General Discussion

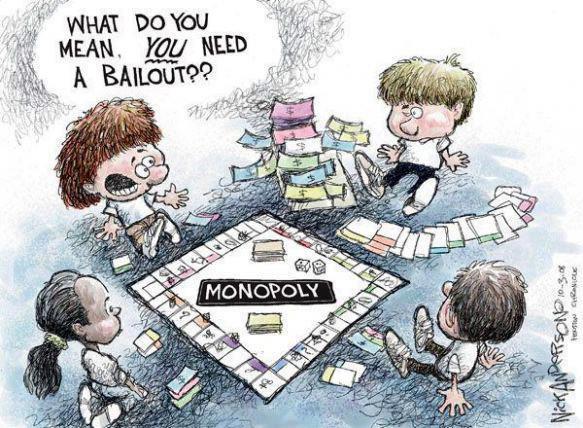

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region Forums@JohnFetterman to SVB exec Greg Becker:"Shouldn't you have a working requirement after we bail out

Link to tweet

( How awesome is that? lol )

blue neen

(12,336 posts)Very awesome. Love our new Senator!

BeckyDem

(8,361 posts)harun

(11,348 posts)marybourg

(12,650 posts)services to low income customers and prospective customers that they don’t provide now, in exchange for a bail out.

Caliman73

(11,760 posts)Policies enacted to prevent such reckless investing that created the problem in the first place. Like...

Maybe don't over leverage your debt...

Stop overinflating the value of investments...

montanacowboy

(6,116 posts)Tell them John, the greedy mother fuckers, it's take take take from the people and put into their pockets. I am so goddamn sick and tired of this shit.

murielm99

(30,790 posts)Deep State Witch

(10,482 posts)We missed you!

Response to BeckyDem (Original post)

Orrex This message was self-deleted by its author.

Butterflylady

(3,557 posts)Because they didn't think he could not win. Did he not only win, he won big.

Pinback

(12,174 posts)said nobody as progressive as Fetterman could possibly win statewide in Pennsylvania. Never mind that he'd already won statewide office to become Lieutenant Governor...

I'm sure there were (are?) lingering hard feelings from his win over the Dem incumbent to become Lt. Gov., as well. Whatever. I'm glad he's in there. He's already making a difference.

Kev80

(26 posts)I grew up in western PA. I moved as a young man ago to Harrisburg PA. I had a sibling who was in politics at the time. I didn’t even know the branches of government. Having been taught Civics, I wrote it off as quickly as Calculus. When will I ever use this. Living here, I soon realized the importance of government. Learned what a Majority/Minority Whip were. A Civics lesson long after I’ve been taught. I became a concerned citizen. An article appeared in the local Harrisburg paper about this Mayor from Braddock PA. Western PA, is always in my heart. You’ll meet no kinder people on the planet. Those steel mills and environs had such a diverse group of people. He came to a dead town as Mayor and revived what could be revived. He actually cares about the working class. It doesn’t surprise me that he is the Senator that was once a caring Mayor of Braddock.

BeckyDem

(8,361 posts)Kev80

(26 posts)I grew up in western PA. I moved as a young man ago to Harrisburg PA. I had a sibling who was in politics at the time. I didn’t even know the branches of government. Having been taught Civics, I wrote it off as quickly as Calculus. When will I ever use this. Living here, I soon realized the importance of government. Learned what a Majority/Minority Whip were. A Civics lesson long after I’ve been taught. I became a concerned citizen. An article appeared in the local Harrisburg paper about this Mayor from Braddock PA. Western PA, is always in my heart. You’ll meet no kinder people on the planet. Those steel mills and environs had such a diverse group of people. He came to a dead town as Mayor and revived what could be revived. He actually cares about the working class. It doesn’t surprise me that he is the Senator that was once a caring Mayor of Braddock.

NBachers

(17,192 posts)hibbing

(10,116 posts)MichMan

(12,002 posts)Since they clearly failed.

So, I don't agree with the Senator that there should be a "working requirement". There should be a "non working" requirement instead.

BumRushDaShow

(130,121 posts)MyOwnPeace

(16,955 posts)a great example of what teamwork does. He had a fantastic crew running his campaign - he was truly a ‘grass roots’ guy, holding rallies in every county of the state - and we had tremendous support for him here at DU once he won the primary.

There had been strong Conner Lamb support, but when it was all over the support for John was strong and effective - a winning combination.

Let’s keep working to keep things blue!![]()

BumRushDaShow

(130,121 posts)and kids (and yes even their dog) were his bedrocks! ![]()

AllaN01Bear

(18,867 posts)property? do u have cash on hand? we have to answer those questions . so should u and did u fly here on your fancy airplane?

moonshinegnomie

(2,508 posts)they should be required to pay back every dollar the bailout cost. when they have to file for BK becasue they dont have that type of money they should have every asset they own seized except for 15,000 times the number of years they worked for the bank. (i chose 15k because thats about the federal minimum wage on an annual basis.

any money they earn after the bankruptcy should be seized until the government is made whole.

this shoudl apply to any of the top corporate officers as well as the board of directors

peppertree

(21,732 posts)

housecat

(3,121 posts)geardaddy

(24,936 posts)Sarah Sherman does a hilarious monologue about Sen. Fetterman

Scroll to 2:09

"Senator-elect, and big gorgeous monster, John Fetterman" ![]()

TNNurse

(6,934 posts)grantcart

(53,061 posts)And no funds were even taken from the FDIC.

The shareholders of the banks lost their shares and the purchasing bank bought the assets.

BeckyDem

(8,361 posts)I believe that behavior is what Fetterman is referring to. The treasury went beyond the $250,000 when needed.

grantcart

(53,061 posts)The new share holders backed the deposits and as far as I know the FDIC was not involved.

In any case the FDIC has zero to do with tax dollars.

BeckyDem

(8,361 posts)You're correcting him?

My thoughts on his sarcasm are in reference to SVB's bad behavior and the subsequent actions required to address it.

excerpt: However, the Treasury Department, the Federal Reserve, and the FDIC announced they would make sure all depositors with accounts at SVB and Signature Bank would have access to their funds by the next day – beyond just the $250,000 guaranteed by the FDIC.

https://abcnews.go.com/Business/bailout-federal-government-bailout-silicon-valley-bank-signature/story?id=97846142

grantcart

(53,061 posts)FDIC finds SVB without enough capital to pass a stress test (they were still liquid and cashing out any depositor who wished to get their money).

FDIC takes over the control of the bank and takes all the shareholders assets.

Citizens Bank negotiates to take over the shares and SVB opens the next day with all of the depositors getting full credit for their deposits.

Not one cent of FDIC was spent and not one tax dollar was spent.

The Federal Reserve and the FDIC made sure that the depositors would have access by taking the shares from the shareholders and giving them to another bank. Because the balance sheet wiped out the assets of the shareholders the bank balance sheet was now showing a surplus.

Again not one penny of tax dollars was ever involved, or has been in a normal bank failure.

BeckyDem

(8,361 posts)I think we disagree on what is a normal bank failure.

I do appreciate your explanation none the less..thank you.

grantcart

(53,061 posts)Creates a bank that has more assets than liabilities because the obligations on the balance sheet that reflect the paid up capital are reduced to zero. That means that the bank that takes over gets all the assets and liabilities from the previous company but doesn't have to pay the previous owners anything.

Think of it as if you are buying a house which has equity of $ 100,000 and a mortgage of $ 50,000. In this case you take over the mortgage but don't have to pay anything to the owners for the equity.

We don't have a lot of bank failures but while it was larger than most it was only half as large as the Washington Mutual collapse.

Once the bank goes into receivership the FDIC contacts banks it seems good candidates for take over and receives offers from the banks, all of which are eager to take over the bank at pennies on the dollar. In the Washington Mutual case JP Morgan was able to acquire WM's assets of $ 307 Billion for only $ 1.9 Billion so these take over banks are volunteering, not forced to do it.

Because it is happening very quickly and the shareholders of the bank in receivership have no voice they can appeal after the fact to a federal bankruptcy trustee for redress but they are usually out of luck.

In any case no tax dollars are involved and no payments from the FDIC were involved but the speaker in question has purposely misrepresented the issue to inflame emotional reactions which is unfortunate and counter productive in the long run.

BeckyDem

(8,361 posts)That is his point, but at least I now see where you're coming from...although I disagree with your take on it.

By Paul Krugman | The New York Times

| March 14, 2023, 9:34 p.m.

Excerpt:

Furthermore, having to rescue this particular bank and this particular group of depositors is infuriating: Just a few years ago, SVB was one of the mid-size banks that lobbied successfully for the removal of regulations that might have prevented this disaster, and the tech sector is famously full of libertarians who like to denounce big government right up to the minute they themselves need government aid.

But both the money and the unfairness are really secondary concerns. The bigger question is whether, by saving big depositors from their own fecklessness, policymakers have encouraged future bad behavior. In particular, businesses that placed large sums with SVB without asking whether the bank was sound are paying no price (aside from a few days of anxiety). Will this lead to more irresponsible behavior? That is, has the SVB bailout created moral hazard?

https://www.sltrib.com/opinion/commentary/2023/03/14/paul-krugman-how-bad-was-silicon/

Alexander Of Assyria

(7,839 posts)Farmer-Rick

(10,242 posts)How often are we going to bailout these thieves? They pay no taxes, hide their profits and bribe our government all the while trying to turn the US into a dictatorship.

But we keep throwing good money after bad bailing out idiots who can't manage to keep banks working.

They are lucky we poors pay our taxes so we can bail them out. If we were like them, their wouldn't be any tax dollars to bail out their mess ups.

grantcart

(53,061 posts)No federal tax dollars were spent and no FDIC funds were involved.

The shareholders of the banks lost their investment and the take over banks got the existing assets (and liabilities) for pennies on the dollar.

I explained it in detail up thread.

Farmer-Rick

(10,242 posts)But thanks for explaining the process. I assumed it would just be like last time when we bailed out the banks during the 2008 crash. But it's going a bit differently now.

"The FDIC has spent roughly $23 billion on bank collapses this year, and is estimated to spend $13 billion more on First Republic Bank.

That money comes from the agency's Deposit Insurance Fund, which gets money from FDIC-insured financial institutions and interest earned on government bonds."

https://www.investopedia.com/who-is-paying-for-svb-first-republic-bank-bailouts-7487138

But it looks like the FDIC, thanks to FDR and the New Deal that started the FDIC, has enough funding to cover it but may have to increase other banks cost for the insurance. And we may be charged for that in the end. In SVB's case, the FDIC is covering more than the $250,000 deposits that's insured.

"The joint statement also noted, "Any losses to the Deposit Insurance Fund to support uninsured depositors will be recovered by a special assessment on banks, as required by law." While it's not clear how much the cost of the special assessment could be, some experts believe that the cost may have to come out of the pocket of bank customers, but it is too early to tell."

"SVB's sudden collapse required the Federal Deposit Insurance Corporation (FDIC) to step in to protect all its depositors.

The FDIC may sell or auction off SVB's assets to other financial institutions to help cover the costs.

The FDIC is funded by banks paying for deposit insurance coverage and may charge a special assessment should it need more funds."

https://www.fool.com/the-ascent/banks/articles/heres-who-will-pay-for-the-svb-bailout/#:~:text=While%20the%20fund%20is%20backed,earned%20on%20U.S.%20government%20investments.

grantcart

(53,061 posts)"You may think tax dollars ultimately foot the bill,but that is not the case".

In most cases it is covered by the receivership and no funds are used by the FDIC as they take the assets from selling the banks ownership and sell to a third party.

The Signature Bank was a significant pay out from the FDIC funds which may or may not recover more from selling assets in the futur In this case their ill advised involvement with cyber assets may be the culprit.

Thanks for sourcing an even more detailed article which again documents my basic point that the OP and the Senator quoted are not correct, no tax payer dollars were spent

As to the bailouts of 2008 it should be pointed out that when the government bailed out a company the existing shareholders lost and the government took equity. In the case of GM the government sold the equity of a healthy company and actually made money so in the end no tax dollars were lost and a profit was made for the government funds invested.

Farmer-Rick

(10,242 posts)It's always better to know the facts.

Thanks for pointing it out.

CousinIT

(9,278 posts)SilasSouleII

(364 posts)n/t

calimary

(81,610 posts)BeckyDem

(8,361 posts)calimary

(81,610 posts)BeckyDem

(8,361 posts)pfitz59

(10,423 posts)give that Exec some blisters.