Michigan

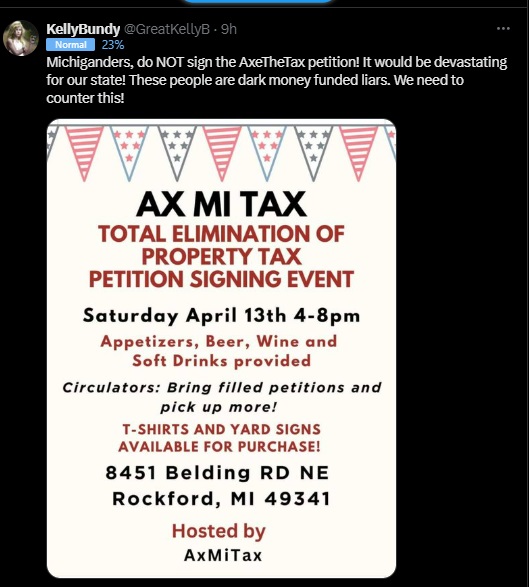

Related: About this forumThis AX MI TAX thing sounds like a really bad idea but I can see it passing if it gets on the ballot.

marble falls

(57,124 posts)jimfields33

(15,842 posts)A small fee per student for example. Make it less than what the property taxes are since it would be a bigger pool of people for revenue. Could it be that it may end up less for people who can spend on other things? Rents would drop since apartment buildings would not have that tax either. Definitely a different paradigm that’s for sure.

PoindexterOglethorpe

(25,865 posts)I guess those opposed to the property tax have never have children. Or have no clue that a decently educated younger generation is necessary for, well for instance well trained health care providers to take care of them in old age.

We all need to pay for public education whether or not we currently have or have ever had kids in public schools. The childless, those who chose private or secular education cannot be exempt.

I chose to send my sons to a secular private school because my older son was being bullied in the public school. I could afford the change, for which I am very grateful, but I realized that if necessary I could have gone to work cleaning houses -- as one other mother I knew there had done -- to pay for their school. The immense improvement in my older son's life at this new school, plus the amazing academics, had us switch younger son the next semester.

I'd occasionally get into conversations with other moms in the school parking lot, and many of them expressed resentment at paying school taxes. I always told them they were wrong, and why. Again, public schools depend on all of us. Heck, I currently live in a state where I never had kids attend school, and I have zero problem with paying school taxes here.

Fiendish Thingy

(15,631 posts)Same bullshit happened about 45 years ago in California, thought not quite as drastic.

marble falls

(57,124 posts)... or I don't have children, why should I pay taxes for school? You never paid for your kids' education and your parents did not pay for yours either. Schools get built on 30 year bonds. Your children and grandchildren will pay for your education.

Secondly it is in your interest to have your neighbor's kid get educated. When you as an aging boomer get hospitalized wouldn't you want that neighbor kid who's working a low paying healthcare job to know the difference between a liter and a gallon when he or she administers an enema on you?

The US was the first country to offer public education to all classes of children and it was financed by plating a town and designating specific lots that the proceeds were used for financing a school. Public education benefits the public. I enlisted in the Military so others didn't have to be drafted. That's why I get the best health care you can imagine at VA. You and I pay taxes so kids can be educated enough to enlist, or work or seek higher education.

Pay your damn property taxes and be glad your grandchildren will pay off your education as you pay off your parents' public education.

Are you sure you're a Democrat?

And when the hell did a land lord ever lower a fucking rent. That's the funniest thing I've heard all damn day!

MichMan

(11,940 posts)jimfields33

(15,842 posts)Love the education on DU though.

catbyte

(34,412 posts)improving local infrastructure. But the MIGOP would prefer us ignorant and angry.

marble falls

(57,124 posts)... of which comes from property taxes in MOST states. If a middleclass gets free from property taxes, so do do the wealthy, real estate trusts (the guys who raises rents) and businesses - who pay more property taxes than we little guys. When there's a short fall, who do you think gets to cover the short fall and loss of services, bub? YOU. You'll be raising your taxes by eliminating the property taxes paid by the wealthier.

Why are we carrying water for the wealthy to get them more tax cuts?

PlutosHeart

(1,281 posts)than MI.'s A lot. And you get less house. Houses in MN. are ugly unless you are higher income.

Not sure what this would do in as far as how things are funded there though.