Economy

Related: About this forumSTOCK MARKET WATCH -- Monday, 11 June 2012

[font size=3]STOCK MARKET WATCH, Monday, 11 June 2012[font color=black][/font]

SMW for 8 June 2012

AT THE CLOSING BELL ON 8 June 2012

[center][font color=green]

Dow Jones 12,554.20 +93.24 (0.75%)

S&P 500 1,325.66 +10.67 (0.81%)

Nasdaq 2,858.42 +27.40

[font color=red]10 Year 1.63% +0.06 (3.82%)

30 Year 2.74% +0.07 (2.62%) [font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Financial Sector Officials Convicted since 1/20/09 = [/font][font color=red]12[/font]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

[HR width=95%]

[center]

[HR width=95%]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Pretty soon, the whole country looks like Detroit.

Tansy_Gold

(17,894 posts)I didn't think anyone would post a reply before me! ![]()

Certainly didn't intend to imply our Demeter is outta touch!

Demeter

(85,373 posts)At those times, it's good to be an over-committed isolate.

Warpy

(111,480 posts)It's a good thing I've turned into a hermit, too, although I have inherited enough to make bail.

I honestly think he misspoke. The private sector is growing sluggishly, unlike during Stupid's tenure when the only thing growing were the number of Federal patronage jobs.

But yes, he's stuck his foot firmly in his mouth at long last. This is a gaffe for the ages.

Demeter

(85,373 posts)more like a Freudian slip.

DemReadingDU

(16,001 posts)McCain: The fundamentals of our economy are strong, and then the stock market lost hundreds of points.

These people are soooo clueless

Fuddnik

(8,846 posts)Demeter

(85,373 posts)Even though it is obvious that the major banks wield tremendous influence over bureaucratic political systems worldwide, it is not often that you find the phrase "bankster puppet" illustrated so clearly in the mainstream media. Usually, there is some pretense or alternative justification for doling out billions of euros, dollars, etc. to the banks, such as - "if we don't do this, the entire global economy will implode" (remember TARP?). Back then, people didn't have a clue what was going on and were scared enough to go along with any vague reason presented to them.

So it's interesting to see now that these pretenses for direct wealth transfers from the people to the banks have been dropped like bad habits. In Europe, the financial atmosphere has become so dire and desperate that the PUPPET politicians and bureaucrats can no longer pretend that they care about anything other than saving the banks at the expense of everyone else. Exhibit A are the excerpts from an article in Bloomberg today that are quoted below, written by James G. Neuger:

The European Commission called for direct euro-area aid for troubled banks, and touted a Europe- wide deposit-guarantee system and common bond issuance as antidotes to the debt crisis now threatening to overwhelm Spain.

The commission, the European Union's central regulator, sided with Spain in proposing that the euro's permanent bailout fund inject cash to banks instead of channeling the money via national governments. It also offered Spain extra time to squeeze the budget deficit.

...

The use of the rescue fund to recapitalize banks "might be envisaged" and would "sever the link between banks and the sovereigns," the commission said today in Brussels. Jose Barroso, the commission's president, said "it is important to use all possibilities offered in terms of flexibility."

What these proposals by the European Commission (Jose Manuel Barroso) translate into is - "Forget austerity! And forget any pretenses of national considerations on how to properly use money from the bailout funds. We need the Spanish banks to take most of that money, as well as an unspecified amount of future money, and use it directly in the form of capital buffers and deposit guarantees... NOW!" With Greece, there was still time to pretend that some of the money would protect government services for the people and would come with conditions attached, designed to promote domestic growth. Not so with Spain.

...

After more than two crisis-filled years and 386 billion euros ($480 billion) in loan pledges to Greece, Ireland and Portugal, "markets remain exceptionally tense and vigilant and confidence is still weak," the commission said.

The money and blood offerings of the Greek, Irish and Portuguese were not enough to satisfy the all-encompassing hunger of the financial puppeteers. There is no doubt in my mind that at least a portion of this market "tension" is engineered by them to put the screws to those who reject the European Commission's cold, hard cash-for-banks proposal. Remember, they ARE the system that they are trying to save, and that's exactly why they are trying so damn hard to save it. So who could possibly have the temerity to resist?

Germany is spearheading resistance to direct European financing for banks because that would let governments bypass the conditions set for full aid programs, such as deeper budget cuts and more European intrusion into economic management.

"Direct help for banks is out of the question, that won't fly," Norbert Barthle, the budget spokesman in parliament for Chancellor Angela Merkel's Christian Democratic Union, said in an interview yesterday. Finland is in Germany's camp, Martti Salmi, a Finance Ministry official, said in a telephone interview today.

Ah, yes - the resistance comes from a small, yet critical portion of the German, Finnish and Dutch politicians/officials, and, more importantly, from the people of those countries. These countries are scared to death of financial contagion wreaking havoc in their banking systems, but they are also faced with the reality that this contagion will occur no matter what. The only question is whether they would prefer to kick the can a few months/years down the road, and allow the European Transfer Union to unwind all of the economic gains they had made over the last two decades while they wait. Also, whether they would like to go into elections with a population on the verge of mass protests and riots.

"Member states which face high and potentially rising risk premia do not have much room for maneuver to deviate from their nominal fiscal targets, even if macroeconomic conditions turn out worse than expected," according to the document.

Still, Economic and Monetary Commissioner Olli Rehn said Spain might be granted an extra year, until 2014, to bring its deficit down to the limit of 3 percent of gross domestic product.

Debate over euro bonds flared at last week's summit of European leaders, the first for French President Francois Hollande after he took office vowing to challenge the German- dominated budget-cutting creed that has marked the crisis response.

The new French President, Francois Hollande, is now exposing himself to be the biggest bankster puppet of them all. He is opposing the imminent austerity paradigm because he knows that the bankers need more time (and less conditions) to extract the wealth required to satisfy their greed. Austerity served to justify the bailouts over the past two years, but now it is also destroying the underlying economies of the peripheral countries and, therefore, the banking sectors. Hollande also knows that the French banks are not really in much better shape than the Spanish banks, and may need to draw on those direct ESM funds soon.

What he wants is what the rest of the European Puppets want - enough time to re-capitalize the Euro area banks with the money of German, Finnish and Dutch taxpayers. The problem for them is that the German, Finnish and Dutch populations (and those politicians who are not yet corrupted) are not altogether ignorant of what happened in 2008 and what has been happening ever since. They know that none of the money used to bail out peripheral banks will a) make it into the general Eurozone economy, b) repaid by the banks and c) conditioned on any credible austerity. There is absolutely no reason for them to play ball; at least, not until the market pressures bearing down get much, much worse.

But, by then, it may be too late for the Banksters and their Eurocratic Puppets.

Demeter

(85,373 posts)Moody’s warned Friday that a Greek pullout from the eurozone could lead to downgrades of the eurozone’s top-rated governments, including economic powerhouse Germany.

Moody’s also said that an EU rescue of Spain’s banking sector could force a cut to Spain’s sovereign rating due to the “increased risk to the country’s creditors.”

“Greece’s exit from the euro would lead to substantial losses for investors in Greek securities, both directly as a result of the redenomination and indirectly as a result of the severe macroeconomic dislocation that would likely follow,” said Moody’s.

“Should Greece leave the euro, posing a threat to the euro’s continued existence, Moody’s would review all euro area sovereign ratings, including those of the Aaa nations,” it said.

The triple-A eurozone countries under Moody’s ratings are Austria, France, Germany, Finland, Luxembourg, and Netherlands.

Moody’s said that a possible move by the region to help Spain recapitalize its banks could also affect Spain’s credit standing...

westerebus

(2,976 posts)France is in no position to do it. Until then, the can will be kicked around the globe from central bank to central bank along the road paved by the politicians in their employ. As the can is kicked, the austerity programs will double down the pain inflicted on wage earner's in the form of a drastically reduced social safety net and an increase in wealth transfers to corporations.

The good news is the American economy is doing fine. And if it's not, a little tweaking of entitlements will fix it. Just ask the Congress. Even the chief banker of the US, the Bernank, told Congress: you need to do something to fix the jobs problem, I've got the banks to worry about.

Fortunately, POTUS is willing to admit the private sector of the economy is not doing as well as it could. And water is wet.

Demeter

(85,373 posts)Nationalize the banks..turn them into public utilities.

westerebus

(2,976 posts)Demeter

(85,373 posts)All the debate about the pros and cons of a Greek exit from the euro area is missing the point: A German exit might be better for all concerned.

Unless Europe’s leaders take some kind of radical action, such as adopting and executing some of the many reform ideas they have floated, the currency union is headed for disintegration. The problems of Greece, Ireland and Portugal have spread to Spain, the fourth-largest economy in the euro area. Italy is probably next. The other members of the currency union can’t afford to bail them all out. Further loans will serve only to exacerbate the fundamental problem of too much debt and add to the growing enmity between the strong northern tier and its wards to the south. Without healthy economic growth -- and Europe is now back in a recession -- multiple countries will have to restructure their sovereign debts. Greece’s agonizing two-year restructuring experience suggests that doing several more would be extraordinarily difficult, if not impossible...A Greek exit from the currency union would make the situation even worse. There is no mechanism to decide, or deal with, whichever nation might be next, and even that presumes that exits could be managed. The more terrifying prospect is that the other afflicted countries might exit in an uncontrollable panic, complete with bank runs, failures and general disarray. The accompanying repudiation of hundreds of billions of euros in debt would overstrain the European financial system, even Germany’s. The global economy would be paralyzed as everyone wondered which domino would be next to fall.

German Exit

What, then, might a German exit do? With integration and multiple restructurings so unlikely and withdrawal of the weak members so fraught, it might actually be the best of all available options. A single, powerful nation would have the best shot at executing a relatively swift exit that would be over before anyone could panic. No agonizing over who exits and who doesn’t. Stripped of its German export powerhouse, the euro would depreciate sharply, but would not become a virtually worthless currency, as, for example, any re-issued Greek drachma surely would. With the euro devalued, a Greek exit and devaluation would be relatively pointless. So, no contagion or bank runs. With new exchange rates making all the non-euro financial havens prohibitively expensive, and with the threat of forced conversion into devalued national currencies removed, depositors in southern Europe would lose their impetus to run. Germany’s exit would provide immediate benefits to all the remaining euro-area nations. The currency depreciation would radically improve their trade competitiveness -- exactly what many observers have said the weaker nations in the south need most. The euro area’s balance of payments would improve, providing sorely needed funds to service its external debt. The benefits would accrue to the euro area as a whole, as opposed to serial exits at the weak end of the spectrum, which would crush one weak nation after another, with each exit increasing pressure on the next candidate.

Other relatively strong euro-area nations, such as the Netherlands, would probably pause before following Germany’s lead. If they left, they would lose the trade advantages offered by the newly depreciated currency, and would have to bear all the costs and complications of reintroducing their own money.

The cheaper euro, of course, would be bad for foreign investors holding euro-denominated assets. On the bright side, the losses would be simultaneous in timing, spread evenly across creditors, and more moderate in the southern European countries than they would be in a euro-exit scenario...MORE

****************************************************************************************

Red Jahncke is president of the Townsend Group International LLC, a business consulting firm in Greenwich, Connecticut. The opinions expressed are his own.

Demeter

(85,373 posts)The chances that Barack Obama will be limited to one term as president increased significantly with last week’s unemployment report. The report for May showed a new uptick in unemployment, to 8.2%, and seemed to indicate that economic and employment growth will remain sluggish between now and the election in November, especially as the situation in Europe continues to worsen.

There’s not much Obama can do about it at this point. He can continue to blame the Bush administration and Republican policies. He can point a finger at an obstructionist Congress, which has blocked many of his measures. He can question whether Mitt Romney can do any better. But none of this is likely to work.

It is now time to pay the piper for the timidity and caution and misguided political calculations of three years of what can now safely be described as a failed economic policy. It will be difficult for Obama to criticize the Republican playbook, since he has been reading from the same pages. ...

Drunken Irishman

(34,857 posts)haha

Oh shit...he was serious?

![]()

girl gone mad

(20,634 posts)If only the "Centrists" had done more listening and less laughing.

Drunken Irishman

(34,857 posts)Why should I take him seriously when he essentially says Obama is pretty much doomed in November? Is Obama guaranteed to win? No. But his chances didn't worsen with the jobs report last week. That's just crazy talk. He'll win or lose on a whole host of reasons, and many aren't directly tied to the jobs reports.

Fuddnik

(8,846 posts)Drunken Irishman

(34,857 posts)He's gonna lose. Pres. Romney is sure to win! How could I have expected anything else?

Might as well just prepare these next five months for total Republican control in Washington. I'm glad you're here to show me the light so that I don't spend the next five months prepping for an Obama win, just to watch him lose in November! Now I know. He ain't going to win.

![]()

Egalitarian Thug

(12,448 posts)miscalculations and leapt to erroneous conclusions about 2010, and are right on track to repeat them this November. The republicans didn't win in 2010, the Democrats lost. The voters didn't vote for republican crazy, they voted against Democratic weakness. Unfortunately, the table is set in the republican's favor and our greatest hope is that Rmoney is such a freak that they will buck tradition.

When every choice is binary, the only possible vote for change is the other guy.

Drunken Irishman

(34,857 posts)So, 'the only possible vote for change is the other guy' doesn't happen very often.

girl gone mad

(20,634 posts)The economy was the deciding factor in all of them.

Tansy_Gold

(17,894 posts)And imho he lost more because of his ties to Nixon than the economy. He inherited Nixon's economic policies anyway, unlike Carter and boooosh 1 who were elected and who had a full four year term as POTUS behind them.

Fuddnik

(8,846 posts)And his "Whip Inflation Now" policy didn't do jack shit for recovery.

Drunken Irishman

(34,857 posts)No one voted for Ford. He had no built-in support outside the typical Republican voters. Obama actually won an election and that means people actually cast their vote for him, unlike ford. That built-in support is huge in a presidential election. Ford had none of it and it hurt the incumbency factor. Even still, Ford barely lost the election to Carter and probably would have won had it not been for Bob Dole's gaffe in the vice-presidential debate and Ford's in the presidential debate - where he asserted there was no Soviet dominance of Eastern Europe.

Egalitarian Thug

(12,448 posts)use of the new Party Convention rules. Clinton would never have won if not for Ross Perot. Shit happens.

Egalitarian Thug

(12,448 posts)high unemployment in a bad economy. And yet 2010 was the biggest shift since 1938 (which followed a capitulation to conservatives of that day to slow and/or end many of the employment/assistance programs begun in '32 - '34). So are there really that many teahaddists, really? Of course not.

Relentlessly pursuing a policy based in the other team's bad ideas resulted in 2010. The President and too many of his followers are in deep denial about this ridiculous notion that pandering to some mythical center results in success.

This is going to be a long, hot summer, and President Obama and the party he leads had better start talking and listening to some people outside the bubble or we're in real danger...

Drunken Irishman

(34,857 posts)Carter and Bush both had far worse approval ratings than Obama right now - as both's disapproval at this point in '80 and '92 almost pushed 60% nationally. Obama is nowhere near the level of either those two incumbents who lost. If anything, he's polling at the level Reagan was in early '84 and Bush was in '04.

Both candidates who won - one who won despite a slow recovery.

Egalitarian Thug

(12,448 posts)I believe that Obama will win, and that's a good thing if for no other reason than his SCOTUS nominees will be far less objectionable that Rmoney's would be. But, the fact remains that he has spectacularly failed a large portion of American voters that should be his with no question through his unwavering commitment to right wing ideas and policies, policies with a long track record of failure and none of success.

He was rolled by the financial industry, he was rolled by the insurance industry, he was rolled by the military, and he was rolled by the religious freaks. That leaves a very bitter taste in the mouths of millions of his formerly ardent supporters that believed his campaign rhetoric. There's just no way to deny it and as a result, he has put the republicans in play in an election that should be a foregone conclusion.

And if he does manage to lose this coming election, it is going to be due to his own apparent lack of conviction to anything beyond wanting to be reelected.

Demeter

(85,373 posts)And she's not shy about using it...

I don't need to see the ultimate devastation to know there's an avalanche in progress. I've seen this film before....

Tansy_Gold

(17,894 posts)But I think this is the money quote (pun intended):

It is now time to pay the piper for the timidity and caution and misguided political calculations of three years of what can now safely be described as a failed economic policy. It will be difficult for Obama to criticize the Republican playbook, since he has been reading from the same pages. ...

And again, this goes right straight back in an unbroken line to those transition appointments of November 2008.

Given Obama''s mandate for change at that time and the fact that he did not follow up on that mandate, his re-election chances are severely diminished. Does that mean he's going to lose in a landslide to Romney? No, not necessarily. This is after all only June and we do have those five months ahead of us. But if we take my own personal theory of how people vote, I think the scenario is going to play out like this:

Blacks as a block will support Obama, not just because he is Black, but because they know Romney and the pukes are racists.

Hispanics as a block will support Obama, because they know Romney and the pukes are not just racists, they are anti-immigrants-of-color racists.

Women as a block will support Obama over Romney, especially women of color. They know Romney hates them.

Unions, self-hating weasels such as they are these days, will support Obama because they know Romney and the pukes are anti-labor. This does not mean all union members will actually vote for Obama, because many TRADITIONAL union members are white males who became raygun democrats back in the day.

White men will split, but they will marginally favor Romney.

The block most turned off by Obama, imho, are the young voters. First are the ones who came into 2008 as their first presidential election and got turned on by the oratory and the promise and how have nothing to show for it. They have no history of support for anything else, so they will become the apathetic non-voters of 2012 and the turncoats to Romney because they don't know any better. The 2012 first time voters may be even more cynical, and therefore more likely to vote for Romney.

If Obama wanted to get the youth vote back, the easiest thing he could do is go after the student loan interest rates. This is an issue that on the surface brings in the young voters, but it also goes after their parents who are trying to help foot the college bills AS WELL AS the older voters who went back to school on the student loan program, now can't get jobs to pay them off, and are facing garnishments of already reduced early retirement social security.

This election is Obama's to lose. I don't think Romney can win it on his own.

Much will depend on who Willard picks as his running mate. McCain was a horrible candidate himself on virtually every level, but Palin took him even further down. Their appeal was to the very lowest denominator voter -- the uninformed christian fundamentalist racist bigot, of which we have plenty. Their campaign was essentially BE AFRAID OF THE BLACK MAN, and it didn't work. Willard is a lot slicker than McCain, and I don't think he'll be coerced into accepting a space cadet of Palin's caliber. (Ron Paul would bring Romney a lot of libertarians, so watch out for that one.)

Had Obama held firm on his own campaign promises, he would be unbeatable. It wouldn't matter if he didn't get EVERYTHING passed by congress; if he had just tried, made a sincere effort, he would have swept the electoral college.

But Obama didn't do that. He started right out in November '08 with those gawdawful economic appointments and the jig was up from there. Health care got watered down, we still have the millionnaires' tax cuts, we're still in Afghanistan and we don't even know how many mercenaries, er I mean "contractors" the tax payers are paying for in Iraq. Nothing has been done on energy policy, everything has gone backward on issues like reproductive rights, Wall Street is still writing its own legislation. And on and on and on and on.

The one area where Obama has more or less made good on his campaign promises is in the area of GLBTQ rights. DADT is pretty much out of the way, and more states are passing laws removing marriage discrimination. But in terms of political strategy, that's an issue that affects maybe 10-15% of the population directly, maybe 30% indirectly, and it's one distinct issue that may be overshadowed by others. By that I mean the voter who has a GLBTQ child or sibling may be personally pro-same sex marriage, but if the other issues aren't engaged, that voter is not likely to support Obama solely on the strength of a same-sex-marriage position.

If I were advising Obama, here's what I'd tell him:

1. First and foremost -- come out strong for an effective college student loan relief policy. I don't care how you calculate the numbers, but make it EFFECTIVE, so people can get on with their lives, buy homes, buy cars. The doofus who made billions from Sallie Mae has enough.

2. Tell the fundamentalists to eat shit on birth control. Family planning is absolutely essential to the economy on half a dozen different level. Women need absolute freedom of choice, and their health needs, including prescription coverage for contraceptives, should come before any religious bull shit. ANY WOMAN WHOSE EMPLOYER=FUNDED INSURANCE DOES NOT COVER 100% THE COST OF HER BIRTH CONTROL SHOULD BE ELIGIBLE FOR 100% MEDICAID-FUNDED COVERAGE. Religious discrimination should not be allowed on any level of health care.

3. Start prosecuting Wall Street and its alleys(sic). I'll bet you'll see some changes in Wall Street behavior if there are a few high-profile trials in the areas of mortgage fraud, insider trading. And pick at least one that goes after clawbacks. If you let people know your administration is willing to go after bazillionaires, you'll get a bazillion more votes.

4. Demand -- DEMAND -- and end to the booooosh tax cuts for the wealthy. Tax capital gains as ordinary income. Read a few liberal/progressive/radical/Marxist books on economic theory and don't let ANY of your current economic advisory team talk to you about it. Hell, you should fire that entire bunch of goons yesterday.

5. Never never never never grant your opponents any respect. They have none for you.

Demeter

(85,373 posts)...Even as most Americans are delaying retirement to bolster their savings accounts, the recession and its protracted aftermath have forced many older people who are out of work to draw Social Security much earlier than they had planned.

According to an analysis by Steve Goss, chief actuary for the Social Security Administration, about 200,000 more people filed initial claims in 2009 and 2010 than the agency had predicted before the recession and he said the trend most likely continued in 2011 and 2012, though that is harder to quantify. The most likely reason is joblessness...

...Drawing Social Security early has repercussions that will be hard to overcome even if the economy — and her work prospects — improve. By collecting four years shy of her full retirement age, Ms. Keany will receive a reduced monthly benefit for the rest of her life. Those who collect early get 20 to 30 percent less a month than they would get if they waited until full retirement age, which varies by year of birth. People in Ms. Keany’s age bracket are expected to live an average of close to 23 more years.

“The most potent lever that individuals can pull in trying to get themselves a secure retirement income is to postpone claiming” Social Security, said Alicia H. Munnell, director of the Center for Retirement Research at Boston College.

As recently as a decade ago, half of those eligible claimed Social Security at 62. But that share has been falling because people are living longer and still want to work as well as shore up retirement funds. That makes it even more galling for those who are forced to claim early because of unemployment. Several people interviewed mentioned blows to their self-esteem along with abandoned dreams of a more comfortable old age.

According to an analysis by Richard W. Johnson, director of the retirement policy program at the Urban Institute, 37 percent of older workers who lost their jobs between 2008 and 2011 and did not return to work ended up claiming Social Security as soon as they turned 62...

Demeter

(85,373 posts)AND A BANKSTER IS A BANKSTER, WHEREVER HE MAY ROAM

http://www.zerohedge.com/news/spain-greece-after-all-here-are-main-outstanding-items

After two years of denials, we finally have the right answer: Spain IS Greece. Only much bigger (it is also the US, although while the US TARP was $700 billion or 5% of then GDP, the just announced Spanish tarp is 10% of Spanish GDP, so technically Spain is 2x the US). So now that the European bailout has moved from Greece, Ireland and Portugal on to the big one, Spain, here are the key outstanding questions:

1. Where will the money come from?

De Guindos, Schauble and the Eurogroup, all announced that the sole source of cash would be the ESM and/or the EFSF. The problem with this is that the ESM has yet to be ratified by Germany, whose parliament said previously it is sternly against allowing the ESM to fund a direct bank bailout, something which just happened. Thus, the successful German ESM ratification vote, whenever it comes, and which previously was taken for granted, now appears to be far more questionable.

Which leaves the EFSF. The problem with the EFSF is that there is about €200 billion in dry powder. And this includes the Spanish quota of €93 billion, which we can only assume is now officially scrapped.

Which brings us to a bigger question: now that Spain is officially to be bailed out, what happens next. And by that we mean of course the big one: Italy. Recall that as we posted in Brussels... We Have A Problem, once the contagion spreads again to Italy, and that country also needs a bailout, it is game over...

2. Where will the money go?...

3. What happens to Spanish sovereign debt?...

4. Precedent

...ironically, what just happened, is that the Eurozone, with the tacit agreement of Germany, essentially gave insolvent banks a green light to short themselves into a full bailout...

5. Market reaction

DETAILS AT LINK

Demeter

(85,373 posts)AUSTRALIA is boosting its ranks with foreign soldiers by offering cash bonuses of up to $200,000 and fast-tracked citizenship. Veterans have hit out at hiring "mercenaries" from countries such as America, Germany and Singapore instead of recruiting more Australians. Defence, meanwhile, has scrapped payments of $680 to single Aussie soldiers to fly home for Christmas.

Figures obtained by the Herald Sun show 726 international military personnel have come to Australia since 2006. It is believed to have cost about $100 million to help them move.

The Victorian RSL says the force should be hiring Australians and training them. War graves advocate John Saddington questioned the loyalties of foreign recruits.

"It's an absolute disgrace," he said. "We are hiring mercenaries."

Recruits are coming from America, Britain, New Zealand, Canada, South Africa, Italy, Singapore, Poland, Greece and Germany. Hundreds of internationals have been lured by the promise of better pay and entitlements - 570 put their hands up to move to the Navy after the force visited Britain in December on a "fact finding" mission.

A Defence Department spokesman said: "The ADF contributes to the cost of relocating lateral recruits. The costs vary according to the family composition and size, but is typically between $150,000 to $200,000.

"Given the significant cost of training and building experience in new military recruits, this cost represents good value."

In other incentives, recruits are also having their Australian citizenship fast-tracked after just three months of service.

Demeter

(85,373 posts)if you want more, I'm going to have to dig for it.

Everyone is off to the Hamptons, or something....or holding their breath to see what falls out of Spain, Ireland, Italy, and more...

It's quiet out there...too quiet.

jtuck004

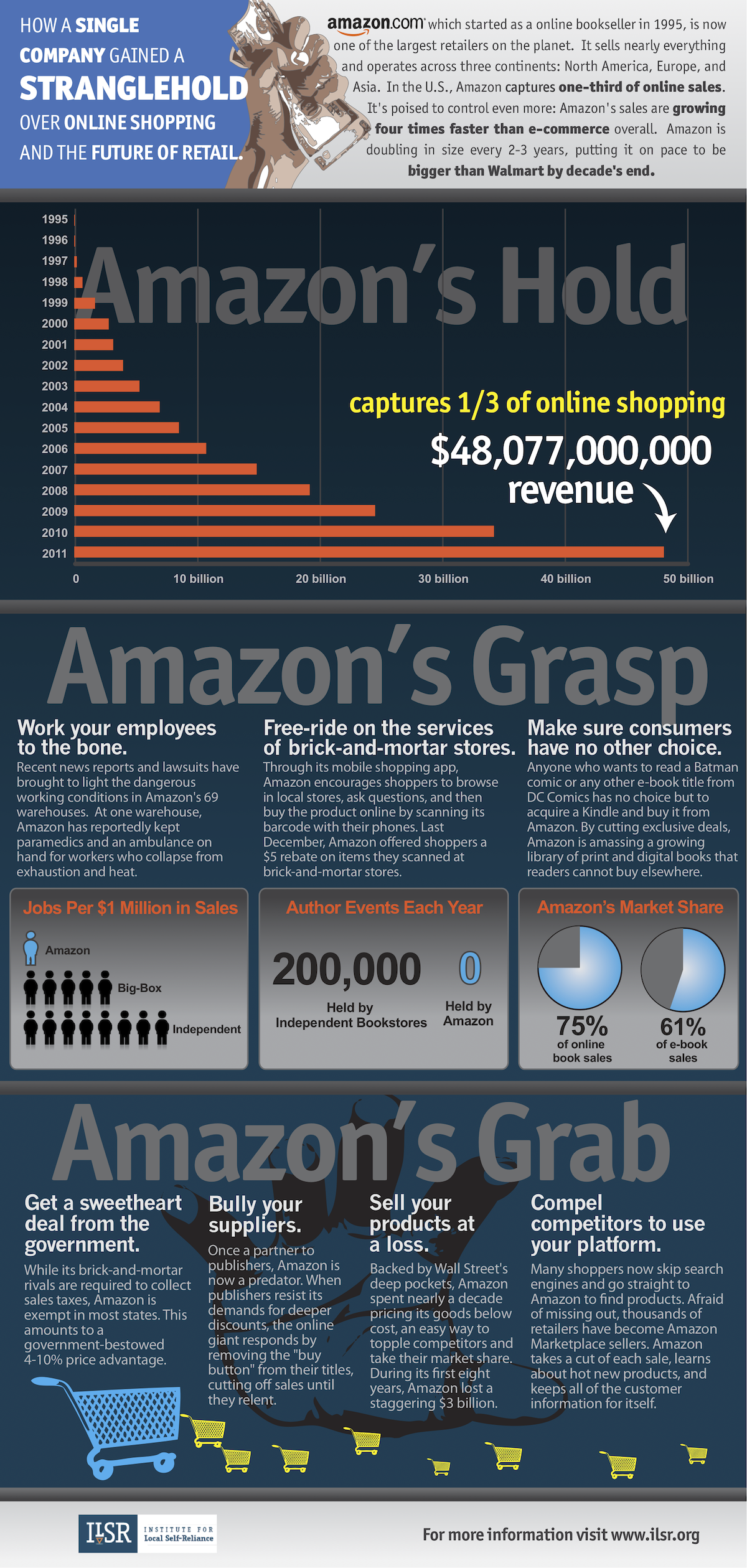

(15,882 posts)The graphic is on The Big Picture, here

I have a theory that corporations who rely on using their capital to cheat and and profit aren't scared of anything but assets they can't buy, (because the people who own those assets don't need their capital and it's the only product/power such corporations have) so that people who figure out how to work together in a democratic cooperative for profit might have the only defense that actually protects their income. They have to work hard, educate their neighbors, market, and even then they may just barely survive. But they might do better than many others, all of whom are really on their own, public or private.

In the future this graphic predicts the trick might be figuring out what the best opportunities are to work together.

TalkingDog

(9,001 posts)n/t

Egalitarian Thug

(12,448 posts)The Sherman Act provides rules & tools to stop these anti-competitive practices. Labor laws would protect the workers. But when law enforcement refuses to enforce the law, it's the wild west and you just grab what you can for as long as you can.

Apparently we learned absolutely nothing from Enron, etc.

girl gone mad

(20,634 posts)The move by China follows targeted measures by Malaysia, Indonesia, Thailand and most recently India to use “compulsory licenses” to make their own generic versions of patented drugs. From Reuters (hat tip reader Joel B):

The amended Chinese patent law allows Beijing to issue compulsory licenses to eligible companies to produce generic versions of patented drugs during state emergencies, or unusual circumstances, or in the interests of the public.

For “reasons of public health”, eligible drug makers can also ask to export these medicines to other countries, including members of the World Trade Organisation.

The intriguing part of this is that this Chinese initiative is completely kosher under WTO rules when life-saving medicines are too costly. Given the high prices put on certain AIDS and cancer drugs in dollar terms, they’re the perfect targets for an action like this. India gave a compulsory license for the manufacture of Nexavar which is used to treat kidney and liver cancers. China appears to be using the compulsory license threat to improve its bargaining leverage for some of the newer HIV drugs, such at Gilead’s tenofovir. China was excluded from a deal with a group of nations to buy tenofovir by paying cost plus a small royalty. Gilead has offered more concessions after the media leaked that China was considering implementing compulsory licensing.

Read more: http://www.nakedcapitalism.com/2012/06/china-goes-where-obamacare-refused-to-tread-takes-on-big-pharma-on-high-priced-drugs.html

xchrom

(108,903 posts)

DemReadingDU

(16,001 posts)My dogs will lay flat-out on the cool patio cement or on top of the hosta plants, whatever is in the shade.

xchrom

(108,903 posts)MILAN (AP) -- Official statistics confirm that Italy's economy contracted by a quarterly rate of 0.8 percent in the first three months of the year, the worst contraction in three years.

The painful recession keeps pressure on Premier Mario Monti's government, which is struggling to fend off the debt crisis and the perception that Italy could be next to seek a bailout following Spain's decision over the weekend to ask for help for its ailing banks.

The ISTAT statistics agency says the contraction is the worst since the first quarter of 2009, when the economy contracted by 3.5 percent. ISTAT forecasts that the Italian economy will contract by 1.3 percent this year, slightly more than the government's estimate of 1.2 percent.

Spending by families is down significantly.

xchrom

(108,903 posts)

Conspicuous consumption … Diego Velázquez's An Old Woman Cooking Eggs (1618). Click for the full image. Photograph: National Gallery of Scotland

Spain is accomplished in the art of decline. At its most powerful, it had economic problems just as difficult to conquer as those of today. And they are mirrored in some of the greatest Spanish art.

In Diego Velázquez's painting Bacchus, the supreme Spanish master of the 17th century portrays the god of wine among a group of real life, mortal drinkers. They look poor and disenfranchised, but the booze makes them happy for a while. It shows an eye for poverty and outsiderdom that also made Velázquez portray a street water-seller and the dwarf-entertainers of the royal court.

Spain had a world empire when Velázquez – who was born in 1599 and died in 1660 – was painting his ironic and melancholic pictures of real life. Yet the reality he records is one of decline and poverty. Spain's galleons of gold and silver from its colonies in the New World failed to buy it a place in the economic rise of modern Europe: the beneficiaries of expanding global trade in the 17th and 18th centuries were the Dutch and British with their merchant ships, sophisticated banks and busy exchanges.

Southern Europe was getting left behind in the Baroque age, just as it is now. In fact, the cruel grinding wheels of economic inequality now ravaging the continent were put in place five centuries ago, when new trade routes in the Atlantic and Pacific put paid to the mercantile leadership of Mediterranean Europe. This is reflected in Italian as well as Spanish art. In Caravaggio's late paintings – as he travelled the south on the run for murder – we see a world of poverty and dirty feet: Jesus born in a very tough stable.

westerebus

(2,976 posts)A second cousin at least.

Demeter

(85,373 posts)Dwarves were used as all purpose objects of fun...

Tansy_Gold

(17,894 posts)were also hampered by religion, specifically the Roman Catholic Church and its involvement in government.

Ferdinand and Isabella (Fernán and Isabel) were Los Reyes Católicos, the Catholic Kings, and were responsible not only for sending Columbus on his way to destroy the indigenous populations of the western hemisphere but for expelling the Jews from Spain and completing the reconquista or reconquest of Spain from the Muslim Moors. The cultural dominance of the Church, including the Inquisition, can remain institutionalized even after laws have been changed, such as allowing same-sex marriage. Religion is frequently used as a means to assert and/or maintain economic dominance.

xchrom

(108,903 posts)Wall Street bankers and traders, given hope by a market rebound in the first quarter, are now seeing earnings and paychecks threatened by turmoil in Greece in what is becoming an annual cycle.

For a third consecutive year, revenue from investment banking and trading at U.S. firms may fall at least 30 percent from the first quarter, Richard Ramsden, a Goldman Sachs Group Inc. (GS) analyst, said in a note last week. Greece, which gave English the word “cycle,” has been the main reason each year that the second quarter soured after a promising first three months.

Deal volume has dropped and equity and credit markets have fallen on concern that Greece may abandon the euro and the European sovereign-debt crisis will spread to nations including Spain. Those economic issues cut profit, bonuses and jobs at Wall Street firms in last year’s second half and threaten to do the same in 2012.

“It’s going to be a tough summer at least, and it does feel like the last couple years all over again,” said David Konrad, an analyst at KBW Inc. in New York. “The bank valuations seem unfairly discounted, but investors are looking at this year and saying, ‘I’m not going to fall for this again.’”

xchrom

(108,903 posts)The 100 billion-euro ($126 billion) rescue for Spain’s banks moved Italy to the frontline of Europe’s debt crisis as an initial rally in the country’s bonds fizzled on concern it may be the next to succumb.

Italy’s 10-year bonds reversed early gains today in the first trading after the Spanish bailout and declined for a fourth day, sending the yield up 7 basis points to 5.84 percent.

“The scrutiny of Italy is high and certainly will not dissipate after the deal with Spain,” Nicola Marinelli, who oversees $153 million at Glendevon King Asset Management in London, said in an interview. “This bailout does not mean that Italy will be under attack, but it means that investors will pay attention to every bit of information before deciding to buy or to sell Italian bonds.”

Italy has 2 trillion euros of debt, more as a share of its economy than any advanced nation after Greece and Japan. The Treasury has to sell more than 35 billion euros of bonds and bills per month -- more than the annual output of each of the three smallest euro members, Cyprus, Estonia and Malta.

Demeter

(85,373 posts)Oh, wow — another bank bailout, this time in Spain. Who could have predicted that?

The answer, of course, is everybody. In fact, the whole story is starting to feel like a comedy routine: yet again the economy slides, unemployment soars, banks get into trouble, governments rush to the rescue — but somehow it’s only the banks that get rescued, not the unemployed. Just to be clear, Spanish banks did indeed need a bailout. Spain was clearly on the edge of a “doom loop” — a well-understood process in which concern about banks’ solvency forces the banks to sell assets, which drives down the prices of those assets, which makes people even more worried about solvency. Governments can stop such doom loops with an infusion of cash; in this case, however, the Spanish government’s own solvency is in question, so the cash had to come from a broader European fund.

So there’s nothing necessarily wrong with this latest bailout (although a lot depends on the details). What’s striking, however, is that even as European leaders were putting together this rescue, they were signaling strongly that they have no intention of changing the policies that have left almost a quarter of Spain’s workers — and more than half its young people — jobless. Most notably, last week the European Central Bank declined to cut interest rates. This decision was widely expected, but that shouldn’t blind us to the fact that it was deeply bizarre. Unemployment in the euro area has soared, and all indications are that the Continent is entering a new recession. Meanwhile, inflation is slowing, and market expectations of future inflation have plunged. By any of the usual rules of monetary policy, the situation calls for aggressive rate cuts. But the central bank won’t move.

And that doesn’t even take into account the growing risk of a euro crackup. For years Spain and other troubled European nations have been told that they can only recover through a combination of fiscal austerity and “internal devaluation,” which basically means cutting wages. It’s now completely clear that this strategy can’t work unless there is strong growth and, yes, a moderate amount of inflation in the European “core,” mainly Germany — which supplies an extra reason to keep interest rates low and print lots of money. But the central bank won’t move.

Meanwhile, senior officials are asserting that austerity and internal devaluation really would work if only people truly believed in their necessity. SO, NOW WE HAVE AN AUSTERITY FAIRY? DEMETER

... you get a picture of a European policy elite always ready to spring into action to defend the banks, but otherwise completely unwilling to admit that its policies are failing the people the economy is supposed to serve. Still, are we much better? America’s near-term outlook isn’t quite as dire as Europe’s, but the Federal Reserve’s own forecasts predict low inflation and very high unemployment for years to come — precisely the conditions under which the Fed should be leaping into action to boost the economy. But the Fed won’t move. What explains this trans-Atlantic paralysis in the face of an ongoing human and economic disaster? Politics is surely part of it — whatever they may say, Fed officials are clearly intimidated by warnings that any expansionary policy will be seen as coming to the rescue of President Obama. So, too, is a mentality that sees economic pain as somehow redeeming, a mentality that a British journalist once dubbed “sado-monetarism.” Whatever the deep roots of this paralysis, it’s becoming increasingly clear that it will take utter catastrophe to get any real policy action that goes beyond bank bailouts. But don’t despair: at the rate things are going, especially in Europe, utter catastrophe may be just around the corner.

Demeter

(85,373 posts)Does anyone on the planet think that the problems surrounding the credibility of the euro have been solved by the €100bn bailout of Spain’s banks? Does any overseas investor believe that a corner has been turned, when the German government continues to set its face against the mutualisation of debt?

We can only hope that Spanish prime minister Mariano Rajoy and European Commissioner Olli Rehn are, as politicians are wont to do, treating the public with contempt in trotting out these bromides. The alternative explanation, that they really believe the problem has been solved, is far more worrying.

Read more >>

http://link.ft.com/r/J0VG55/WTQXUK/Q38E1/MS83UW/JE78FA/ZH/t?a1=2012&a2=6&a3=11

Demeter

(85,373 posts)Alexis Tsipras, leader of Syriza, says favourable terms won by Madrid for its bank rescue confirms his argument that Athens got a bad deal from EU

Read more >>

http://link.ft.com/r/3JFELL/FK0HS0/87I64/OROURS/EXCNJI/ID/t?a1=2012&a2=6&a3=11

THEY WOULD BE FOOLS IF THEY DIDN'T.

Ghost Dog

(16,881 posts)That is the process and the point.

Nb.

DemReadingDU

(16,001 posts)"a historic change."

Maybe in Spain.

But in America, the police come with tear gas, destroy the occupied parks, and take you to jail.

Seems the message in America is Don't upset the Status Quo.

Ghost Dog

(16,881 posts)And Spain (and France, and Italy) are very much in play.

It's the metastasizing corruption, you see. And the demand for justice.

DemReadingDU

(16,001 posts)Americans have become complacent. From my own family, they truly believe the constitution and amendments will protect us from harm, that there have been laws and regulations to prevent another '1929 market crash', that the TSA prevents terrorists on planes by performing body scans and searches before boarding, and on and on. They tell me personally that there is nothing to worry about. It is impossible to discuss anything with them. I'm sure one day, when it all goes kaboom, they will open their own eyes and ears, but by then it will be too late. And I fear the demand for justice will be too great.

Demeter

(85,373 posts)High-cost nations are considering a return to manufacturing as innovation makes it cleaner and more competitive, writes Peter Marsh

Read more >>

http://link.ft.com/r/5F39HH/97HNTH/OFBYP/30YZOU/B56JE0/9A/t?a1=2012&a2=6&a3=11

Demeter

(85,373 posts)SEVERAL EXAMPLES OF "PRIVATIZATION" AT WORK...I'LL JUST USE ONE:

Medicare

In 1994 the Republicans took over the House of Representatives and immediately began to privatize Medicare. Their first step, achieved in 1997 with the support of President Clinton was Medicare+Choice. But the Republicans made a serious tactical mistake. They were so confident in the inherent superiority of the private sector they didn’t ask for a handicap. Private insurers received the same amount as the service cost under Medicare. The private sector lost the race. Badly. Private insurers began pulling out en masse. In 2000, more than 900,000 patients were dropped from the program.

No one should have been surprised. Private insurers overhead costs (marketing, profits, etc.) dwarf those of Medicare: Slightly under 17 percent compared to about 5 percent for Medicare. So to become competitive the private sector required at least a 12 percent handicap...Which private insurers received when Medicare Advantage replaced Medicare+Choice in 2003. The federal government now pays private insurers on average 14 percent more than the same care would cost under traditional Medicare.

The huge subsidy allowed private insurers to compete. Today, about 12 million older Americans are enrolled in some form of private plan, more than 22 percent of all Medicare beneficiaries. According to the Medicare Payment Advisory Commission (MedPAC), subsidies to the private sector will exceed $150 billion over 10 years.

Since taking office President Obama has argued that insurers are overpaid. He wants to finance part of his health-care overhaul by paring their subsidies. In February the Administration announced it would be cutting the Medicare Advantage premium. The private insurers are screaming. They need their handicap to stay in the game.

Demeter

(85,373 posts)Marjorie Kelly's new book explains how we can create a "generative economy" that is focused on sustaining life rather than extracting profit. The economy was bound to tank. Not just because greedy corporations rigged the system or because government helped grease the wheels for them. But because the dominant way that we've come to do business -- profit at the expense of all else -- is simply incompatible with the planet we're living on. It's an economy that Marjorie Kelly would call "extractive."

Kelly, a fellow at the Tellus Institute and co-founder of Business Ethics magazine, wrote the just-released book, Owning Our Future: The Emerging Ownership Revolution (Berrett-Koehler, 2012) that helps provide an antidote to the extractive, money-at-all-costs economy. She calls it the "generative economy," and her book is proving to be a great contribution to the growing New Economy movement.

"My sense is that there is an alternative, and that the reality of it is farther along than we suppose. When we can't see this, it's because we've left no room for it in our imagination. If it's hard to talk about, it's because it doesn't yet have a name. I suggest we call it the generative economy. It's a corner of the economy (hopefully someday much more) that's not designed for the extraction of maximum financial wealth. Its purpose is to create the conditions for life. It does this through its normal functioning, because of the way it's designed, the way it's owned -- like an employee-owned solar company."

Kelly's book takes readers across the U.S. and across the world to examine communities and businesses that have flipped the traditional corporate model on its head, providing us with working examples of the transformation we are headed toward if we want a sustainable economy. "Emerging ownership models are new members of an older family of designs that include cooperatives, employee-owned firms, and government-sponsored enterprises," she writes. "In the UK, these include the John Lewis Partnership--the largest department store chain in the country--which is 100 percent owned by its employees and has an employee house of representatives in addition to a traditional board of directors."

INTERVIEW FOLLOWS

Demeter

(85,373 posts)this is one bouncy dead cat.

Demeter

(85,373 posts)Demeter

(85,373 posts)Investment bank in ‘late-stage’ talks with State Street over tie-up that could create the largest administration services provider to hedge funds

Read more >>

http://link.ft.com/r/P75VYY/HYVBNJ/204L2/30YZON/L95HPO/PJ/t?a1=2012&a2=6&a3=11

DANGER! DANGER, WILL ROBINSON!

Demeter

(85,373 posts)Last edited Mon Jun 11, 2012, 10:32 AM - Edit history (1)

Just 16 such delisting deals have been completed in past two years in America, Dealogic figures show, but a similar number are pending

Read more >>

http://link.ft.com/r/P75VYY/HYVBNJ/204L2/30YZON/2OPX7R/PJ/t?a1=2012&a2=6&a3=11

MORE DANGER

Demeter

(85,373 posts)The experience of last year’s near-default has taught lobbyists to prepare a campaign to stop the political brinksmanship over the economy

Read more >>

http://link.ft.com/r/3JFELL/FK0HS0/87I64/OROURS/163WZF/ID/t?a1=2012&a2=6&a3=11

I READ THIS LITTLE BLURB WITH INCREASING SURPRISE.

THE K STREET LOBBYISTS ARE GOING TO REIN IN THE TEA BAGGERS?

Demeter

(85,373 posts)The Republican presumptive nominee would support wider use of plans that make patients pay more out-of-pocket expenses

Read more >>

http://link.ft.com/r/3JFELL/FK0HS0/87I64/OROURS/ORX8TX/ID/t?a1=2012&a2=6&a3=11

AN OBVIOUS APPEAL TO THE IGNORANT BUT PROUD

Demeter

(85,373 posts)On Thursday, the Bipartisan Policy Center’s (BPC) Task Force on Defense Budget and Strategy, co-chaired by General (ret.) James L. Jones, former Senate Budget Committee Chairman Pete Domenici, and former Agriculture Secretary Dan Glickman, released the report, Indefensible: The Sequester’s Mechanic and Adverse Effects on National and Economic Security.

The report describes the looming sequester of federal spending scheduled to occur in January as fiscal, economic and national security “folly” as the imposition of the sequester will have significant consequences to our military/national security. And, the taskforce is calling for congressional action to repeal and replace the legislation with a “broader fiscal plan that encompasses entitlement and tax reform.”

Jones said the nation can have a more effective fighting force at lower costs to taxpayers but the sequester “is not the way to get there.”

The report states that “the indiscriminate and irrational application of sequester cuts in 2013 will have adverse impacts on our military capabilities and readiness and economic vibrancy” and will do little or nothing to reduce our nation’s long-term debt situation.

Unless Congress and President Obama can agree on a plan to stop the January 2013 automatic cuts, our military will realize a reduction of $492 billion over the next ten years. Domestic programs also would be reduced by $492 billion over a decade.

About one million defense/non-defense jobs are expected to be lost over two years, which will cause a spike in unemployment.

The report concluded that:

• The sequester will require a 15-percent indiscriminate cut in defense spending for Fiscal Year 2013 that will undermine “U.S. military capabilities and readiness…without accomplishing any sensible and necessary reforms to the defense budget;”

• The adverse economic impacts of the pending sequester are already being felt in the national economy as businesses attempt to handle the uncertainty of funding that the sequester has caused;

• The sequester could cost defense- and non-defense-related job losses for more than one million American workers over 2013 and 2014;

• Costs related to delayed contracts, weapons system procurement confusion and slowdown, and job loss within the fragile American economy could well result in savings in federal spending of far less than the $1.2 trillion that the nine-year sequester has as its goal;

• Even if the sequester saved as much as it is intended to do, it would delay the nation’s debt from reaching more than 100 percent of Gross Domestic Product by only two years.

WELL THEN, LET'S DECLARE PEACE AND BRING THE TROOPS HOME...FROM EVERYWHERE.

Demeter

(85,373 posts)The U.S. is unlikely to escape a strait-jacket of mediocre growth if the economies in the rest of the world continue to slow down.

The ongoing financial crisis in Europe, which has waxed and waned for more than a year, is just one of the problems. The downturn in Europe has been matched by decelerating growth in rising economic powers such as China, India and Brazil.

“We are seeing a global slowdown,” said Scott Anderson, senior economist at Wells Fargo & Co. in Minneapolis

The effects are already evident in relationships with key trading partners. U.S. exports to the European Union, for example, fell 11.1% in April. And exports to China dropped 14%.

Demeter

(85,373 posts)Mom-and-pop investors, and not the Federal Reserve, have been the ones most responsible for driving the mad dash to government debt, according to newly released data. The Fed's ambitious Treasury-buying program has pushed the central bank's balance sheet to $2.83 trillion and, by many accounts, the benchmark 10-year Treasury yield to record lows, most recently to 1.56 percent. But despite the low yields, it's been retail investors most responsible for the recent move plunge.

"The conventional view is that 10-year Treasury yields have been pushed down to 1.5 percent and 10-year (Treasury Inflation Protected Securities) yields to -0.5% by the actions of the Federal Reserve and the safe haven demand from foreign investors," Capital Economics said in a research note. "The reality, however, is slightly different."

The demand among average investors has swelled so much, in fact, that they bought more Treasurys in the first quarter than foreigners and the Fed combined. Households picked up about $170 billion in the low-yielding government debt during the quarter, while foreigners increased their holdings by $110 billion.

PUTTING LIPSTICK ON A PIG, IMO

Demeter

(85,373 posts)Global standards to identify parties in financial trades should be in place by March next year, the Financial Stability Board said today.

“This system would be a building block for many financial stability and regulatory objectives, and it would deliver substantial benefits to financial firms,” FSB Chairman Mark Carney said in an e-mailed statement.

The lack of global standard practices for capturing data prevents financial institutions from producing timely and accurate assessments of their risk management, Bank of England official Andrew Haldane said in a speech in March. He said Lehman Brothers Holdings Inc. mistakenly excluded a $6 billion real-estate exposure in reports to its board months before its collapse. The FSB, based in Basel, Switzerland brings together global regulators and central bankers. It proposed a system for identifying financial counterparties in transactions which would include a 20-character alphanumeric code and the official name and address of the legal entity involved. The March 2013 implementation date is “ambitious,” the FSB said in its report, and “will require high level political support and strong engagement and co-operation with a wide range of private sector stakeholders.”

The FSB proposed a three-tiered system, consisting of a central oversight committee, an organization to develop detailed standards and a network of national bodies to implement the rules.

Demeter

(85,373 posts)A global system to tag trades in stocks, bonds and derivatives that would help authorities spot risks and market abuse must be in place by March 2013, regulators said on Friday.

...In 2008 markets and regulators were alarmed by how much time they needed to find out who was exposed to derivatives transactions on the books of U.S. bank Lehman Brothers when it went bust. The FSB says the LEI system will help regulators share information across borders and spot market abuses more easily and help banks assess risks on their books better.

"This system would be the 'building block' for many financial stability and regulatory objectives, and it would deliver substantial benefits for financial firms," FSB Chairman and Bank of Canada Governor Mark Carney said in a statement.

The G20 leaders meet later this month in Mexico, where they are set to give political backing to the FSB plans they requested last year...Full rollout to all trades will take years, starting with the $700 trillion over-the-counter or off-exchange derivatives market and then widening to stocks, bonds and other instruments...The FSB said the tagging system will be headed by a regulatory oversight committee whose members are drawn from public authorities to keep an eye on how the private sector operates the system...

LOTS OF DETAIL STILL AT LINK--READ ON

SEE ALSO:

http://www.securitiestechnologymonitor.com/news/3-tier-system-lei-fsb-proposed-30716-1.html

FOR THE REAL WONKY DETAIL

xchrom

(108,903 posts)For much of 2010 and 2011, the German economy seemed immune to the euro crisis raging around it. Now, however, it looks as though those days are over. Several indicators show that dark clouds are gathering over the country's economic output. The latest of those came on Friday.

According to data released on Friday by Germany's Federal Statistical Office, exports fell by 1.7 percent in April in comparison with March. The fall, while expected, was twice what most economists had forecast. It marks the first time in 2012 that German exports have fallen. In total, Germany exported €81.7 billion ($102 billion) worth of goods in April.

The data revealed that Germany can no longer count on the strength of growth in developing countries to offset the euro crisis. Exports to euro-zone countries mired in debt crises fell by 3.6 percent in April. Even though exports to non-European countries actually grew 10.3 percent in the month, demand from China and India has slowed, and German companies are worried.

"German companies have the feeling that foreign demand is not as dynamic as before and that the global economy is entering a weak phase," Dekabank economist Andreas Scheuerle told the conservative daily Die Welt. Still, he added, the main problem was more local. "The weakness is coming from the euro zone, where the debt crisis is not only taking the form of budget plans and savings programs, but it is also creating more uncertainty about the economic situation that's being reflected in weaker investment."

Demeter

(85,373 posts)Britain prevailed over Europe because of the protection of the English Channel--until Hitler's V2 rockets breached that barrier.

The US relied on its oceans (and subjugated provinces of Canada and Mexico) for protection...until the global economy breached that--and that was a case of treachery from the US corporations. So the bombs are economic, and they were built by American banks and multinational, US origin corporations. Traitors and bumbling fools, all of them.

Now, India and China will probably finish us off. And Russia will pick up whatever pieces she can.

xchrom

(108,903 posts)Politics is a strange business, and one of its premier oddities is that monumental changes are rarely heralded by great speeches. Addresses indicating a shifting course tend not to be of the visionary variety. And the public attention paid to such utterances often has no relation to their far-reaching consequences.

Often, in fact, it is only a tiny verbal adjustment that hints at a great change. Or a slightly different tone presaging a new direction.

Listening closely to Chancellor Angela Merkel in recent weeks has revealed just such a change in tone. It has been a careful shift, extremely nuanced. But it has become clear that her well-known melody is now a new one.

"We need a so-called fiscal union," she said during an appearance on German public broadcaster ARD last week. "Which means more joint budgetary policy." Up to that point, Merkel had merely repeated that which she always demanded. But then came the new tone: "More than anything, we need a political union," she said. "That means that we must, step by step through the process, give up more powers to Europe as well and allow Europe oversight possibilities."

Demeter

(85,373 posts)She couldn't be that cutting in German.

Demeter

(85,373 posts)French President Francois Hollande’s Socialist Party is set to win the largest number of seats in parliament, exit polls for the first round of the country’s legislative elections yesterday showed.

Hollande will have to wait until the June 17 second round to know if he has an absolute majority or will need allies in parliament, some of whom say his plans to increase spending and taxes are too timid.

In yesterday’s round, the Socialist Party and its Green and Left Front allies took 46.9 percent of the popular vote nationally, according to pollster Ipsos. Former President Nicolas Sarkozy’s Union for a Popular Movement and its allies got 34.6 percent. The Interior Ministry will issue official results later today.

“The Socialist Party has actually a good chance of winning an absolute majority on its own,” Dominique Barbet, an economist at BNP Paribas SA in Paris, wrote in a note to clients. “This would be helpful in case Hollande decides to deliver some austerity in the near future or, possibly, some structural reforms further down the road.”

MORE

Demeter

(85,373 posts)With an agreement to bail out Spain’s struggling banks, Europe again avoided financial chaos in a debt crisis that is in its third year. But Europe still faces far bigger challenges that threaten the Continent and, with it, the world economy. The most urgent of those concerns is being driven by events in a country at the other edge of the euro zone: Greece. While the Spanish banking rescue will be expensive — as much as $125 billion — it will be well within the means of a European emergency fund established for just such purposes.

Far harder to calculate are the costs if, after Greek elections next Sunday, the new government reneges on the bailout Greece negotiated with its European lenders a few months ago. That could lead to a withdrawal from the euro zone, threatening that currency union, which has largely benefited more prosperous members like Germany.

What is more, the Spanish bailout will do little to address European banks’ addiction to the borrowed money they have depended on for their daily financing needs.

“The way the currency union has been functioning is not sustainable,” Jens Weidmann, the president of the German Bundesbank, told the Welt am Sonntag newspaper. “A breakup of the currency union would bring extremely high costs and risks that no one can really predict.”

Lucas Papademos, a former interim prime minister of Greece, said that Greece’s departure from the euro zone would be catastrophic, pushing inflation in the country to as high as 50 percent, putting extreme stress on Greek banks and slashing living standards.

“The stakes are exceptionally high,” Mr. Papademos, who is also a former vice president of the European Central Bank, told a group of bankers in Copenhagen last week. “Because the decisions to be made at, and immediately after, the forthcoming elections will determine the country’s future for at least the next decade.”

Those problems would not be Greece’s alone. Europe’s big fear is contagion — an infection of financial panic that could spread far beyond Greece. Spain’s leaders have long said Greece’s problems contributed to the general market uncertainties that helped undermine Spanish banks. NO, I DON'T THINK SO....IT WASN'T GREECE, IT WAS BANKSTER PRACTICES, THAT UNDERMINED BANKS AROUND THE GLOBE.

Demeter

(85,373 posts)China is a kleptocracy of a scale never seen before in human history. This post aims to explain how this wave of theft is financed, what makes it sustainable and what will make it fail. There are several China experts I have chatted with – and many of the ideas are not original. The synthesis however is mine. Some sources do not want to be quoted.

The macroeconomic effects of the Chinese kleptocracy and the massive fixed-currency crisis in Europe are the dominant macroeconomic drivers of the global economy. As I am trying a comprehensive explanation for much of the world's economy in less that two thousand words I expect some kick-back.

China is a kleptocracy. Get used to it.

I start this analysis with China being a kleptocracy – a country ruled by thieves. That is a bold assertion – but I am going to have to assert it. People I know deep in the weeds (that is people who have to deal with the PRC and the children of the PRC elite) accept it. My personal experience is more limited but includes the following:

(a). The children and relatives of CPC Central Committee members are amongst the beneficiaries of the wave of stock fraud in the US,

(b). The response to the wave of stock fraud in the US and Hong Kong has not been to crack down on the perpetrators of the stock fraud (so to make markets work better). It has been to make Chinese statutory accounts less available to make it harder to detect stock fraud.

(c). When given direct evidence of fraudulent accounts in the US filed by a large company with CPC family members as beneficiaries or management a big 4 audit firm will (possibly at the risk to their global franchise) sign the accounts knowing full well that they are fraudulent. The auditors (including and arguably especially the big four) are co-opted for the benefit of Chinese kleptocrats.

This however is only the beginning of Chinese fraud. China is a mafia state – and Bo Xilai is just a recent public manifestation. If you want a good guide to the Chinese kleptocracy – including the crimes of Bo Xilai well before they made the international press look at this speech by John Garnaut to the US China Institute: SEE LINK AT SOURCE

NOW I KNOW WHERE OBAMA'S ECONOMIC POLICY CAME FROM--MADE IN CHINA!

appal_jack

(3,813 posts)Excellent article, Demeter. It deserves to be its own OP, maybe in GD for even better visibility.

I'll leave it to you since I'm on an i-pad...

![]()

-app

Egalitarian Thug

(12,448 posts)Demeter

(85,373 posts)Last edited Mon Jun 11, 2012, 06:55 PM - Edit history (1)

But consider also that China has over 5000 years of continuous "civilization", or at least, culture. And Bush and Nixon went over there. Perhaps they taught us, or the GOP/Military/Industrial complex, at least.

Meanwhile, there's far too much Democratic hand-wringing, and far too little anything else, including teaching or even remembering history...

Demeter

(85,373 posts)Europe has lit the fuse on an economic and financial bomb. The rescue package for Spain cannot plausibly be contained to €100bn once it begins, given the subordination of private creditors and collapse of global confidence in the governing structure of monetary union...

BUT WHAT'S ONE MORE BOMB BETWEEN FRIENDS AND NEIGHBORS?

Italy must guarantee 22pc of the bail-out funds, even though it cannot raise money itself at a sustainable rate. You could hardly design a surer way to pull Italy into the fire.

Citigroup warned over the weekend that Italy’s economy will shrink by 2.5pc this year and another 2pc next year as the fiscal squeeze starts in earnest, with grim implications for debt dynamics. Public debt will jump from 121pc of GDP to 137pc by 2014.

“The situation could rapidly become critical, because the country is highly vulnerable if the sovereign debt crisis persists or intensifies. A significant further rise in yields would deepen and extend the recession and accelerate the rise in the debt/GDP ratio, triggering a worsening vicious circle. We expect that Italy will have to request help,” it said.

The world is uncomfortably close to a 1931 moment. Italy’s public debt is the world’s third largest after the US and Japan at €1.9 trillion. There is no margin for political error...

ANOTHER MUST READ!

Demeter

(85,373 posts)...Spain’s pain is not novel. It is a carbon copy of Ireland’s. A period of ponzi growth was occasioned by money-capital fleeing the metropoles of financialised capitalism, toward places like Spain and Ireland, in search of higher returns. It found its lucrative returns in a bubble created in the real estate business, aided and abetted by local banks, developers, politicians. Then, Wall Street came crashing down, capital fled (as is its wont at times of financial implosion) and the losses of the banks were passed on to states (the Spanish and Irish governments) which had been, interestingly, running a very tight ship for some time before the Crash. The change in political personnel made little difference. No state, however tightly or austerely is run, can survive (a) once mountains of losses are deposited on it, and (b) when it has no Central Bank of its own to help it remain afloat.

Just like Ireland’s government almost two years ago, so Spain’s now went through the same emotional cycle. First, they refused to accept that the state and the ‘national’ banks were embraced in deadly embrace that condemned both to insolvency. Denial caused angry rejections of the notion that the country would seek EU assistance. However, frustration was bound to follow the realisation that no other avenue was open to them. And, lastly, the bailout was announced in almost triumphant terms – as the road to national recovery and a demonstration of the wonders of European solidarity.

Tragically, of course, Spain’s ‘bailout’, exactly like Ireland’s, will achieve none of that. All that has happened is that proud nations like Ireland and Spain have now joined Greece and Portugal in the Workhouse that is the EFSF-ESM; the Temple of Ponzi Austerity. Structured as a giant CDO, the whole edifice is spearheading the disintegration of the Eurozone, with untold costs for the whole of Europe. If Greece was the canary in the mine, and Ireland the harbinger of a systemic Eurozone-wide crisis, Spain is the portend that Europe’s Reverse Alchemy has now began, dissolving the fabric of countries that, unlike Ireland, are too large to ignore.

Yet again, Europe avoided doing the rational thing

What would the rational thing be? For two years now we have been shouting from the rooftops (in the context of our Modest Proposal – see Policy 1) that unifying the Eurozone’s banking systems is a prerequisite for arresting the Crisis. A single currency area cannot afford to have separate banking sectors that are supervised by national governments. It is nonsensical to speak of Spanish banks, French banks, Irish banks and German banks when, by Treaty, Spanish and Irish citizens have the right to wire their deposits at will from one jurisdiction to another, with these transfers immediately switching from ‘assets’ of one national Central Bank to the ‘liabilities’ of another (i.e. the Target2 and ELA system of within-Eurozone capital movement accounting)...

ANOTHER MUST READ

Demeter

(85,373 posts)...over 400 children have been abandoned in hatches in Europe since 2000...The United Nations is increasingly concerned at the spread in Europe of "baby boxes" where infants can be secretly abandoned by parents, warning that the practice "contravenes the right of the child to be known and cared for by his or her parents", the Guardian has learned. The UN Committee on the Rights of the Child, which reports on how well governments respect and protect children's human rights, is alarmed at the prevalence of the hatches – usually outside a hospital – which allow unwanted newborns to be left in boxes with an alarm or bell to summon a carer.

The committee, a group of 18 international human rights experts based in Geneva, says that while "foundling wheels" and baby hatches had disappeared from Europe in the last century, almost 200 have been installed across the continent in the past decade in nations as diverse as Germany, Austria, Switzerland, Poland, Czech Republic and Latvia. Since 2000, more than 400 children have been abandoned in the hatches, with faith groups and right-wing politicians spearheading the revival in the controversial practice.