Economy

Related: About this forumSTOCK MARKET WATCH -- Wednesday, 6 June 2012

[font size=3]STOCK MARKET WATCH, Wednesday, 6 June 2012[font color=black][/font]

SMW for 5 June 2012

AT THE CLOSING BELL ON 5 June 2012

[center][font color=green]

Dow Jones 12,127.95 +26.49 (0.22%)

S&P 500 1,285.50 +7.32 (0.57%)

Nasdaq 2,778.11 +18.10 (0.66%)

[font color=red]10 Year 1.58% +0.02 (1.28%)

30 Year 2.64% +0.04 (1.54%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

ret5hd

(20,573 posts)and i don't care that you don't care 'cause it's before midnight!

Tansy_Gold

(17,894 posts)And I'm glad to see a DUer that I'm not familiar with! ![]() and welcome!

and welcome!

i'm glad to see people get excited about being thefirst rec because it means they're waiting and watching for SMW and that means THEY care -- YOU care.

And SMW never sleeps. Oh, it nods off once in a while, but never really .. . . . .sleeps. ![]()

Demeter

(85,373 posts)Many a bout of insomnia has seen me chatting with Marketeers...and I've seen ret5hd about before!

Welcome to this haven of sanity on DU3! Stick around and post!

Tansy_Gold

(17,894 posts)Demeter

(85,373 posts)Take a bow, Tansy Gold!

Demeter

(85,373 posts)http://news.firedoglake.com/2012/03/13/foreclosure-fraud-settlement-docs-ii-giving-homes-to-charity-as-a-penalty/

Here’s the second installment in the review of the foreclosure fraud settlement documents. Exhibit D in this document lays out the menu for credits toward the settlement. When we talk about credits, the federal government and state AGs want you to assume that means a set amount of principal reductions that the banks will grant. But in reality, the banks can employ a variety of strategies to receive credit toward the settlement, including a number of routine actions they would probably undertake whether there was a settlement in place or not.

First, let’s look at the top line. Banks get a dollar-for-dollar credit on first-lien principal modifications on bank-owned loans when the borrower is under a 175% loan-to-value ratio. [E.g., you still owe $175,000 on a property whose current market value is only $100,000.] Any principal reduction on a portion of a loan over 175% is given half-credit. This stops the bank from getting credit on loans likely to default anyway. Banks can also get $0.40 credit on the dollar by forgiving forbearance on modifications they have already done. Forbearance occurs when a certain amount of principal is shifted to a balloon payment at the end of the loan. If the bank forgives that, they get partial credit, even though that doesn’t affect a monthly payment in the near term whatsoever.

When the loan is not owned by the banks but by investors in mortgage-backed securities, the credit for a modification drops to 45 cents for each dollar of principal reduction. There’s a provision in the rules that states “First liens on occupied Properties with an unpaid principal balance (“UPB”) prior to capitalization at or below the highest GSE conforming loan limit cap as of January 1, 2010 shall constitute at least 85% of the eligible credits for first liens (the “Applicable Limits”),” which is supposed to assure that the bank’s portfolios will be the primary source of first-lien write-downs. But as Yves Smith explains, there are ways to structure it so that the number of write-downs may conform, but the value is weighted more heavily on those investor-owned loans. After all, if you can get any credit at all with someone else’s money, you’re going to do it. (more on this in a later post)

If a first lien gets written down, and one of the five banks covered by the agreement owns the second lien, that second lien (typically a home equity line of credit) must be written down on equal terms. It doesn’t have to be extinguished entirely unless it’s 180 days delinquent. This violates standard priority, which would be to wipe out the second liens first before modifying the firsts. Since banks own most of the second liens, this gives them an implicit subsidy, and by improving the chances of the first lien to perform, it enhances the ultimate value of the second liens, giving an additional bank subsidy. “Performing second liens” (up to 90 days delinquent) actually get $0.90 on the dollar credit, so banks will have a lot of incentive to make their seconds current through whatever alchemy. More delinquent second liens (up to 180 days) get $0.50 on the dollar credit, and second liens delinquent over 180 days get $0.10 on the dollar....

IN OTHER WORDS, THIS STUFF WILL STILL BE IN COURT LONG AFTER THE HOUSES THEMSELVES HAVE CRUMBLED TO DUST...

The Mortgage Settlement Lets Banks Systematically Overcharge You And Wrongly Take Your Home By Abigail Caplovitz Field

http://abigailcfield.com/?p=1057

On my first read through of the consent agreements among the bailed-out bankers (B.O.Bs), the Feds and the States I saw much as had been promised. One thing I hadn’t seen coming, however, was that the B.O.Bs would now be allowed to systematically overcharge borrowers and steal their homes. Seriously. Who cares about $1 million or $5 million penalties if horrible damage can be inflicted without punishment?

To see what I’m talking about, you need to look at Exhibit E-1. (It’s in all the consent agreements; here’s Chase’s.) Exhibit E-1 is a 14 page table titled “Servicing Standards Quarterly Compliance Metrics.” That is, it’s a table that details what, precisely, will be monitored to make sure that the B.O.Bs are meeting the very pretty servicing standards detailed in Exhibit A (again part of all the agreements.)

Note: You may want to print out table E-1 while reading this, or at least keep it open in another browser window; these metrics are shocking enough you won’t want to take my word for it, you’ll want to verify I’m citing the text correctly.

Now, the table doesn’t come right out and say, we, the federal and state governments of the United States of America do hereby bless the institutionalization of servicer abuse, but it should. To understand why, you need to keep your eye on how the table’s columns are defined. For most issues, the critical columns are C “Loan Level Tolerance for Error” and D “Threshold Error Rate.” Later I’ll talk about the problems in Column F, the “Test Questions.”...MORE

Matt Stoller: Robosigning Still Going on at Wells Fargo, Reports HUD Inspector General

http://www.nakedcapitalism.com/2012/03/matt-stoller-robosigning-still-going-on-at-wells-fargo-reports-hud-inspector-general.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

I’ve been going over the mortgage settlement documents over the past few days – a lot has been released, with many implications. There is plenty to criticize. Subprime Shakeout has a great summary, and David Dayen has done a wonderful job going through the nitty gritty. Abigail Field has a spectacular review of the problems with the servicing standards. I’ll make a few criticisms of my own below. But I think the most interesting parts of the document release were the HUD Inspector General reports on the five banks and the DOJ complaint. What these prove is what we’ve always known – the law enforcement community knew exactly what these banks were doing. DOJ simply chose not to prosecute. There was intent to defraud, fraud, and frankly, according to HUD.

In fact, it’s not clear that the past tense is the correct tense to use. The Wells Fargo report is particularly interesting on that last point. Take it away, HUD OIG (italics are mine).

I’m sorry, but WHAT THE $&*@!?!? I’m so glad Eric Holder has cut a deal with Al Capone while Capone is still on a shooting spree. And note, this isn’t just robosigning, this is potentially overcharging homeowners with junk fees and just generally not verifying accurate data on who owes what to whom. There really is no lesson here except “crime pays”...

Demeter

(85,373 posts)...there’s good reason to suspect that this official confirmation of what numerous critics had claimed, that the OCC was not at all on top of servicing bad practices, was held back until the settlement was no longer deemed news. Why? Well, the OCC and other regulators maintained they had a solid grasp of what was wrong; this was critical to believing they were competent to negotiate a settlement. Thus this inspector general report undermines the legitimacy of the settlement (not that anyone who is not part of the problem believes it was adequate).

Both the summaries and the IG report’s overall conclusion are narrowly accurate (actually, it’s an encouraging sign that the Washington Post calls what used to be described as at most “foreclosure abuses” as “foreclosure fraud”). But is telling the public that the OCC missed the looming problems in foreclosure-land hardly qualifies as news. So the real question is whether the IG audit did an adequate job in assessing the OCC’s epic fail on foreclosure fraud and recommending improvements. The answer is a resounding no.

Second, this report is an exercise in Potemkin oversight. It enables a deeply pro-bank agency to stay on its present path; it’s meant to persuade the chump public that the Administration is serious about remedying regulatory fiascoes....

YVES ON A TEAR...WELL, AREN'T WE ALL?

Demeter

(85,373 posts)Progressives cheered when New York's progressive attorney general, Eric Schneiderman, was named to head a task force looking into the massive fraud committed by banks in foreclosing on thousands of homes around the country.

The foreclosure crisis is still ongoing, though, and the task force remains woefully underfunded.

So the Occupy-affiliated group F the Banks, along with the Campaign for a Fair Settlement is holding a "fundraiser"--hitting Bryant Park in New York City... with dollar bills (and pots and pans to bang), calling attention to Obama's big-dollar fundraiser for his reelection campaign while leaving

“This is our attempt to continue to put the pressure on the Obama administration to actually deliver on their promise of the Mortgage Fraud Task Force, which was formed early this year with the promise of holding accountable those who brought down the global economy,” Alexis Goldstein, a former Wall Street analyst and now a frequent MSNBC guest, told Allison Kilkenny at The Nation...

Demeter

(85,373 posts)Ever since the beginning of the financial crisis and quantitative easing, the question has been before us: How can the Federal Reserve maintain zero interest rates for banks and negative real interest rates for savers and bond holders when the US government is adding $1.5 trillion to the national debt every year via its budget deficits? Not long ago the Fed announced that it was going to continue this policy for another 2 or 3 years. Indeed, the Fed is locked into the policy. Without the artificially low interest rates, the debt service on the national debt would be so large that it would raise questions about the US Treasury’s credit rating and the viability of the dollar, and the trillions of dollars in Interest Rate Swaps and other derivatives would come unglued.

In other words, financial deregulation leading to Wall Street’s gambles, the US government’s decision to bail out the banks and to keep them afloat, and the Federal Reserve’s zero interest rate policy have put the economic future of the US and its currency in an untenable and dangerous position. It will not be possible to continue to flood the bond markets with $1.5 trillion in new issues each year when the interest rate on the bonds is less than the rate of inflation. Everyone who purchases a Treasury bond is purchasing a depreciating asset. Moreover, the capital risk of investing in Treasuries is very high. The low interest rate means that the price paid for the bond is very high. A rise in interest rates, which must come sooner or later, will collapse the price of the bonds and inflict capital losses on bond holders, both domestic and foreign.

The question is: when is sooner or later? The purpose of this article is to examine that question.

Let us begin by answering the question: how has such an untenable policy managed to last this long?

A number of factors are contributing to the stability of the dollar and the bond market. A very important factor is the situation in Europe. There are real problems there as well, and the financial press keeps our focus on Greece, Europe, and the euro. Will Greece exit the European Union or be kicked out? Will the sovereign debt problem spread to Spain, Italy, and essentially everywhere except for Germany and the Netherlands? Will it be the end of the EU and the euro? These are all very dramatic questions that keep focus off the American situation, which is probably even worse.

The Treasury bond market is also helped by the fear individual investors have of the equity market, which has been turned into a gambling casino by high-frequency trading. High-frequency trading is electronic trading based on mathematical models that make the decisions. Investment firms compete on the basis of speed, capturing gains on a fraction of a penny, and perhaps holding positions for only a few seconds. These are not long-term investors. Content with their daily earnings, they close out all positions at the end of each day. High-frequency trades now account for 70-80% of all equity trades. The result is major heartburn for traditional investors, who are leaving the equity market. They end up in Treasuries, because they are unsure of the solvency of banks who pay next to nothing for deposits, whereas 10-year Treasuries will pay about 2% nominal, which means, using the official Consumer Price Index, that they are losing 1% of their capital each year. Using John Williams’ (shadowstats.com) correct measure of inflation, they are losing far more. Still, the loss is about 2 percentage points less than being in a bank, and unlike banks, the Treasury can have the Federal Reserve print the money to pay off its bonds. Therefore, bond investment at least returns the nominal amount of the investment, even if its real value is much lower. (For a description of High-frequency trading, see: http://en.wikipedia.org/wiki/High_frequency_trading )

MUCH BACKGROUND INFORMATION

Now we have arrived at the nitty and gritty. The small percentage of Americans who are aware and informed are puzzled why the banksters have escaped with their financial crimes without prosecution. The answer might be that the banks “too big to fail” are adjuncts of Washington and the Federal Reserve in maintaining the stability of the dollar and Treasury bond markets in the face of an untenable Fed policy.

DISCUSSION ON BANKSTERS, TBTF, COLLUSION, GOLD AND SLIVER AND NAKED SHORTS AND MORE

The list is long. There is a limit to how many stupid mistakes and corrupt financial policies the rest of the world is willing to accept from the US. When that limit is reached, it is all over for “the world’s sole superpower” and for holders of dollar-denominated instruments.

Everyone wants a solution, so I will provide one. The US government should simply cancel the $230 trillion in derivative bets, declaring them null and void. As no real assets are involved, merely gambling on notional values, the only major effect of closing out or netting all the swaps (mostly over-the-counter contracts between counter-parties) would be to take $230 trillion of leveraged risk out of the financial system. The financial gangsters who want to continue enjoying betting gains while the public underwrites their losses would scream and yell about the sanctity of contracts. However, a government that can murder its own citizens or throw them into dungeons without due process can abolish all the contracts it wants in the name of national security. And most certainly, unlike the war on terror, purging the financial system of the gambling derivatives would vastly improve national security.

***********************************************************************

Paul Craig Roberts was Assistant Secretary of the Treasury for Economic Policy and associate editor of the Wall Street Journal. He was columnist for Business Week, Scripps Howard News Service, and Creators Syndicate. He has had many university appointments. His internet columns have attracted a worldwide following. www.paulcraigroberts.org

See also - Global Economic Collapse For Dummies: Forget the complicated flowcharts, scenarios, and government-banking-system reacharounds, the global economic collapse has never been so easy to comprehend

Demeter

(85,373 posts)Tansy_Gold

(17,894 posts)Demeter

(85,373 posts)NO need to monger fear....it is a natural phenomenon under circumstances like these.

Po_d Mainiac

(4,183 posts)Demeter

(85,373 posts)with no reusable pieces, just rubble

Demeter

(85,373 posts)NOTHING GOOD, I'LL WARRANT

http://www.aljazeera.com/indepth/opinion/2012/05/2012526163512636123.html

Even as the Obama campaign ramps up its operations for the 2012 presidential race and seeks to gin up its liberal base, the White House has become increasingly more assertive in pushing for a global network of US military bases. Indeed, if the progressive community was paying attention, it might be somewhat surprised to find that Obama has been even more militaristic in some ways than predecessor George Bush, the long-time bane of the US left. In particular, Obama has been quietly constructing American bases in the remote Southern Cone. It's an intriguing news story which has received scant attention in the US media, much less the so-called progressive media.

In a recent column, I discussed the novel story of Obama's new military base located in the Chaco region of northern Argentina. Officially, the Resistencia base forms part of a joint US-Argentine initiative which will provide joint emergency services and eventually deploy troops for "humaninatarian relief". Local authorities have emphatically stressed that the installation is a civil base only, and will be subject to the oversight of provincial authorities. Nevertheless, the Argentine left claims that Resistencia amounts to a covert US intelligence operation, thinly disguised as humanitarian relief. One Argentine legislator has even called for an investigation into the "Yankee base in Chaco" and recently political and environmental activists held a demonstration against the installation.

If the Resistencia story was not outlandish enough, now comes word that the Obama administration has pushed for yet another base, this one located just across the border in Chile. The installation, which has cost the US taxpayer nearly a half million dollars to construct, is situated in the port city of Concón in the central Chilean province of Valparaíso. In Chile, the political debate surrounding the Concón base mirrors the previous fight over the Resistencia installation: while local authorities and the US military claim that Concón will be used for training armed forces deployed for peacekeeping operations, the Chilean left believes the base is aimed at controlling and repressing the local civilian population.

The social impact of US bases

For Chilean civil society, which has longtime experience with US interventionism going way back to the dark days of the Augusto Pinochet military dictatorship, the Concón base raises eyebrows. Human rights groups charge that the actual design of the base - which simulates an urban zone with eight buildings as well as sidewalks and roads - suggests that the Chilean military is interested in repressing protest. According to United Press International, Concón "is growing into a major destination for regional military trainers and defence industry contractors".

The facility is run by the US Southern Command, headquartered in Miami, Florida. The US, which has in recent years been losing some of its political and economic hegemony in the region, is interested in getting another foothold for its military operations. Indeed, ever since the nationalist/populist regime of Rafael Correa booted Washington out of its base in Manta, Ecuador, the US has been on a quest to find alternative sites in South America.

PROBABLY ANOTHER PREDATOR DRONE INSTALLATION...IN CASE THERE'S AL QAEDA IN VENZUELA...

westerebus

(2,976 posts)If memory serves, * bought a large chunk of land in Chile while still in the White House.

Demeter

(85,373 posts)although I cannot think of any force of nature or man that make him let go....

westerebus

(2,976 posts)Demeter

(85,373 posts)Last edited Wed Jun 6, 2012, 05:37 AM - Edit history (1)

The world’s big international banks are paying out much more on staff costs relative to profits since the financial crisis while slashing the portion of income paid out in dividends, according to data compiled by the Financial Times

Dividends comprised just 4.5% of net profits and staff costs last year, down from nearly 15% in 2006, last full year before onset of financial crisis

Read more >>

http://link.ft.com/r/OZMCDD/16FACY/NRHD3/QN0937/B56XM0/ID/t?a1=2012&a2=6&a3=6

Tansy_Gold

(17,894 posts)I've not been around SMW and WEE as much the past several months as I would have liked. I plead the demands of the day job, the dogs and household in general, the various arts endeavors. In other words, real life.

And I suppose I had sort of hoped that Wisconsin -- the state where my dad was born and much of my family still lives -- would come to its senses and boot out the bastards, so I didn't get very worked up about it. I should have, and for that I apologize, because leaders should, well, lead.

So I sat down this evening, after the first dismal reports started coming in, and I wrote a perfectly beautiful rant. I spent over an hour on it. And then I hit the wrong button and it all disappeared. POOF!

I'm not sure I can reconstruct all of it, but I'm going to try. And maybe you'll get this piecemeal, as I post parts rather than have them vanish into the ether, too.

The chosen 'toon is part of the theme. In spite of what he has and hasn't done, Barack Obama is still adamantly defended by people who do not care to recognize the truly anti-progressive things he has done. He is The Leader, and he has led us into, not out of, economic peril. It's not economic disaster yet, though it's getting closer by the minute. But Obama, as president and so-called leader of the free world, has been pretty much a clone of his predecessor.

But he was a successful candidate, a very successful candidate, because he appealed to the emotions of the Democratic electorate. Some can look back at his lack of a solid legislative record and say they saw his spinelessness then. But others saw it and ignored it or denied it or voted for him anyway because they wanted to. They liked him. He was the not-Hillary. He voted against the war by not being able to vote for it. He gave rousing speeches and looked presidential.

We watched as the pukes put up that old man and that idiot woman and we wondered how they could do that, but we never examined how we made our own choice. The couple dozen of us resident on SMW in 2008 are hardly representative, not even of the DU population. Are we elitists? Yes, of course. But we should be proud of that, not denying it or being embarrassed.

We also have to understand -- and this is where the Democratic leadership (?) makes its big mistakes -- that pukes do not think like us. They are not swayed by logic and reason. I mean, c'mon, folks, if they were logical and reasonable, would they have allowed that Palin creature on the national ticket? She's dumb as a box of rocks, has the morals and ethics of a tapeworm, and dresses like a discount hooker (meaning, not really cheap, but not high priced either). WTF prompted McCain to pick her? You know damn well he's never going to admit it was a mistake, but the heart of the matter is that the right wing does EVERYTHING, ABSOFUCKINGLUTELY EVERYTHING out of fear.

Look at the recent study on belief in climate change -- it's not so much whether people have a science background that allows them to understand the facts behind GCC. It's all about their ideology.

Pukes vote their ideology. Period. Logic and facts and reality are absolutely nothing to them. You cannot use logic or facts or reality to sway them. It's a complete and total waste of time.

So look at what happened in Wisconsin:

Walker and his minions went to war on the unions. They stoked up the voters' fear of unions. Unions are killing jobs. Unions are breaking the budget. Unions are evil, evil, evil.

So what do the Dems do? They put up a union man as their recall candidate. Remember, you cannot argue facts with a puke. They will fall back on ideology/fear every single time. EVERY SINGLE TIME. Without fail. How in heaven's name were the Dems going to sway voters who were terrified of unions to vote for a union man? THIS IS FUCKING STUPID.

There are millions and millions and millions of perfectly "normal" people who are so terrified of having a Black Man in the White House that they will cling to any shred of ideology/mythology they can to deny that he has a right to be there. They do not care how much evidence is produced to certify Barack Obama's birth in Hawaii. They wouldn't care if you produced 8mm movies of the birth. They are never never never never going to believe it because it challenges too many other beliefs that they have built their entire worldview on. (Weltanschauung is almost as cool a word as Schadenfreude.) They cannot allow themselves to believe it.

The problem is that the Dems won't call them on it. The Dems won't stand up to them. The Dems think everything runs on logic and proportion, and they forget that it doesn't.

That's why I get so upset when so many Dems (which I use as shorthand for anyone left of what used to be the real center) dismiss Atlas Shrugged. It's an absolute must read because it gives such a stunning portrait of that fear-riddled right wing mind, right down to the persecution complexes of the rich and powerful, the denial of reality, the ideological ability to hold two diametrically contradictory concepts to be equally true at the same time. And it also feeds the emotional insecurity of most of its adherents.

Atlas Shrugged promotes and defends the kind of inequality that most pukes insist they are against even while absolutely every single one of their policies do the opposite. The right wing is all about inequality. It is part of their ideology. Do not expect them EVER to support gay marriage; they do not believe in equal rights. Do not expect them ever to support raising taxes on the rich; they do not believe in economic equality. Do not expect them ever to stop voter purges; they do not believe in civil rights. You cannot campaign on those issues with them.

Personally, I don't think Romney can beat Obama, not unless something dramatic happens between now and November. I could be wrong. I didn't think boooosh could beat Kerry either. (But then, Kerry ran a lackluster campaign in many ways, and we have no idea what was going on behind the scenes with him and Edwards.) And it may in fact be that boooosh didn't beat him.

But incumbent Obama is not the same as Senator Obama. Now he has a record he has to run on, and as the 'toon says, it ain't all that great a record. And this huge failure for the Dems in Wisconsin shows they don't know what the fuck they're doing.

They got lucky in 2008. McCain and the pukes screwed themselves with Palin. I don't think Romney is as stupid as McCain. And if the Dems don't wise up, Romney could very well win.

Demeter

(85,373 posts)Especially at the very top. If PD doesn't get a little fear, and apply a little Democratic ideology pretty soon, the only thing he will have to look forward to is a war crime trial and/or a predator drone. Can't see him making Clinton millions on the lecture circuit, nor anybody buying another book. Can't see Romney giving him the courtesies a former President is accustomed to receive, either.

It's probably too late. Barring a serious blow up close to home, the die is cast.

DemReadingDU

(16,001 posts)They don't stand up for what is the right thing to do. And those few who do stand up and speak out, are labeled troublemakers, aggressive and threatening. It results in the so-called leaders to ram their agendas down our throats because few people will stop them. And they have the big bucks to support winning.

Warpy

(111,480 posts)They don't sass the psychotic boss because they need the job. They don't stand up to the sociopaths in government because they need the stability it takes to support that job.

Threaten their survival, and you'll see those spines grow overnight.

Well, if they're not too exhausted and beaten down.

DemReadingDU

(16,001 posts)We have an elected mayor and 6 elected council members. None of these people need this job as an elected official that merely pays a few dollars per year for the privilege of a 'title'. They just need to do their job in the community they were elected to serve.

We have a rogue, incompetent, dishonest, arrogant, lying jerk for a police chief who was appointed by the previous mayor nearly 4 years ago. No one would stand up to this a**hole until spouse and I started speaking at every meeting, for 3 years, the things the chief was doing in our community. Nothing was done. No reprimands, no suspensions, nothing.

Finally, nearly a year after we filed a multi-million dollar lawsuit, did their attorney tell them to 'resign' this guy with a sweet severance package.

I posted this yesterday...

6/4/12 ENON — The village will pay one year’s salary to its former police chief, who resigned Friday amid “pending and imminent court action.”

The signed severance agreement obtained by the Springfield News-Sun on Monday also gives Troy Callahan one year of health insurance benefits and a letter of recommendation for future employment.

Callahan will receive his current salary of about $52,000 over 52 weeks. He would receive a lump sum payment of any remaining salary if he gains new employment before the end of the agreement.

The health insurance benefits will end if he finds new work before one year’s time.

The deal allows Callahan and village representatives to admit that Callahan resigned but bars them from discussing the negotiations, terms or formation of the agreement.

The agreement “ ... should not be considered an admission of guilt, wrongdoing, or violation of any rights,” it said.

A call to Mayor Tim Howard Monday was not returned. Callahan could not be reached.

Callahan had been controversial in recent years.

click to read the controversies...

http://www.springfieldnewssun.com/news/springfield-news/ex-enon-police-chief-to-get-year-of-pay-1386332.html

previous posting

http://www.democraticunderground.com/?com=view_post&forum=1116&pid=14812

A police officer takes an oath to uphold the law, not to abuse it. And our elected officials did nothing. They should be ashamed that they allowed and let this guy to continue as a police chief for as long as they did.

Loge23

(3,922 posts)That is the basic premise of republican influence - fear. Dems may indeed have a poor record to run on, but the pukes record is even worse, and much more objectively verifiable, but yet they seem to have the momentum.

One of the most obvious ways they control the argument is in persuading the under-informed. They are masterful at this.

Vast numbers of voters for the right are voters that have absolutely no stake at all in right-wing policies, but yet they are motivated and even energized by the fear-mongering. Just this AM I read a letter in the local newspaper from a fellow who claimed to have worked for years in business with (as he described) minimal benefits. Why, he asked, should public employees get better benefits?

This is completely the equivalent of saying: "Those are MY crumbs, and I like them - we have no business asking for more!"

We expect the under-informed to vote Dem - why bother trying to reach them? Anyway, they probably don't understand our argument, we smugly opine.

That letter, after yesterdays somewhat inevitable outcome in WI, is a yet another clear sign to me that I live on the wrong planet; that everything I believe in, and know to be true, has become totally upside down.

We tend to lie low these days, the left. This site is called the "underground". As TG alludes to, it's probably because all of our arguments have become moot in this environment. We just don't speak crazy.

bread_and_roses

(6,335 posts)article from World Socialist Web Site that is equally - and I think justly - harsh on both the Democrats and our Unions.

http://www.wsws.org/articles/2012/may2012/wisc-m31.shtml

By Patrick Martin

31 May 2012

After running a campaign in which he has hardly mentioned the issues that provoked mass protests last year, Democratic candidate Tom Barrett appears likely to lose recall elections scheduled for June 5.

... The likely reelection of Walker, widely hated by Wisconsin workers, is an object lesson in the reactionary and bankrupt character of the unions and their alliance with the Democratic Party...

Union leaders embraced a series of recall petition drives aimed at diverting this mass movement away from demands for a general strike and into election campaigns to replace Republican state senators, and then the Republican governor, with Democrats...

... within the framework of the two-party system, the only alternative to Walker is an equally right-wing big business politician...As politico.com noted, “The issue of worker’s rights—which initially sparked last fall’s movement that resulted in the collection of nearly 1 million signatures—was almost a secondary issue in the debate...

... The only right that concerns the union officials is their “right” to keep collecting dues from union members, to share control of lucrative pension and benefit funds, and to have a place at the table when state and local government officials devise plans to slash the benefits, wages and jobs of the workers...they have endorsed a Democrat whose main difference with Walker is that he wants to use the collaboration of the unions against the working class, rather than carrying out such attacks unilaterally.

I did not follow the Barrett campaign blow-by-blow, but the little I did I was struck by the ABSENCE of "workers' rights" language. Once again, "Middle-Class" rhetoric ruled. I don't know if anyone else agrees with me, but despite the fact that the phrase "polls well" I have not seen it exactly lighting a fire under people to dispossess the 1% of their unwarranted and extortionate gains?

The big question that comes out of this whole affair is "what happened between Feb 2011 and June 2012?" Yes, money is a part of it, but not the whole story.

I would note that the original Wisconsin emblem - the raised fist imposed on a map of the State - generated far more intensity, far more fire than this election, which was reduced to the usual "Dem vs Repub" same-old same-old. Same-old same-old gets us ....more of the same old. Yes, people worked hard. The turn-out was extraordinary - which, not long ago, would have harbored well for a Dem win. That it did not turn out that way is as ominous a harbinger as I can think of. Not just for Dem politicians - but for what it says about the fundamental - maybe "existential" is the right word - ideological muddle a majority of voters seem mired in. For which I place the blame squarely on both the Democratic and Union leadership.

More ominous still is this nugget:

http://www.commondreams.org/view/2012/06/06

Published on Wednesday, June 6, 2012 by The Nation

'Big Money' Thwarts 'People Power' in Wisconsin Recall

Recall Campaign Against Scott Walker Fails

by John Nichols

Brother Trumka is out there today trying to spin some gold from this bale of lead straw, but make no mistake, it's a disaster for the AFL-CIO. After kissing up to President Butter-Wouldn't-Melt-In-His-Mouth, fat chance of getting anything out of him after we couldn't even secure our own members. What the hell good is turn-out if 1/3 of your members vote for the other side?

I have written before about the extraordinary effort it took to get the union vote in '08 against the entrenched racism, the gun-nuts, the staunch Rs who comprise a good portion of our membership. I don't think it will work this time. That doesn't mean President Mellifluous will lose - I don't have a clue right now what will happen in November - but whatever the outcome, the influence of "Labor" will be that much less than it is now - although we're so close to rock-bottom now it won't make much difference. This administration abandoned tossed us Lilly, and that was the end of it. And for all our faults, manifold and deep as they are - Labor still speaks more to the interests of workers than anyone else in the US - certainly more than the Scraps and Bones Party does.

"How many times must a man turn his head, and pretend that he just doesn't see?"

before he answers the question

Not that a narrow victory in WI would have done much better. The only way this recall was going to have a positive impact was if there was a crushing defeat for Walker.

Fuddnik

(8,846 posts)And Barrett stood there and wouldn't deny it.

Labor knew going in that Barrett wasn't their friend. And they wanted a different candidate. See how well selling out your base works out for you?

Demeter

(85,373 posts)It doesn't take much when you are balancing on a pin to fall off. I think it's over.

DemReadingDU

(16,001 posts)Spouse thinks Obama could have stopped somewhere in Wisconsin this past weekend. But I'm thinking Obama realized Wisconsin was already lost, so why appear to be associated with losers.

Fuddnik

(8,846 posts)You'd better.

Maybe a few more tweets could have increased turnout.

http://livewire.talkingpointsmemo.com/entries/final-wisconsin-turnout-57-percent?ref=fpblg

Tansy_Gold

(17,894 posts)Fuddnik

(8,846 posts)Tansy_Gold

(17,894 posts)Roland99

(53,342 posts)9/11 esp. sent them all cowering in fear of the Grand Ol' Party.

Why?!!?

I mean really....why?!?!

Tansy_Gold

(17,894 posts)With an RIP nod to Bradbury, Michael Moore captured some of that in Fahrenheit 9/11. The Dems were never never never able to stand up to ANYONE. I mean, you can go back and look at everything from the 8/6 01 PDB to the coziness with the Saudi royals to the lies from Condi Sleezi. FFS, will someone please stand up and LEAD?

And then to get into that bullshit of Obama voted against the war because he couldn't vote at all. . . .Where's the grabbing-my-head-with-both-hands-to-keep-it-from-exploding smiley?

Roland99

(53,342 posts)Po_d Mainiac

(4,183 posts)Or the slide in commodities continuing.

Multiple rumors, likely originating at the FED, of more twist and easing just out. Don't be surprised when the story breaks about our friendly neighborhood fucked up Central Bank exchanging U$D's for PIIGS MBS. ![]()

The bernanks new mandate/s:

The banks must be saved. Savers (and those on fixed incomes) must continue to get cornholed.

But it will work this time, because now it's different. The FED just took delivery of genetically tailored humongeous ears of corn.

Tansy_Gold

(17,894 posts)Someone should photoshop his mug on a

?w=300&h=218

?w=300&h=218

DemReadingDU

(16,001 posts)I have never seen one dead before, out of the water.

5/11/09 Four foot jellyfish found on British beach

http://www.telegraph.co.uk/news/newstopics/howaboutthat/5308217/4ft-jellyfish-found-on-British-beach.html

Tansy_Gold

(17,894 posts)first pic didn't work. try again

DemReadingDU

(16,001 posts)Tansy_Gold

(17,894 posts)DemReadingDU

(16,001 posts)but wait a minute, isn't that jellyfish upside down?

I've always seen pictures with the tentacles on the bottom.

Demeter

(85,373 posts)They are all trying frantically to kick Trouble down the road a piece, so as to finesse the elections.

It just won't work, but they are going to try it yet again, because to date they have managed to kick it down the road a little bit each time, but lesser and lesser amounts.

I expect Greece will blow up the eurozone, and it will be the Great Reset like a tsunami around the world, sweeping away all the debris of the past 30 years, including the Democrats. I'm not sure the GOP can exist without Democrats, but it will be interesting to see what happens.

Po_d Mainiac

(4,183 posts)IMHO, the capture inside the beltway is so complete, either party suits the banksters just fine.

It's just that the clock winding down to a major implosion of the financial sector led kleptocracy, happens to coincide with the election cycle.

“Give me control over a nations currency, and I care not who makes its laws.” ~Baron M.A. Rothschild

Demeter

(85,373 posts)The Office of the Comptroller of the Currency is reviewing whether the company provided adequate information on trading positions that have led to at least $2bn in losses

Read more >>

http://link.ft.com/r/OZMCDD/16FACY/NRHD3/QN0937/TUETPI/ID/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)The exchange is expected to take the first steps to compensate brokerages that lost some $100m on the first day of Facebook trading due to software glitches.

Read more >>

http://link.ft.com/r/OZMCDD/16FACY/NRHD3/QN0937/ORX3SD/ID/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)Timothy Mayopoulos will alter his recusal agreement regarding his former employer, which is in a dispute with the housing finance group

Read more >>

http://link.ft.com/r/OZMCDD/16FACY/NRHD3/QN0937/TUETPQ/ID/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)A US court decision says the UK group can keep more than a billion dollars in a dispute related to the Lehman Brothers bankruptcy, reversing a previous decision

Read more >>

http://link.ft.com/r/OZMCDD/16FACY/NRHD3/QN0937/JE7SI7/ID/t?a1=2012&a2=6&a3=6

IT'S OFFICIAL, THE US IS TOAST, AND HAS LOST THE RESPECT AND FEAR OF THE WORLD.

Demeter

(85,373 posts)The company shuffled around its bets on eurozone sovereign debt to avoid stumping up more regulatory capital just weeks before its collapse last year

Read more >>

http://link.ft.com/r/OZMCDD/16FACY/NRHD3/QN0937/DW0D41/ID/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)Last edited Wed Jun 6, 2012, 10:12 AM - Edit history (1)

Germany’s ruling Christian Democrats are ruling out the use of eurozone rescue funds to recapitalise Spanish banks directly

Read more >>

http://link.ft.com/r/P75VYY/DW6EJL/YGZ3O/ZG418Q/97G5OC/B7/t?a1=2012&a2=6&a3=6

AND YET, MARKETS ARE UP....

THEY GOT UNCLE BEN TO WATCH THEIR BACKS, I'LL BETCHA....WITH THE FULL FAITH AND BACKING OF UNCLE SUCKER. THERE WERE NUDGES THAT BERNANKE SHOULD GO BUY SPANISH BONDS AND MORTGAGES...

Demeter

(85,373 posts)Growing concern over Spain prompts move to hold a conference call among finance ministers and central bankers of the leading industrial powers

Read more >>

http://link.ft.com/r/P75VYY/DW6EJL/YGZ3O/ZG418Q/FKVYZ4/B7/t?a1=2012&a2=6&a3=6

I GUESS ANOTHER DUMBASS PLAN IS IN THE WORKS

Demeter

(85,373 posts)Beijing official calls on the US to stop publishing pollution data for Chinese cities, arguing it is against conventions for diplomatic conduct

Read more >>

http://link.ft.com/r/P75VYY/DW6EJL/YGZ3O/ZG418Q/WTSBFR/B7/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)After resisting for months, Spain has made an explicit plea for bank aid from its European neighbours. The immediate objective is to recapitalise struggling banks and minimise the risk of disruptive deposit withdrawals. A major challenge is to avoid this emergency funding turning Spain into a long-term ward of the European state, a phenomenon that has already occurred in the three countries to have already received bail-outs – Greece, Ireland and Portugal.

Read more >>

http://link.ft.com/r/4RNQTT/XH9V6F/HI3M9/C4N5GH/KQMFRW/YT/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)The state (read GOP) takeover of Detroit has been a cherished dream in Republican hearts for some 50+ years...maybe longer, I'm just not old enough to know first hand. But they wanted to take Detroit over not to live there, or extract wealth, they wanted to destroy it, the engine of wealth in Michigan. I never said dreams made sense....Demeter

http://www.loop21.com/life/detroit-financial-takeover-lawsuit?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+theloop21+%28TheLoop21.com+Comprehensive+Feed%29

State oversight of the struggling city’s finances being challenged

A lawyer for Detroit has filed a complaint against the state, alleging illegality of an April agreement to takeover the city’s finances.

The complaint was been filed in Michigan’s Court of Claims by Detroit Corporation Counsel Krystal Crittendon on Monday, Reuters reports.

Crittendon argues the city’s agreement with Michigan Treasurer Andy Dillon was not valid under state law because the state “was in default to the city.”

In other words, the state supposedly owes Detroit lots of money...

I'LL BET THEY DO. THEY OWE MONEY ALL OVER, BUT THE TAX CUTS CONTINUE...

Demeter

(85,373 posts)...Amid the swirling legal uncertainty, Detroit next week plans to sell $575 million of sewage disposal system new and refunding senior lien bonds through Goldman, Sachs & Co. Proceeds from the issue will fund capital improvements, refund some outstanding debt and cover termination costs of interest rate swap agreements attached to certain outstanding sewer bonds.

The preliminary official statement for the deal said that, while swap counterparties have not exercised their right to terminate the swaps due to the consent agreement, the city plans to use the upcoming deal to do so.

The POS also lays out various scenarios of what could happen to Public Act 4 and to the city should it breach the financial stability agreement, noting the state treasurer would then have the power to place Detroit in receivership. As for Crittendon's complaint, the POS states it was not clear when the matter would be resolved and what the impact would be on the agreement.

Fitch Ratings last month cut its rating on about $1.4 billion of senior lien sewer bonds to A-minus from A, citing rising debt levels. Moody's Investors Service, which dropped its rating to Baa1 from A2 in April, continues to keep it on review for another potential downgrade. The review's focus includes "the continued uncertainty of how the sewage system would be treated in the event of a (Detroit) bankruptcy filing," Moody's said last week.

Demeter

(85,373 posts)City financial officer Jack Martin wants to increase revenue and cut spending.

The city of Detroit's new chief financial officer said he will ask President Obama for help as he seeks to increase revenue and cut spending to keep the city from crumbling financially, according to the Detroit News.

Jack Martin, the city's new CFO, is looking to make City Hall more efficient and revamp the city's information technology department. He's also looking to get two executives from the Obama Administration to help fix Detroit pro-bono.

Martin worked for former presidents George H.W. Bush and Bill Clinton as a chairman of the provider reimbursement review board of the U.S. Department of Health and Human Services. He also served in President George W. Bush's administration as a chief financial officer for the U.S. Department of Education...

YEAH, WELL, ALL THAT POLITICAL WATER-CARRYING MADE YOU A WATER BOY, JACK MARTIN. AIN'T NOBODY GONNA RESPECT YOU OR RETURN YOUR PHONE CALLS....

xchrom

(108,903 posts)

xchrom

(108,903 posts)

Later today the ECB makes its decision on interest rates.

The range of forecasts is all over the map, though the majority of economists think there will be no change.

That being said, markets are booming.

Italy is up 1.3%.

Germany is up 1.3%.

Spain is up 0.7%. UPDATE: Spain is now up 2.6%!

S&P futures are up 0.8%.

Gold and silver are rallying very hard.

Other than ECB anticipation, the other big news is the confirmation that QEIII is now seriously on the table at the Fed.

UPDATE: Headlines about a European banking union or deposit gaurantee scheme are also making the rounds.

Also, one more thing from overnight that's helping risk appetite: A surprisingly strong Aussie GDP report.

Read more: http://www.businessinsider.com/morning-markets-june-6-2012-6#ixzz1x0YDsU4Q

Demeter

(85,373 posts)but I'm going to be a lady today and not use it.

Good morning, X! Another fair, not too hot one.

xchrom

(108,903 posts)warms up in the afternoon to go in t-shirts.

yes, miss demeter it's as weird out there as i have ever seen it.

this is getting sooo old.

Demeter

(85,373 posts)I really need a different hobby. This one is too depressing.

Roland99

(53,342 posts)Demeter

(85,373 posts)Last edited Wed Jun 6, 2012, 12:09 PM - Edit history (1)

I'd wager today's goal is Po's 12350...we'll find out in a few hours.

Edit: I was a little optimistic on that guess..or the fingers slipped. My digits need glasses...

Po_d Mainiac

(4,183 posts)xchrom

(108,903 posts)

Big morning for the precious metals, as traders sense the world's central banks leaping into action.

Gold and silver are both making sharp up moves.

Here's a gold chart.

Read more: http://www.businessinsider.com/gold-and-silver-go-wild-2012-6#ixzz1x0Yk9FOo

Demeter

(85,373 posts)The CEO of Goldman Sachs, Lloyd Blankfein, told a New York federal court that his former colleague Rajat Gupta regularly attended highly confidential board meetings.

The chief executive took the stand for the second time in as many years to testify about Gupta, accused in one of the highest profile insider trading cases for years.

Talks at board and committee meetings on which Gupta sat -- before allegedly passing insider tips to hedge fund manager Raj Rajaratnam -- were not for public consumption, Blankfein said....Blankfein is one of the biggest witnesses prosecutors are using against Gupta, an Indian-born immigrant who reached the pinnacle of US business. The former Goldman board member was also on the board of Procter & Gamble and the director of McKinsey & Co...

READ THE WHOLE THING FOR AN EYE-OPENING CHARACTER SKETCH OF THE MAN DOING "GOD'S WORK". JUST DON'T EAT FIRST.

Po_d Mainiac

(4,183 posts)muppet (I mean client) of GS. Which wood explain why the restaurant tab is more than his (the judge's) wallet can stand.

Demeter

(85,373 posts)Po_d Mainiac

(4,183 posts)xchrom

(108,903 posts)We mentioned this earlier in our morning market roundup, but we wanted to break it out.

Spain is having a gigantic day. The market is up over 3% now as the minutes tick down to the ECB rate decision.

Intraday chart of the IBEX via Bloomberg.

Read more: http://www.businessinsider.com/spain-is-having-a-gigantic-day-2012-6#ixzz1x0ZFeM4m

Roland99

(53,342 posts)Demeter

(85,373 posts)When Bank of America announced it was buying Merrill Lynch in September 2008, bank execs told their shareholders that the merger might hurt earnings a touch. It didn't turn out that way. Losses at Merrill piled up over the next two months, before the deal even closed. Yet the execs kept painting a prettier picture to shareholders — even though it turns out they knew better.

As the New York Times detailed this morning, a brief in a new lawsuit filed in federal court in Manhattan recounts sworn testimony and internal emails in which execs admitted to giving bad information to shareholders and that they had worried about the legal ramifications of doing so. SEE http://www.nytimes.com/2012/06/04/business/bank-of-america-withheld-loss-figures-ahead-of-merrill-vote.html?_r=2&pagewanted=1&hp

AND IT GOES ON CITING CHAPTER AND VERSE...IT'S A STUNNING INDICTMENT ALL ON ITS OWN...

xchrom

(108,903 posts)

Posters for the fiscal pact referendum in Dublin (May 30 photo).

Henry Healy spent March 17, St. Patrick's Day, at the White House in Washington. His distant cousin Barack Obama had invited him. The US president has Irish roots on his mother's side of the family. "We went to a bar for a pint of Guinness," recalls Healy.

Last week, however, Healy, an accountant from the small Irish town of Moneygall, was no longer in a celebratory mood. "Joined the ranks of the recession brigade today!! #unemployed," he wrote in a Twitter message. His employer, an Irish supplier to the construction industry, had laid him off after six years. It was probably inevitable, Healy says without bitterness, pointing out that "the construction industry in Ireland is rapidly downsizing."

Healy is one of hundreds of thousands of Irish who have lost their jobs. Since 2008, Ireland has been struggling to overcome the financial crisis -- and can't seem to get back on its feet. The unemployment rate has stagnated at roughly 14 percent for months on end. Many young Irish have decided to leave the country altogether.

Illusory Confidence

In 2010, the European Union had to support the country to the tune of €67.5 billion ($84 billion). Ireland's local banks had gambled and lost on real estate loans, and had been bailed out with comprehensive state guarantees. Soon thereafter, the Irish and their fellow Europeans throughout the continent had great hopes that the worst was over. Recently, the Irish were considered a paragon for the entire euro zone. In 2011, the economy even grew, albeit only by 0.7 percent. But such confidence proved illusory.

As things now stand, Ireland will have to be bailed out a second time. The banks have proven to be a bottomless pit. They have to be recapitalized once again. The previous write-downs of the 10 largest consumer banks, amounting to €118 billion, are still not enough.

xchrom

(108,903 posts) ?ts=1338979592

?ts=1338979592

ECONOMIC COMMENT: SUPPOSE THAT in June 2007 you had been told the UK 10-year bond would be yielding 1.54 per cent, the US treasury 10-year 1.47 per cent and the German 10-year 1.17 per cent on June 1st, 2012.Suppose, too, you had been told that official short rates varied from zero in the US and Japan to 1 per cent in the euro zone. What would you think?

You would think the world economy was in a depression. You would have been wrong if you had meant something like the 1930s. But you would have been right about the forces at work: the West is in a contained depression; worse, forces for another downswing are building, above all in the euro zone. Meanwhile, policymakers are making huge errors.

The most powerful indicator – and proximate cause – of economic weakness is the shift in the private sector financial balance (the difference between income and spending by households and businesses) towards surplus. Retrenchment by indebted and frightened people has caused the weakness of western economies. Even countries that are not directly affected, such as Germany, are indirectly affected by the massive retrenchment in their partners.

According to the International Monetary Fund, between 2007 and 2012 the financial balance of the US private sector will shift towards surplus by 7.1 per cent of gross domestic product (GDP). The shift will be 6.0 per cent in the UK, 5.2 per cent in Japan and just 2.9 per cent in the euro zone. But the latter contains countries with persistent private surpluses, notably Germany, ones with private sectors in rough balance (such as France and Italy) and ones that had huge swings towards surplus: in Spain, the forecast shift is 15.8 per cent of GDP. Meanwhile, emerging countries will also have a surplus of $450 billion (€361 billion) this year, according to the IMF.

Demeter

(85,373 posts)No stockbrokers jumping out of windows these days...if they ever did. There were a few prominent suicides in Europe when Lehmans went down, but nothing really above the beer and bowling crowd since.

Po_d Mainiac

(4,183 posts)Visualize everyone currently on food stamps standing in a line.

Demeter

(85,373 posts)One of the most troubling features of today’s global economic crisis is the lack of political leadership anywhere. No one has the courage to tell their people the truth. And the truth, alas, is that four of the pillars of today’s global economy — Europe, America, China and the Arab world — have, each in their own way, squandered huge dividends they enjoyed in recent decades, and now they have to dig out of their respective holes with fewer resources, less time and, almost certainly, more pain. There is no easy way out. But, as confronting these hard truths becomes unavoidable, I think we’re likely to see some wild, angry and destabilizing politics that could make the economic recovery even more difficult. Deep holes and weak leaders are a bad combination.

I CAN'T STAND FRIEDMAN USUALLY, BUT IN THIS CASE, HE'S STICKING TO FACTS, NOT PREJUDICES AND IDEOLOGY...UNTIL THE CONCLUSION...

So for Europe, the Arabs, China and America, in different ways, these have been the years the locusts ate. Getting healthy again will be wrenching for all of us. If I were President Obama, I’d focus my entire campaign now on an effort to reforge a “grand bargain” with Republicans based on a near-term infrastructure stimulus tied with a Simpson-Bowles long-term fiscal rebalancing. At a minimum, it would show that Obama has a sensible plan to fix the economy — which is what people want most from the president — and many in business would surely support it. We cannot wait until January to do serious policy making again. We, and the world, need America to be a rock of stability — now.

AND THAT'S WHERE TOM AND I PART WAYS....PEOPLE CAN SEE THE FACTS, BUT NOT THE FOLLY OF THEIR EXPECTATIONS AND HOPES....

OH, AND TOM CAREFULLY FORGETS TO MENTION THAT THOSE ARE LOCUSTS OF THE 1% VARIETY....

Demeter

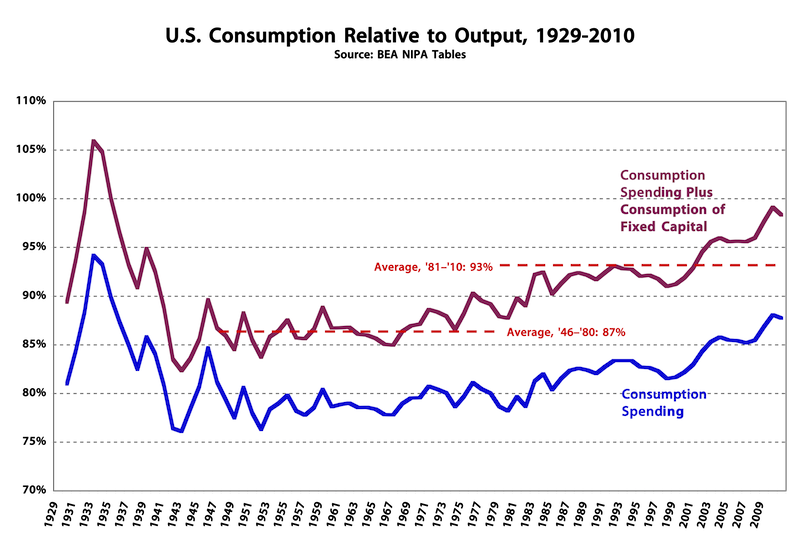

(85,373 posts)Following up on some work I did a while back (Kuznets Revisited: Investment in the American Economy Since 1929), I got curious about what consumption has looked like in America over the last 80 years.

I’ll give you the results first, as a proportion of output, or GDP, followed by explanation and discussion:

we see:

• A denominator-driven spike in these measures during the depression (GDP plummeted).

• A rapid decline in the pre-war and war years driven by 1. rising GDP and 2. a massive temporary increase in government consumption spending. (Factoid: In just seven years 1940-1947, government’s share of national consumption spending went from 13% to 39% and back to 16%.)

• A steady period of relatively low consumption from the late 40s until the mid 70s or early 80s (depending which measure you look at).

• Consuming an increasingly large portion of our national output since the late 70s/early 80s — with Gross Consumption just shy of 100% ’08-’10.

(The timing of the 70s/80s breakpoint is somewhat unclear because of the high and variable inflation of that period, which had a significant impact on estimates of capital consumption. Changed amortization and depreciation schedules, applied against the whole existing stock of fixed assets, results in significant moves.)

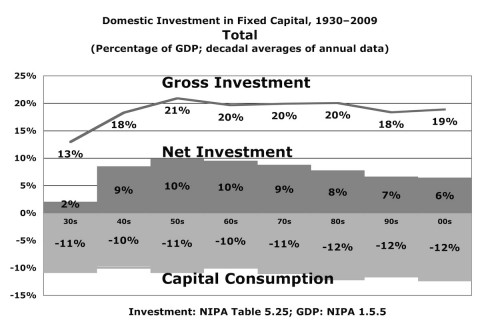

The depression and war years are pretty to easy to understand. What’s interesting here is the trend change since the 70s/80s. That change is not generally driven by more rapid capital consumption: that’s been pretty steady over the decades (though business capital consumption has accelerated as the capital proportions have shifted from longer-lived structures to more rapidly depreciating hardware and software):

So the long-term trend change for the nation as a whole is simply toward more consumption spending and less investment spending. That may seem obvious to some, but it’s nice to know it for sure...

TODAY'S ECONOMIC LESSON FOR REAL PEOPLE...RECOMMENDED READING

Demeter

(85,373 posts)Fuddnik

(8,846 posts)Last edited Wed Jun 6, 2012, 08:29 AM - Edit history (1)

Heartburn or not.

In case Friedman and the President haven't noticed, the Republicans have zero interest in reaching a grand bargain, fixing the economy, or the good of the nation. Their sole interest is power and perks.

Nothing else.

Tansy_Gold

(17,894 posts)And the president hasn't noticed. Talk about cloud cuckoo land. . . . .

Demeter

(85,373 posts)and where will it stop?

Demeter

(85,373 posts)Here’s CBS New York, back in February.

“Dolan from a media and pop culture point of view is a rock star. He just exudes charisma, sort of charisma on steroids,” National Catholic Reporter’ John Allen said.

Allen calls Dolan the star of the consistory, and Pope Benedict XVI could use some star power on his team.

Here’s what came out today.

Dolan, while serving as Milwaukee archbishop in 2003, agreed to pay multiple accused pedophile priests $20,000 in exchange for their agreeing to leave the priesthood, according to documents cited by The New York Times.

Joseph Zwilling, Dolan’s New York Archdiocese spokesman, told The Post last week that there was no “payoff” to pedophile priests — only “charity.”

In the dominant cultural and media narrative, Dolan is a “rock star” for being elevated to Cardinal. He’s successful and charismatic, and a possible papal successor. The bishops represent the Catholic masses, and the hierarchy of the church speak on behalf of those Catholics, attending to their spiritual and political needs. On another level, of course, these leaders are simply unaccountable corrupt corporate leaders who happen to wear robes and run a big multi-national venture known as Catholic Church, Inc, which is distinct from the religious practices of millions of Catholics. Like many corporate elites, these men, and they are men, protect their institution by covering up horrific acts of violence perpetrated on the powerless.

This dual-tracking, of an overall narrative on one hand and revelations that cut entirely against that narrative, is why Obama will negotiate with bishops over contraception instead of challenging their legitimacy. It’s why the Pope’s attacks on nuns and suppression of all but deeply reactionary authoritarian impulses within the bureaucracy go unremarked within elite circles. Catholic elites are like bankers, who are trusted men in suits no matter what they do. Or generals, who are heros regardless of their incentive model and links to defense contractors. Etc.

Obviously, not all upper level Catholic Church leaders are corrupt, and some are no doubt good faith community leaders. This is true across all authoritative classes. It’s just that the structures that hold their authority, that are supposed to self-police, are no longer doing so. So corruption flourishes, as you’d expect. These institutions spiraling downward reinforce each other. That Dolan isn’t prosecuted, that the Catholic Church can implement discriminatory policy against women taking leadership positions, that child sex abuse is unpunished, all of that relies on our legal and political infrastructure tolerating and encouraging the evolution of these reactionary structures. And then Church elders can provide moral cover for any number of authoritarian impulses by political factions, such as the current war on women’s rights.

In other words, the collapse of the rule of law in America is refracting across all elites institutions...In modern America, Wall Street bankers aren’t the only ones who go unpunished for their crimes.

xchrom

(108,903 posts)The investigation into widespread fraud on Wall Street leading up to the financial crisis will now have a proseucting attorney to help the effort. Virginia Chavez Romano,a former assistant US attorney in New York, was hired by Eric Schneiderman, the New York attorney general and co-chair of the task force. She is not an official hire of the working group, but rather will assist Schneiderman in his efforts as co-chair.

Romano participated in the criminal indictments of Credit Suisse employees earlier this year for falsifying prices tied to collateralized debt obligations. This is just the sort of fraud the working group wants to go after, though you can look at Romano’s case history in two different ways.

While it’s terrific to go after mispricing CDOs—this is really at the heart of the crisis—Credit Suisse itself was not charged in that case, but rather relatively lower-level employees were indicted. If the working group is now interested in actually going after institutions for this behavior and Romano can help, great. If we’re just going to see indictments of folks on the trading desk, that’s generally not the sort of prosecutions that force systemic change on Wall Street.

But Romano’s hiring is no doubt another step forward, and it shouldn’t go unnoted that she has experience prosecuting criminal cases of financial fraud. The addition of Romano comes after Matthew Stegman was hired as coordinator in May and also on the heels of an all–working group meeting in Washington late last week.

Demeter

(85,373 posts)Just like Sheila Bair's non-governmental counsel...see below:

Group Forms to Urge Strict Oversight of Wall Street By FLOYD NORRIS

http://www.nytimes.com/2012/06/06/business/new-systemic-risk-council-to-press-for-stricter-financial-regulations.html?_r=1

Efforts to increase and improve regulation of Wall Street have bogged down, according to Sheila C. Bair, the former chairwoman of the Federal Deposit Insurance Corporation. On Wednesday, she will announce a new group, the Systemic Risk Council, that will monitor and encourage regulatory reform.

“The great challenge is to devise a system to identify risks that threaten market stability before they become a danger to the general public,” she said. “We need a more effective and efficient early-warning system to detect issues that jeopardize the functioning of U.S. financial markets before they disrupt credit flows to the real economy. And two of the most critical tasks are how to impose greater market discipline on excess risk-taking and effectively end the doctrine ‘too big to fail.’ ”

The Dodd-Frank act passed in 2010 provided for numerous steps, including the creation of an Office of Financial Research that was supposed to help the newly created Financial Stability Oversight Council in identifying threats to financial stability and deciding which financial firms were systemically important and how much additional regulation they should receive. That council is composed of all the major regulatory bodies, and so far it has accomplished little. Some of what Dodd-Frank called for has been enacted, including so-called living wills for large banks and rules on how the business of such a firm would be wound down if it failed.

But much has not been done....In many areas, Ms. Bair said, “nothing has been finalized. F.S.O.C. is M.I.A. O.F.R. is barely functional. The Volcker Rule is mired in controversy. Securitization reform is stalled. They haven’t even proposed new bank capital rules. The public is becoming cynical about whether the regulators can do anything right, which is undermining support for reforms.” In an interview, she cited a report by Davis Polk, a major law firm, saying that regulators had so far missed two-thirds of the 221 deadlines for adopting regulations set forth in the law.

The new group, which expects to begin issuing reports quickly, will include a long list of former regulators and officials from both parties, including former Senators Bill Bradley, Democrat of New Jersey; Chuck Hagel, Republican of Nebraska; and Alan K. Simpson, Republican of Wyoming. It will also include Brooksley E. Born, a former chairwoman of the Commodity Futures Trading Commission, whose efforts to fight deregulation in the Clinton administration failed, and Paul H. O’Neill, the first Treasury secretary under George W. Bush. Others include John S. Reed, the former head of Citicorp, and Hugh F. Johnston, the chief financial officer of Pepsico. Mr. Volcker is listed as a senior adviser. The organization is being formed by the Pew Charitable Trusts, where Ms. Bair now works, and the CFA Institute, an organization of financial analysts...

SHEILA MUST BE OUT OF HER FREAKIN' MIND. OR SETTING UP FOR GLADIATOR CONTESTS. NO, SHE'S JUST PLAIN CRAZY.

Demeter

(85,373 posts)John Giddens, the bankruptcy trustee in MF Global, garnered headlines Monday by saying that he will decide in the next 60 days whether to filing suits against Jon Corzine and other officers for breach of fiduciary duty and negligence and against JP Morgan if he is unable to come to a settlement. JP Morgan so far has returned roughly $518 million in MF Global assets and $89 million in customer monies, a meager recovery relative to $1.6 billion in missing customer funds.

The report Giddens released Monday is thorough and confirms many of the observations made in journalistic accounts of the firm’s collapse, particularly regarding inadequate risk and accounting controls, JP Morgan’s aggressive posture greatly increasing the liquidity squeeze. It also makes clear that this is an interim report, and unlike the trustee’s report on Lehman, says that reaches no conclusion regarding legal strategies, including whether prosecutions are warranted.

But a stunning revelation that comes early in the account and is central to the failure of the firm does not get the emphasis that it warrants.

What is not surprising but nevertheless important is the way the document depicts MF Global as a train wreck waiting to happen. Ironically, the firm is a casualty of ZIRP. MF Global historically had gotten most of its income from low risk activities, such as interest on customer margin. Its net interest income from those sources fell by $3.5 billion from 2007 to 2011. Corzine had embarked on a strategy of turning the firm into a full service investment bank, an approach we deemed doomed to fail. To get there, Corzine took an approach that was similar to the one of Lehman and Bear, who were vastly less behind the industry leaders than MF Global was: putting lots of their chips in high risk, high profit potential activities (for Bear and Lehman, real estate; for MF Global, prop trading, specifically, Corzine’s Eurobond trade) in the hope that they could grow more rapidly than the top firms and thus close the gap with them...the firm was running out of runway and was not even close to achieving takeoff speed....

THERE'S A LOT OF THOSE TRAIN-WRECKS-WAITING-TO-HAPPEN....THIS IS A NUTS AND BOLTS LOOK UNDER THE HOOD...VERY TECHNICAL, BUT A GUIDED TOUR, AT LEAST.

IT ALL BOILS DOWN TO A FAILURE TO REGULATE.

Demeter

(85,373 posts)FROM MARCH

http://www.nakedcapitalism.com/2012/03/matt-stoller-hud-secretary-shaun-donovan-attacks-mbs-investors-as-liars-on-settlement.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+NakedCapitalism+%28naked+capitalism%29

There’s a rule of thumb in politics, which is that you cannot fight for someone who won’t fight for himself. The players missing from the financial fraud fight are the investors, or in Wall Street parlance, on “the buy side”. These are the entities getting routinely ripped off by the big banks through a variety of means, and at least the pension and insurance industry folks are temperamentally more passive than the more predatory banks. They are also the ones holding the mortgage backed securities whose value is being pillaged by the big bank servicers. But you can see how they are being punked by the way the Obama administration treats them....

Demeter

(85,373 posts)so whatever the weekend brings, it will probably be late.

What SHOULD this weekend bring, by the way?

Any requests, suggestions, demands, ideas? I've been so culturally isolated and deprived lately, nothing springs to mind...and Men in Black is not that worthy of contemplation...it's more like the popcorn one eats while watching it...air, salt, crunch, and it's gone.

If you have a theme, artist or production with some meat on its bones, speak up!

Demeter

(85,373 posts)We lost a giant last night.

Tansy_Gold

(17,894 posts)Demeter

(85,373 posts)The European Central Bank has held its main interest rate at 1 per cent, despite the deteriorating eurozone economic outlook, as it piles pressure on politicians to resolve the region’s debt crisis.

The decision by the ECB’s 22-strong governing council in Frankfurt, was widely expected, although some economists had forecast a quarter percentage point interest rate cut.

Mario Draghi, ECB president, warned last week that the bank could not “fill the vacuum” created by politicians’ inactivity.

Read more >>

http://link.ft.com/r/H60H77/ZGJAD4/VTVRG/EX37KZ/30UZXH/W1/t?a1=2012&a2=6&a3=6

Demeter

(85,373 posts)Treasury Secretary Timothy F. Geithner has challenged bankers to give him specifics on their longstanding complaint that the Dodd-Frank Act is imposing costly, confusing and burdensome regulations on them, according to four people familiar with the matter.

The Federal Advisory Council, a group of bank executives from each of the 12 Federal Reserve districts, complained to Geithner at a May 10 meeting about overlapping and duplicative rules, according to the people. Geithner urged the bankers to prepare a study with examples of regulatory burden, said the people, who are preparing the report...

NOW TIMMY WOULD NEVER DISS THE BANKSTERS, SO WHAT'S UP? IS HE PISSED AT JAMIE? WHATEVER FOR?

MAYBE IT'S A PAST-DUE NOTICE ON BRIBE BILLS?

Demeter

(85,373 posts)CAN'T PROVE IT BY ME--I THINK THEY ARE STILL DRINKING KOOLIAD OVER THERE

http://www.spiegel.de/international/europe/why-germany-must-give-up-power-to-save-the-euro-a-837063.html

Germany's booming economy and plummeting unemployment has long insulated the country from the euro crisis on Europe's periphery. Those times, however, are coming to an end. The German economy is now showing it is vulnerable after all, and Chancellor Merkel will now be forced to make sacrifices...There they are again: the traders with sad eyes and the stock price displays showing jagged lines sloping downward. In the last 10 days, the DAX, Germany's blue-chip stock index, has fallen by 16 percent. On Monday it fell below the 6,000 point benchmark for the first time since January and has continued its plunge on Tuesday. Has the crisis, which for so long seemed to leave Germany untouched, finally reached Europe's largest economy?

The stock slump is a warning signal, just as it was last summer, when the DAX lost 30 percent within just a few weeks, sparking a wave of politicking. One euro summit followed the next, resulting in ever larger bailout funds. Meanwhile, the German government tried to battle the problem by simply banning certain bets on sinking share prices. The widespread belief in Germany was that only the financial markets were acting up.

That is probably the biggest problem the Germans have in the now two-year-old euro crisis. For Germans, it was always a crisis that belonged to others -- the Greeks, Portuguese, Spanish and Italians. That is, those who didn't have their finances in control and were expected to kindly atone for it by adopting the German model. Back home in Germany, by contrast, the economy was booming and people had work. In a sea of misery, Germany was an island of bliss.

Fears Justified

But now, though, even its most stubborn adherents have begun realizing that this concept cannot work. The falling stock prices are just one of many indicators. Corporate purchasing managers have been reporting unfavorable outlooks for months in surveys, and in May the Ifo business climate index, one of the country's leading economic pulse checks, fell for the first time in half a year...

BREAK OUT THE DONNE:

No man is an island,

Entire of itself.

Each is a piece of the continent,