you think a 70% tax rate for over $10 mil annually is too radical.

Ask yourself who has spent billions to convince you that the central Dem policy for 50 yrs after the new deal was “socialism,” and who pillaged the wealth of 99% of us in the process. 6)

Let’s dispel this strawman: raising the high tax bracket is not about denying our nations entrepreneurs & innovators reward for the efforts. The rich people of the ‘30’s - ‘70’s were still very rich, but their out-of-control greed since 1980 has gutted our nation’s commons..7)

..commons on which the America of today was built.

👉The interstate highway system

👉electrical and communication grids

👉Water and Power utilities

👉Schools, including the greatest higher education institutions in the world

All crumbling from lack of public investment. 8)

A higher tax bracket is not just economic populism, it’s common sense. The 37% tax rate is unsustainable, and doesn’t meet America’s needs to remain competitive in the 21st century.

Growing challenges of econ inequality, healthcare, education, and climate change demand it. 9)

InfoView thread info, including edit history

TrashPut this thread in your Trash Can (My DU » Trash Can)

BookmarkAdd this thread to your Bookmarks (My DU » Bookmarks)

3 replies, 742 views

ShareGet links to this post and/or share on social media

AlertAlert this post for a rule violation

PowersThere are no powers you can use on this post

EditCannot edit other people's posts

ReplyReply to this post

EditCannot edit other people's posts

Rec (8)

ReplyReply to this post

3 replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

= new reply since forum marked as read

Highlight:

NoneDon't highlight anything

5 newestHighlight 5 most recent replies

The solution, as it was during the largest economic growth in history, is taxes (Original Post)

CousinIT

Jan 2019

OP

Hermit-The-Prog

(33,573 posts)1. thank you for posting this!

Bookmarked.

JHB

(37,166 posts)2. Add another graphic: it's not just the rates, it's where the brackets reach

CousinIT

(9,276 posts)3. Great chart! Thanks. n/t