Economy

Related: About this forumWeekend Economists Trace the Long and Winding Road February 7-9, 2014

Today turns out to be memorable in a lot of ways. Consider the birthdays for February 7th:

Sir Thomas More 1478

John Deere 1804

Charles Dickens 1812

Frederick Douglas 1817

Laura Ingalls Wilder 1867

Eubie (James Hubert) Blake 1883

Sinclair Lewis 1885

Larry "Buster" Crabbe 1908

Oscar Brand 1920

An Wang 1920

Eddie Bracken 1920

Wilma Lee Cooper (Leary) 1921

Keefe Brasselle 1923

Gay Talese 1932

Earl King 1934

King Curtis 1934

Dieter Bohlen 1944

Sammy Johns 1946

Jimmy Greenspoon (Three Dog Night) 1948

Alan Lancaster (Status Quo) 1949

Marilyn Cochran 1950

Miguel Ferrer 1954

Brian Travers (UB40) 1959

James Spader 1960

Garth Brooks 1962

David Bryan (Bon Jovi) 1962

Chris Rock 1966

Jason Gedrick 1967

Edward Bergenholz 1974

Ashton Kutcher 1978

Tina Majorino 1985

1795 - The 11th Amendment to the U.S. Constitution was ratified.

1913 - The Turks lost 5,000 men in a battle with the Bulgarian army in Gallipoli.

1922 - DeWitt and Lila Acheson Wallace offered 5,000 copies of "Reader's Digest" magazine for the first time.

1936 - The U.S. Vice President’s flag was established by executive order.

1940 - "Pinocchio" world premiered at the Center Theatre in Manhattan.

1941 - The Tommy Dorsey Orchestra and Frank Sinatra recorded "Everything Happens to Me."

1943 - The U.S. government announced that shoe rationing would go into effect in two days.

1944 - During World War II, the Germans launched a counteroffensive at Anzio, Italy.

1962 - The U.S. government banned all Cuban imports and re-export of U.S. products to Cuba from other countries.

1974 - The nation of Grenada gained independence from Britain. TO LOSE IT TO REAGAN, 9 YEARS LATER

1977 - Russia launched Soyuz 24.

1984 - Space shuttle astronauts Bruce McCandless II and Robert L. Stewart made the first untethered space walk.

1985 - "Sports Illustrated" released its annual swimsuit edition. It was the largest regular edition in the magazine’s history at 218 pages.

1985 - "New York, New York" became the official anthem of New York City.

1986 - Haitian President-for-Life Jean-Claude Duvalier fled his country ending 28 years of family rule.

1991 - The Rev. Jean-Bertrand Aristide was sworn in as Haiti's first democratically elected president.

1999 - King Hussein of Jordan died. His son was sworn in as king four hours after the announcement that his father had died.

2000 - California's legislature declared that February 13 would be "Charles M. Schulz Day."

But the February 7th that shaped our nation was this one:

Demeter

(85,373 posts)This was a different country then....no protective seals on bottles of aspirin, catsup, mayonnaise, windshield washer fluid, etc., no bans on smoking or advertising cigarettes, no talk of climate change, peak oil, austerity, and gas was 29 cents per gallon.

And the Beatles landed on our shore, and the entire world changed.

No, I don't blame anything on the Beatles. They just fit the times better than anything since.

Can you imagine the Beatles today, on a cruise ship gig, or trying to perform rap songs? Or dragging their weary bodies through endless retrospectives? Neither can I.

And yet, what I wouldn't give to turn back the clock, and steer the ship of state in a better direction.

The Beatles did try, and succeeded all too well, as far as the 1% were concerned. They changed our story for the better, unlike the Bushs, the Cheneys, and others of that power-grabbing ilk.

DemReadingDU

(16,000 posts)Who can imagine going to a Big concert today that doesn't have lavish special effects, a million dollar production, and tickets with outrageous prices.

Demeter

(85,373 posts)If I want fireworks, the 4th of July. If I want outrageous prices...well, there's always politics.

But music needs to be heard to be appreciated (or not).

Demeter

(85,373 posts)if we ever get to the point that one of the big ones goes down, I may have to give up this gig for a wild celebration...one of several years' duration!

Demeter

(85,373 posts)Demeter

(85,373 posts)On February 7, 1964, Pan Am Yankee Clipper flight 101 from London Heathrow lands at New York's Kennedy Airport--and "Beatlemania" arrives. It was the first visit to the United States by the Beatles, a British rock-and-roll quartet that had just scored its first No. 1 U.S. hit six days before with "I Want to Hold Your Hand." At Kennedy, the "Fab Four"--dressed in mod suits and sporting their trademark pudding bowl haircuts--were greeted by 3,000 screaming fans who caused a near riot when the boys stepped off their plane and onto American soil.

Two days later, Paul McCartney, age 21, Ringo Starr, 23, John Lennon, 23, and George Harrison, 20, made their first appearance on the Ed Sullivan Show, a popular television variety show. Although it was difficult to hear the performance over the screams of teenage girls in the studio audience, an estimated 73 million U.S. television viewers, or about 40 percent of the U.S. population, tuned in to watch. Sullivan immediately booked the Beatles for two more appearances that month. The group made their first public concert appearance in the United States on February 11 at the Coliseum in Washington, D.C., and 20,000 fans attended. The next day, they gave two back-to-back performances at New York's Carnegie Hall, and police were forced to close off the streets around the venerable music hall because of fan hysteria. On February 22, the Beatles returned to England.

The Beatles' first American tour left a major imprint in the nation's cultural memory. With American youth poised to break away from the culturally rigid landscape of the 1950s, the Beatles, with their exuberant music and good-natured rebellion, were the perfect catalyst for the shift. Their singles and albums sold millions of records, and at one point in April 1964 all five best-selling U.S. singles were Beatles songs. By the time the Beatles first feature-film, A Hard Day's Night, was released in August, Beatlemania was epidemic the world over. Later that month, the four boys from Liverpool returned to the United States for their second tour and played to sold-out arenas across the country.

Later, the Beatles gave up touring to concentrate on their innovative studio recordings, such as 1967's Sgt. Pepper's Lonely Heart's Club Band, a psychedelic concept album that is regarded as a masterpiece of popular music. The Beatles' music remained relevant to youth throughout the great cultural shifts of the 1960s, and critics of all ages acknowledged the songwriting genius of the Lennon-McCartney team. In 1970, the Beatles disbanded, leaving a legacy of 18 albums and 30 Top 10 U.S. singles.

During the next decade, all four Beatles pursued solo careers, with varying success. Lennon, the most outspoken and controversial Beatle, was shot to death by a deranged fan outside his New York apartment building in 1980. McCartney was knighted by Queen Elizabeth II in 1997 for his contribution to British culture. In November 2001, George Harrison succumbed to cancer.

http://www.history.com/this-day-in-history

?w=360&h=240&crop=1

?w=360&h=240&crop=1

The Beatles, from left to right, Ringo Starr, John Lennon, Paul McCartney and George Harrison, make a windswept arrival at JFK airport in New York City on Feb. 7, 1964.

The Beatles Invasion, 50 Years Ago: Friday, Feb. 7, 1964 By Bob Spitz

It seems impossible to recall a time when the Beatles weren’t part of Americans’ collective consciousness. Yet exactly 50 years ago, on Feb. 7, 1964, as John Lennon, Paul McCartney, George Harrison and Ringo Starr boarded Pan Am Flight 101 in London for their first U.S. visit, they had little idea what lay in store for them.

John calculated the Beatles’ odds as the plane began its descent. He stared dolefully at the seat back in front of him, clutching the hand of his wife Cynthia. There were so many variables that would determine their success: whether “I Want to Hold Your Hand,” released in late December, would sustain its initial impact in the States; how tickets there were selling for their upcoming concerts; whether their appearances on The Ed Sullivan Show would capture the imagination of American teenagers. Sure Beatlemania had already gripped Britain, but would anyone in the U.S. even care?

Minutes before landing, news filtered from the cockpit through the plane that helped to put their minds at ease. As Paul remembered it: “The pilot had rung ahead and said, ‘Tell the boys there’s a big crowd waiting for them.’ ”

From the air, the terminals looked jittery, alive. A swarm of locusts? No. Wall-to-wall kids, who had scrambled over barricades and fences to get a look at the Beatles. Applause and cheers broke out inside the plane. Just before 1:30 p.m., Flight 101 taxied to a stop outside the terminal and the aircraft door popped open. An explosion of cheers and screams rang out as the crowd stormed forward.

“We heard that our records were selling well in America,” George noted (Capitol announced that they were the fastest-selling in the label’s history), “but it wasn’t until we stepped off the plane … that we understood what was going on. Seeing thousands of kids there to meet us made us realize just how popular we were there.”

Everywhere, perhaps, but with the pool of hard-boiled reporters who had been waiting for hours to cover these British intruders. More than 200 of them were crammed into Pan Am’s smoke-filled lounge, grumbling about the lousy assignment, when the Beatles finally paraded into the room. Like a cavalry charge, the reporters opened fire, question after question without letup, until it all just fused into babble.

Brian Sommerville, the band’s new press officer, tried desperately to impose order but eventually succumbed to shouting back. “All right then. Shut up!” he insisted. “Just shut up!”

“Yeah, yeah, everybody just sharrup,” barked John, which stunned the crowd into applause.

What now? The press and the Beatles stared awkwardly at each other until a reporter managed to break the ice. “Will you sing something for us?”

“No! ” the Beatles shouted in unison.

“We need money first,” John shot back.

Wha …? These boys were witty. The frost in the lounge started to melt.

“What do you think of Beethoven?”

“Great,” Ringo answered, “especially his poems.”

It went on like that for almost an hour, a spontaneous Abbott and Costello–type routine, with the cynical press corps as willing straight men. Whatever the press expected from these boys, it was completely unprepared for what it got. The Beatles were irresistible; they made great copy.

As everyone prepared to head for the exits, Paul commandeered the mike. “We have a message,” he announced with great significance. The reporters flipped their notebooks back open, as photographers pressed in to get the crucial shot. “Our message is: buy more Beatles records!”

The Beatles were gobsmacked. New York City seemed a world unto itself, and as they limoed in from JFK, its wonders unfolded.

The radio, for one thing, symbolized the city’s fabulousness.

At the airport, Pepsi had given each of the Beatles a transistor radio, and throughout the trip in, they flitted from station to station, unable to wrap their heads around it.

“We were so overawed by American radio,” John confessed. In England there was only one station, the stodgy BBC, which basically ignored the type of music the Beatles craved. Suddenly it was all at their fingertips—a nonstop jukebox of those American R&B hits they’d been dying to hear: Marvin Gaye, Smokey Robinson, the Shirelles, the Ronettes. And sandwiched between each two, a Beatles record!

By the time the Beatles’ car made its way from JFK to Manhattan, word was out and fans had already begun to mob the posh Plaza Hotel on Fifth Avenue, where the boys were shown to a spacious 10-room suite on the 12th floor with commanding views of Central Park.

To the Beatles, it was heaven—a TV in every room, a fully stocked bar, no end of luxuries—and hell: absolutely no place to go. The fans outside had hemmed the boys in, making any excursion just plain foolhardy.

The sidewalks in front of the building were a solid block of humanity. Chants of “We want the Beatles! We want the Beatles! ” punctuated the New York din.

This is the first installment in a series of excerpts from the new TIME book, The Beatles Invasion: The Inside Story of the Two-Week Tour That Rocked America, by Bob Spitz. Copyright 2013, Time Home Entertainment Inc. Available wherever books are sold.

http://entertainment.time.com/2014/02/07/the-beatles-invasion-50-years-ago-friday-feb-7-1964/

Demeter

(85,373 posts)A new study advocates a pension plan that's impossible for most families, unless they have a huge income and decades to spare...At their most self-indulgent, the theological scholars of the Renaissance were mocked for abandoning the debate over moral decisions to bicker about how many angels could dance on the head of a pin. The scholars of personal finance seem on track for a similar level of disconnection from reality. Take this new study, in the Financial Analysts Journal, that says "retirement is not hopeless." Indeed, all you need to do is save 22 times the annual income you hope to have when you retire. That means if you make $150,000, and hope to retire on $100,000 a year, you only need to sock away $2.2m in a bank account to be able to retire comfortably.

The authors of the study assume you will live to be 100 years old, by the way, if not 105 years old. As you do. The Wall Street Journal breezily calls this arrangement "retiring on your own terms." You can call it retiring on your own terms, the same way you can call buying a private jet and a ranch in Telluride, Colorado living on your own terms – the terms, that is, of fantasy and not reality. It's simply a math problem. Let's say you are in your 40s, making $150,000 a year, a generous salary in almost any city in the country. The taxman cometh, does he not? That $150,000, after taxes, becomes the slightly less dazzling sum of $100,000 a year. It would be churlish to complain about such a salary, however: $100,000 a year is still far more than many Americans dream of, particularly in this less-than-stellar economy, and certainly at the upper end of the middle class.

Now you have to save that money as well as living on it. How much can you save? A standard and sensible budget, advocated by LearnVest and others, is to use a simple formula called 50/20/30. This means that you spend 50% of your salary on expenses. Another 30% goes to lifestyle expenses – the things that make life liveable unless you prefer living in a hut: cable and phone plans, clothes, books, gym fees, childcare and pets, restaurants and entertainment.

Then the final 20% goes to saving for retirement.

This is a reasonable budget. If you save more than 20% of your salary for retirement, you're giving up enjoying your present life: you're dedicating yourself to living in holy denial of all worldly pleasures like a monk or a nun, in the hopes of a lavish, or at least an exceedingly comfortable, life when you're over 60-years-old. Twenty percent for retirement is, by the way, an aggressive goal. Most people save much less. So let's say that, with your net pay of $100,000 a year, you set aside 20% for retirement. That gives you $20,000 a year, saved, every year, to make your retirement as comfortable as possible. That's $20,000 a year you're now foregoing, not putting it into school fees, into trips, into anything you might need at the moment. It's locked away with a retirement chastity belt - in a bank account, by the way, not in stocks. And once you reach this pinnacle of saving virtue, how long would it take you to reach your goal of $2.2mn for retirement?

Only a mere 110 years.

MORE FANTASY AT LINK

Demeter

(85,373 posts)Retirement security experts parsing President Obama’s State of The Union speech and his follow-up address Wednesday on retirement policy at a U.S. Steel plant are frustrated that the White House is proposing to do too little for America’s oldest generations—whose savings fall trillions short of what’s needed to maintain their current living standards.

In Tuesday evening’s State of The Union, President Obama announced that the Treasury Department would expand the U.S. Savings Bond program to allow people to create their own retirement accounts—called MyRA—for up to $15,000 in post-tax income. The executive branch initiative was part of Obama’s larger call to help the middle class.

“And if this Congress wants to help, work with me to to fix an upside-down tax code that gives big tax breaks to help the wealthy save, but does little to nothing for middle-class Americans,” the President said, saying everyone should have access to “an automatic IRA on the job, so they can save at work just like everyone in this chamber can.”

... liberal retirement security experts have spent the week trying to put the best face on what’s at best a disappointment because Obama did not even mention the big picture—that the financial floor provided by Social Security has been shrinking compared to rising costs of living since the mid-1980s, to say nothing of the aging baby boom generation’s inadequate retirement savings. That’s because most people lack pensions (deferred paydays) and private 401K plans haven’t filled in that gap in most cases...

GEE, I WONDER WHY...MORE FATUOSITY AT LINK

Demeter

(85,373 posts)The timing is ironic that on the same day that the EU releases a study calling the level of corruption in the European Union to be "breathtaking" that we see headlines like this:

How Goldman Sachs Helped Tear Denmark’s Government Apart

http://world.time.com/2014/02/01/denmark-government-goldman-sachs/

The source of the political crisis in Denmark is Prime Minister Helle Thorning-Schmidt . You might remember her from the selfie that was done in such poor taste.

?1391463652

?1391463652

US President Barack Obama (R) and British Prime Minister David Cameron pose for a picture with Denmark's Prime Minister Helle Thorning Schmidt (C) next to US First Lady Michelle Obama (R) during the memorial service of South African former president Nelson Mandela at the FNB Stadium (Soccer City) in Johannesburg on December 10, 2013. Mandela, the revered icon of the anti-apartheid struggle in South Africa and one of the towering political figures of the 20th century, died in Johannesburg on December 5 at age 95. AFP PHOTO / ROBERTO SCHMIDTROBERTO SCHMIDT/AFP/Getty Images

Technically Thorning-Schmidt's government is center-left, but what her government really is is neoliberal. Besides privitizing public assets, she's pushed through means testing for child care benefits, and pushed back the retirement age. What finally broke her government was the deal to sell a large stake in Dong Energy to Goldman Sachs, while giving them veto rights over management decisions. The deal was opposed by 68% of the Danish public, and it brought out thousands of protesters.

It's a telling point that Goldman Sachs had to specifically say that they would "comply, with all applicable tax laws in Denmark, Luxembourg, the U.S." The simple fact that they felt it necessary to reassure the Danish public of this tells you how little trust there is of Goldman Sachs.

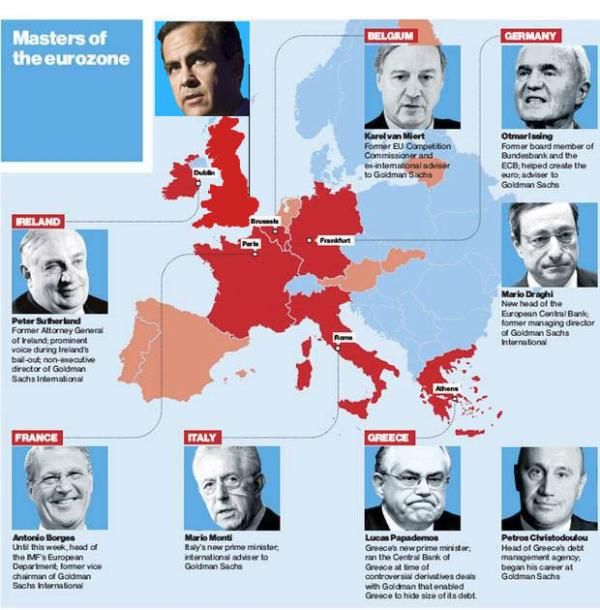

Ironically, while the coalition break will weaken her party and probably doom her re-election bid, it will help her in the short-term. Why? Because the leftists are now gone from her coalition, so now she can replace them with conservatives and thus move her neoliberal agenda forward. I would compare this to President Clinton's decision to push ahead with NAFTA despite his voting base completely opposing it. Denmark's center-right party is now leading in polls. As for the rest of Europe, I would like to remind everyone of this infamous graphic.

The photo at the top-left is Goldman Sachs man, Mark Carney, now head of the Bank of England, that helped tank Russia's economy in the 1990's. These policies ended in a severe economic collapse, which just happened to profit Goldman Sachs tens of millions of dollars. In spite of their involvement in a 1.25 billion dollar bail-out of the Russian government, Goldman Sachs appears to have been betting against success.

I shouldn't have to remind everyone that Goldman Sachs already owns the Treasury Department. Or that while Goldman Sachs was getting bailed out by the Federal Reserve in 2008, Stephen Friedman was sitting on the New York Federal Reserve board AND was purchasing stock in Goldman Sachs. When the Treasury Department was considering bailing out AIG, who was making "two dozen" personal calls to the Treasury Secretary? Why the CEO of Goldman Sachs, of course. And who benefited the most from the AIG bailout? Why Goldman Sachs, of course. Lately people have forgotten about Goldman Sachs because the criminal lawlessness of JP Morgan Chase has overshadowed them. However, not to be outdone, Goldman Sachs is currently under investigation by the DoJ, and is being sued by Libya's sovereign wealth fund.

Demeter

(85,373 posts)On Wednesday, Douglas Elmendorf, the director of the nonpartisan Congressional Budget Office, said the obvious: losing your job and choosing to work less aren’t the same thing. If you lose your job, you suffer immense personal and financial hardship. If, on the other hand, you choose to work less and spend more time with your family, “we don’t sympathize. We say congratulations.” And now you know everything you need to know about the latest falsehood in the ever-mendacious campaign against health reform...Let’s back up. On Tuesday, the budget office released a report on the fiscal and economic outlook that included two appendices devoted to effects of the Affordable Care Act.

The first appendix attracted almost no attention from the news media, yet it was actually a bombshell. Much public discussion of health reform is still colored by Obamacare’s terrible start, and presumes that the program remains a disaster. Some of us have pointed out that things have been going much better lately — but now it’s more or less official. The budget office predicts that first-year sign-ups in the health exchanges will fall only modestly short of expectations, and that nearly as many uninsured Americans will gain insurance as it predicted last spring. This good news got drowned out, however, by false claims about the meaning of the second health care appendix, on labor supply.

It has always been clear that health reform will induce some Americans to work less. Some people will, for example, retire earlier because they no longer need to keep working to keep their health insurance. Others will reduce their hours to spend more time with their children because insurance is no longer contingent on holding a full-time job. More subtly, the incentive to work will be somewhat reduced by health insurance subsidies that fall as your income rises. The budget office has now increased its estimate of the size of these effects. It believes that health reform will reduce the number of hours worked in the economy by between 1.5 percent and 2 percent, which it unhelpfully noted “represents a decline in the number of full-time-equivalent workers of about 2.0 million.”

Why was this unhelpful? Because politicians and, I’m sorry to say, all too many news organizations immediately seized on the 2 million number and utterly misrepresented its meaning. For example, Representative Eric Cantor, the House majority leader, quickly posted this on his Twitter account: “Under Obamacare, millions of hardworking Americans will lose their jobs and those who keep them will see their hours and wages reduced.” Not a word of this claim was true. The budget office report didn’t say that people will lose their jobs. It declared explicitly that the predicted fall in hours worked will come “almost entirely because workers will choose to supply less labor” (emphasis added). And as we’ve already seen, Mr. Elmendorf did his best the next day to explain that voluntary reductions in work hours are nothing like involuntary job loss. Oh, and because labor supply will be reduced, wages will go up, not down. We should add that the budget office believes that health reform will actually reduce unemployment over the next few years....Just to be clear, the predicted long-run fall in working hours isn’t entirely a good thing. Workers who choose to spend more time with their families will gain, but they’ll also impose some burden on the rest of society, for example, by paying less in payroll and income taxes. So there is some cost to Obamacare over and above the insurance subsidies. Any attempt to do the math, however, suggests that we’re talking about fairly minor costs, not the “devastating effects” Mr. Cantor asserted in his next post on Twitter....

MORE

Demeter

(85,373 posts)As the U.S. hit its debt limit on Friday, a leading business group urged Congress to act quickly to raise it to avoid damaging the economy.

The Business Roundtable sent a letter to House and Senate leaders Thursday night warning that "urgent action is required" to prevent a potential default as the Treasury Department was set to begin so-called extraordinary measures to extend the nation's borrowing authority.

"Any default by the federal government on its debts would cause devastating, long-lasting effects for all Americans," wrote AT&T Inc. Chief Executive Randall Stephenson, the group's chairman, and United Technologies Corp. Chief Executive Louis R. Chenevert, chairman of the organization's tax and fiscal policy committee.

"Further, prolonged inaction that takes the government up to the precipice would foster uncertainty, dampen consumer and business confidence, risk higher borrowing costs, and could have immediate consequences on hiring and investment," they said...

MORE HYPERVENTILATING AT LINK

Demeter

(85,373 posts)OH, REALLY? THE BASTARDS WHO MADE NO REAL BOOTS FOR WOMEN, NOR REAL CLOTHES, NOR REAL COATS NOR HATS NOR GLOVES NOR....DO YOU KNOW THEY HAVE SUN DRESSES IN THE STORES THIS WEEK? AND THEY ARE UGLY SUNDRESSES. YOU WANT WINTER CLOTHING? TRY THE THRIFT STORES AND RECYCLING PLACES....

Propane companies

Food delivery services

THIS I'LL BELIEVE. AFTER FREEZING MYSELF SOLID, THE LAST THING I WANT TO TRY TO DO IS COOK.

Salt suppliers

ANOTHER VERIFIABLE FACT: OUR CONDO ASSOCIATION ALREADY CAN'T BUY MORE SALT. IT'S UNAVAILABLE, AND WE ARE RUNNING OUT OF OUR CONTRACTED PURCHASE ALREADY...

Plumbers

ALSO VERIFIABLE; WE HAVE HAD FAR TOO MANY FROZEN PIPES BECAUSE OF FURNACE FAILURE OR REALLY STUPID HOUSEHOLDER TRICKS.

Florida’s tourism industry

Online retailers

FOR THOSE LUCKY ENOUGH TO STAY HOME

Weather forecasters

http://www.marketwatch.com/story/7-companies-profiting-from-this-miserable-winter-2014-02-07?siteid=YAHOOB

Demeter

(85,373 posts)YOU JUST KNOW THIS CAN'T BE GOOD...ALL THE BENEFITS RAN OUT, AND PEOPLE ARE TRYING TO LIVE ON CREDIT...WHILE THEY STILL HAVE ANY

http://news.yahoo.com/u-consumer-credit-posts-biggest-jump-10-months-200325672--business.html

U.S. consumer credit in December grew by the most in nearly a year due to a sharp increase in credit card usage, a potentially positive sign for the economy. HOW CAN THEY SAY THAT!

Total consumer credit rose by $18.8 billion to $3.1 trillion, the Federal Reserve said on Friday. That was the biggest gain since February. Economists polled by Reuters had expected consumer credit to rise by $12 billion in December.

Revolving credit, which mostly measures credit-card use, rose by $5 billion in December after climbing $465 million in November. Revolving credit figures can be volatile.

Non-revolving credit, which includes auto loans as well as student loans made by the government, increased $13.8 billion in December.

Demeter

(85,373 posts)"The Long and Winding Road" is a ballad written by Paul McCartney (credited to Lennon–McCartney). It is the tenth track on the Beatles' album Let It Be. It became the group's 20th and last number-one song in the United States on 13 June 1970,[3] and was the last single released by the quartet while all four remained alive. "The Long and Winding Road" was listed with "For You Blue" as a double-sided hit when the single hit number one on the US Billboard Hot 100 in 1970.

While the released version of the song was very successful, the post-production modifications to the song by producer Phil Spector angered McCartney to the point that when he made his case in court for breaking up the Beatles as a legal entity, McCartney cited the treatment of "The Long and Winding Road" as one of six reasons for doing so. New versions of the song with simpler instrumentation were subsequently released by both the Beatles and McCartney.

http://en.wikipedia.org/wiki/The_Long_and_Winding_Road

Demeter

(85,373 posts)Bitcoin prices have crashed over the last few days--again!--this time because Mt. Gox, a major bitcoin exchange headquartered in Tokyo, abruptly announced it was suspending all withdrawals for "technical" reasons.

Mt. Gox said the suspension was temporary, but didn't say when customers' funds would again be available. It promised there will be an "update," though not a resolution, on Monday.

On the news, bitcoin prices have plunged--the virtual currency, which had been quoted at $1,038 on Mt. Gox as recently as Jan. 26, fell below $700 Friday before settling in the mid-$700s.

Whether you're into bitcoins as an investment, a speculative play, a genuine alternative to dollars, euros or yen, or as a device to move money across national borders without worrying about currency exchange regulations, that's not the sort of price action you want to see in your financial instrument--especially not if it's caused by the problems of an unrelated operator in Tokyo....

truedelphi

(32,324 posts)Demeter

(85,373 posts)the Fed's only begun to unwind the Bernanke mess...and already it's roiling the rest of the world. Everyone's been sucking off Uncle Sugar.

Next crisis: April.

Demeter

(85,373 posts)

Demeter

(85,373 posts)Is it to be inequality or equal opportunity?

Under a headline “Obama Moves to the Right in a Partisan War of Words,” The New York Times’ Jackie Calmes notes Democratic operatives have been hitting back hard against the President or any other Democratic politician talking about income inequality, preferring that the Democrats talk about equality of opportunity instead.

"However salient reducing inequality may be," writes Democratic pollster Mark Mellman, “it is demonstrably less important to voters than any other number of priorities, including reducing poverty.”

The President may be listening. Wags noticed that in his State of the Union, Obama spoke ten times of increasing “opportunity” and only twice of income inequality, while in a December speech he spoke of income inequality two dozen times. But the President and other Democrats — and even Republicans, for that matter — should focus on the facts, not the polls, and not try to dress up what’s been happening with more soothing words and phrases. In fact, America’s savage inequality is the main reason equal opportunity is fading and poverty is growing. Since the “recovery” began, 95% of the gains have gone to the top 1 percent, and median incomes have dropped. This is a continuation of the trend we’ve seen for decades. As a result:

(1) The sinking middle class no longer has enough purchasing power to keep the economy growing and creating sufficient jobs. The share of working-age Americans still in the labor force is the lowest in more than thirty years.

(2) The shrinking middle isn’t generating enough tax revenue for adequate education, training, safety nets, and family services. And when they’re barely holding on, they can’t afford to — and don’t want to — pay more.

(3) Meanwhile, America’s rich are accumulating not just more of the country’s total income and wealth, but also the political power that accompanies money. And they’re using that power to reduce their own taxes, and get corporate welfare (subsidies, bailouts, tax cuts) for their businesses.

All this means less equality of opportunity in America.

Obama was correct in December when he called widening inequality “the defining challenge of our time.” He mustn’t back down now even if Democratic pollsters tell him to. If we’re ever to reverse this noxious trend, Americans have to hear the truth.

Robert B. Reich has served in three national administrations, most recently as secretary of labor under President Bill Clinton. He also served on President Obama's transition advisory board. His latest book is "Aftershock: The Next Economy and America's Future." His homepage is www.robertreich.org.

Demeter

(85,373 posts)xchrom

(108,903 posts)

AOL Chairman and CEO Tim Armstrong blamed the babies of two employees for increasing the company’s benefit costs on Thursday, explaining in a conference call that AOL had to pay millions out in medical bills and alter its entire benefits package. The remarks came just hours after the company announced changes to its 401(k) plans and complained that Obamacare has increased costs by $7.1 million.

“We had two AOL-ers that had distressed babies that were born that we paid a million dollars each to make sure those babies were OK in general,” Armstrong said on a conference call first reported by Capital New York. “And those are the things that add up into our benefits cost. So when we had the final decision about what benefits to cut because of the increased healthcare costs, we made the decision, and I made the decision, to basically change the 401(k) plan.” Under the new program, AOL employees will not be able to collect any matching funds toward their retirement savings from the company for any given year if they leave before Dec. 31 of that year.

But health care experts ThinkProgress contacted questioned why a large self-insured company with more than 5,000 employees could not absorb the additional health care costs associated with the pregnancies. Large employers typically purchase reinsurance, which could cover a substantial share of big claims and ensure stability in cases of larger-than expected medical payouts.

xchrom

(108,903 posts)Welcome to the future, its already here. Solar employs and nuclear destroys; we have ample evidence of that now, and with the annual U.S. solar jobs census we now have proof that solar power isn’t just providing energy, without destroying our oceans and contaminating the earth and air with strontium, caesium and barium, among other chemicals, it is providing more than 143,000 Americans a paycheck.

Since 2012, that’s nearly a 20 percent increase, says The Solar Foundation, which conducts the census. An additional 23,682 jobs have been added—10 times the rate of employment growth as the national average of just 1.9 percent. In the past four years, 50,000 well paying jobs were added—many of them building and installing solar panels and this employment rate is expected to continue growing at a steady pace.

Solar installers also make an average of $20 to $23.60 an hour compared to the wages of a coal miner; that isn’t bad especially considering the payout to workers with black lung disease amount to billions and the detrimental affects to a worker’s health are almost irreversible.

Comparatively, during the last two years, fossil fuel jobs declined by 8.7 percent leaving 8,500 positions void, according to the Bureau of Labor Statistics. If you add up the figures, the solar industry now employs more folks than our coal and natural gas industries combined.

xchrom

(108,903 posts)WHAT'S FOR DINNER? THE FARM BILL HAS A BIG IMPACT

WHERE YOU SHOP: The law includes incentives for farmers markets and makes it easier for food stamp recipients to shop there. A new program would award grants to some farmers markets and grocery stores that match food stamp dollars if recipients buy fruits and vegetables. It has a bit of money to help finance the building of grocery stores in low-income areas that don't have many retail outlets.

THE MAIN COURSE: Most of the subsidy money benefits producers of the main row crops - corn, soybeans, wheat, cotton and rice. Most corn and soybeans in the U.S. are grown for animal feed, so those subsidies keep costs down for the farmers and the livestock producers who buy feed for their beef cattle, hogs and chickens. Corn is an ingredient in hundreds if not thousands of processed foods you buy in the grocery store.

So the steak, rice and bread you buy are all most likely to be cheaper because of the law, as are sweet corn and edamame, the corn and soybeans that people eat.

FRUITS AND VEGGIES: Most fruits and vegetables don't get generous subsidies like the staple crops do. But starting in the 2008 farm law, fruit and vegetable producers are getting more of the share, including block grants, research money and help with pest and disease mitigation. Money for these "specialty crops" - everything from blueberries to tomatoes to potatoes to nuts and honey - was expanded in the new law, which also provides money to encourage locally-grown food production and boosts organic agriculture.

xchrom

(108,903 posts)The U.S. unemployment rate dipped to 6.6 percent in January from 6.7 percent in December as college graduates flooded the job market, and most found work.

Among workers older than 25, 668,000 college graduates began looking for jobs last month, according to the Labor Department report issued Friday. And a nearly equal number of college graduates - 663,000 - were hired.

Their influx illustrates that U.S. workers, as a group, continue to become better educated. Employers have hired an average of 136,333 college graduates each month over the past year.

This has contributed to a decline in the unemployment rate among those with higher educations to 3.2 percent from 3.7 percent in January 2013

xchrom

(108,903 posts)Sen. Ron Wyden, the incoming chairman of the Senate Finance Committee, said Friday his first priority in the job will be overhauling the nation's tax system, which he called a "dysfunctional, rotten mess."

In a telephone interview with The Associated Press, Wyden said he was inspired by the bipartisan income tax changes of 1986, when former Oregon Republican Sen. Bob Packwood was Senate Finance chairman and Ronald Reagan was president.

"The last time there was a big tax reform effort like this it created 6 million new jobs," Wyden said. "I can't say every one was due to tax reform, but it sure helped."

Wyden is currently chairman of the Energy and Natural Resources Committee. He is expected to be named Finance Committee chairman next week to replace Sen. Max Baucus, D-Mont., whom the Senate on Thursday confirmed as the new ambassador to China.

xchrom

(108,903 posts)WASHINGTON (AP) -- Consumers boosted their borrowing in December by the largest amount in 10 months as demand for auto, student and credit card loans showed big gains.

Consumer borrowing rose $18.8 billion in December, the biggest increase since February, the Federal Reserve reported Friday. The category that includes auto and student loans increased the most, rising $13.8 billion. Credit card debt, which has been lagging, rose by $5 billion. That was the largest jump since May.

The big increase pushed total borrowing to a fresh record of $3.1 trillion. Gains in borrowing are viewed as an encouraging sign that consumers are more confident and willing to take on more debt to finance consumer spending, which accounts for 70 percent of economic activity.

Consumers had increased borrowing by $12.4 billion in November.

xchrom

(108,903 posts)SAN JUAN, Puerto Rico (AP) -- Puerto Rico's credit rating was dealt its second blow in a week when Moody's Investors Service announced Friday it had downgraded the U.S. territory's debt to junk status.

The downgrade of two notches came just days after Standard & Poor's downgraded the island's debt by one notch, prompting the local government to file new legislation aimed at shoring up the economy as it prepares to re-enter the bond market this month.

Moody's said Puerto Rico's government took strong and aggressive actions to control spending and reduce debt issuance, among other things, but that it remained concerned about its liquidity and ability to access the market.

"While some economic indicators point to a preliminary stabilization, we do not see evidence of economic growth sufficient to reverse the commonwealth's negative financial trends," the agency said. "Without an economic revival, the commonwealth will face difficult decisions in coming years, as its debt and pension costs rise."

xchrom

(108,903 posts)Turkey’s credit rating outlook was cut to negative from stable by Standard & Poor’s, which said there’s a growing risk of a “hard economic landing” as reserves decline and policy makers spar over interest rates.

The lira reversed gains after the announcement late yesterday, falling 0.4 percent to 2.2195 per dollar at 11:30 p.m. in Istanbul.

The move by S&P, the only one of the three main credit rating companies that doesn’t classify Turkish debt as investment grade, comes after the country’s central bank reversed policy and raised interest rates to halt a currency slump. The government has been calling for borrowing costs to be kept low, and says it has alternative plans to revive the economy and the lira.

“Turkey’s policy environment is becoming less predictable” and “this could weigh on the economy’s resilience and long-term growth potential,” S&P said in a statement explaining its decision. It cited “constraints on the independence and transparency” of Turkey’s central bank.

xchrom

(108,903 posts)

n poll after poll, Americans place the need for more jobs as their number one priority, but lawmakers and politicians keep serving up austerity instead. (File)

Today’s unemployment report from the Labor Department is disappointing to millions of Americans who are looking for jobs. It shows that the U.S. economy created only 113,000 jobs – well below most economists’ expectations. Many experts had hoped that this report for January would erase the gloom created by the December jobs report, which reported only 74,000 new jobs.

While bad weather may be blamed, these weak numbers show that the economy and job creation continue to be crippled by the impact of conservative austerity policies. Federal and state spending have been cut over a series of ‘deficit reduction’ and sequestration agreements forced on the country by right-wing legislators who care more about their rigid ideology than about healthy investment and growth.

Today’s report shows the unemployment rate, now at 6.6 percent, has barely budged. And the number of long-term unemployed – people who have been unable to find work over 27 weeks – remains at historically high levels at 3.6 million. Republican senators who just Thursday cravenly blocked a vote to extend long-term unemployment benefits must come back to the table and pass legislation that will help these people and stimulate the economy.

In poll after poll, Americans place the need for more jobs as their number one priority. But it is now clear – from recent reports from the Congressional Budget Office and other experts – that conservative government policy is killing jobs and growth. Unless new policies are instituted to spur more robust job creation, the U.S. economy will take a very long time to get back to good employment levels.

Demeter

(85,373 posts)Good morning, X!

Thanks for posting, while I try to work up enough nerve (and clothing) to venture out.

It's a whole 8F (positive 8) and currently, no windchill, but that is variable...

Groundhog Day has entered its 4th month....and counting.

xchrom

(108,903 posts)Demeter

(85,373 posts)We must be setting records for number of days that never hit freezing, or 20F, or 0 F....

Demeter

(85,373 posts)Demeter

(85,373 posts)Bitter partisan brinkmanship has been the hallmark of debates over raising the debt ceiling in recent years, but there are signs that it could be less contentious this time around. Still, Congress needs to act fast to avoid a default. Here are three things you should know as things move forward:

— Without a deal, the Treasury will officially run out of money on Feb. 27:

Treasury Secretary Jacob Lew wrote to Congress on Friday, saying that in less than three weeks the Treasury will have a mere $50 billion left to spend. : USAToday writes: "That sounds like a lot of money, but the government can spend as much as $60 billion a day — especially in February, when tax refunds alone can total $15 billion."

In Lew's letter to Congress, he wrote:

"Based on our best and most recent information ... we are not confident that the extraordinary measures will last beyond Thursday, February 27. ... At that point, Treasury would be left with only the cash on hand and any incoming revenue to meet our country's commitments."

— The debate might not be as bitter this time around:

The Washington Post's Robert Costa and Ed O'Keefe report that many Republicans wanted to see the debt-ceiling increase linked to concessions in the health-care law — the sort of demand almost guaranteed to seriously gum-up the works:

"A clean increase — that is, one with no strings attached — is what President Obama has long demanded. And so far, there is no reason for him to budge from that position. None. Republicans have not formulated a counteroffer. And it's possible they may not even be able to coalesce around one, given the competing positions in the GOP Conference and the ticking clock."

— A vote could come next week:

Reuters writes:

"Some Republican lawmakers and aides said possible conditions still under discussion include the elimination of military pension cuts approved in December and a provision known as the "doc fix" to prevent a drop in payments to doctors under the Medicare healthcare program for the elderly."

"These would be a far cry from past Republican debt-limit demands for ambitious spending cuts and may be acceptable to many Democrats."

Demeter

(85,373 posts)President Obama doesn't leave office until January of 2017, but already the competition has begun for the right to host his presidential library and museum.

A new foundation has been set up to raise money and to begin the site selection process, and there are already bids in the works from Chicago, Honolulu and elsewhere...

WORDS CANNOT DESCRIBE THE THOUGHTS AND EMOTIONS THAT SWAMP ME AT THIS REPORT...

...Another serious bid could come from Columbia University in New York City, where Obama was a student.

A decision on a site will come early next year, and look for the Obama Presidential Library dedication ceremony sometime around the year 2020.

NO COMMENT

Demeter

(85,373 posts)THIS ARTICLE ANNOYS, BECAUSE IT SAYS NOTHING FOR THOSE WHO CANNOT KEEP BODY, SOUL AND FAMILY TOGETHER, A MASS WHOSE NUMBER INCREASES DAILY UNDER THE MISGUIDANCE OF OUR FINANCIAL ELITE.

Demeter

(85,373 posts)

xchrom

(108,903 posts)With the country still locked in a painful austerity drive to cut the public deficit, the Portuguese government has come up with a plan to reduce black-market activity – which is estimated to amount to 25 percent of GDP – and swell the state’s coffers.

As of April, the state will hold weekly lotteries to encourage consumers to ask for official receipts or invoices for all goods and services they have paid for. The plan will apply to all sectors of the economy and all types of businesses. The bills can be for any amount, but they must include the purchaser’s personal tax identification number. Consumers will be given coupons for every kosher receipt they receive, including for utility bills. The amount of coupons for each transaction will depend on the size of the bill. For example, a consumer who pays a restaurant bill that amounts to 80 euros will be entitled to eight coupons, all of which will go into a weekly draw, with prizes such as new cars or cash likely to be up for grabs.

With the standard value-added tax rate raised to a hefty 23 percent as part of the austerity drive, businesses and individuals have a clear incentive to pay for things under the table. The government is now hoping to take in between 600 and 800 million euros a year by rewarding those who follow the path of fiscal righteousness.

The measure was approved Thursday by the government. The secretary of state for fiscal affairs, Paulo Núncio, was due later Thursday to give details of the lottery, which is to be known as the Factura da Sorte (Lucky Invoice).

Demeter

(85,373 posts)Divide and conquer doesn't always work...sometimes the mice are smarter than the scientists. Especially when they aren't mice, but men and women.

Demeter

(85,373 posts)http://www.truth-out.org/opinion/item/21664-economic-exaggerations-in-europe

It is, of course, a perfect quote for our times, too. It comes from the last chapter of the "General Theory" - a chapter that definitely bears rereading in the light of current debates. For what Keynes describes in this chapter is, pretty much, a condition of secular stagnation - of persistently low returns on investment, combined with a chronic oversupply of saving. He believed, in 1936, that this would be the state of affairs in the decades ahead, and was of course wrong in that belief. But he wasn't wrong about the possibility of such a state of affairs, and since Larry Summers, the former Treasury secretary, came out as a secular stagnationist a while back, the view that we may well be there now has gone mainstream.

What struck me, looking at what Keynes wrote, were his remarks on interest rates and the return to capital: low rates of interest, he suggested, "would mean the euthanasia of the rentier, and, consequently, the euthanasia of the cumulative oppressive power of the capitalist to exploit the scarcity-value of capital."

Actually, for now, at least profits remain high - but bond yields are very low.

What Keynes didn't say, but now seems obvious, is that the rentiers are unlikely to accept their euthanasia gracefully. And therein, I'd argue, lies the ultimate explanation for the persistent clamor for monetary tightening despite weak economies and low inflation. I've described on a number of occasions how tight-money advocates are constantly shifting their arguments - it's about inflation; no, it's about sound market functioning; no, it's about financial stability - but always with the same bottom line: rates must rise now, now, now.

Well, what I think we're hearing are the voices of the rentiers - and those who, explicitly or implicitly, work for them - demanding their natural right to earn good returns even if the resource they control isn't actually scarce anymore.

They are not willing to go gently into their euthanasia.

WELL, NOT ENTIRELY, DR. KRUGMAN. YOU SEE, THERE ARE LITTLE PEOPLE WITH A LITTLE BIT OF SAVING, WHO HAVE NO DESIRE TO GAMBLE IN THE STOCK MARKET, OR THE REAL ESTATE MARKET, OR ANY OTHER UNREGULATED FINANCIAL CASINO IN CURRENT OPERATION. THEY WOULD LIKE TO EARN INTEREST ON THEIR SAVINGS, AS IS ONLY PROPER, FROM THE BANKSTERS, AT THE OBSERVABLE RATE OF INFLATION, NOT THE "OFFICIAL" ONE.

AND I DON'T MEAN .1%, EITHER.

I DON'T SEE THE RENTIERS EUTHANIZED ANY TIME IN THE NEAR FUTURE. THEIR HOLDINGS AREN'T EVEN ALLOWED TO SUFFER THE VICISSITUDES OF MARKET FORCES. THE PLUNGE PROTECTION TEAM IS ALREADY PUMPING UP THE DJIA, THE HOUSING MARKET IS RECYCLING THE STOCK MARKET PROFITS FOR HEDGE FUNDS, AND BANKS ARE AFLOAT IN CAPITAL....

IN SHORT, IT'S THE CONTINUING EUTHANASIA OF THE MIDDLE CLASS.

Demeter

(85,373 posts)xchrom

(108,903 posts)I wasn't sure I'd heard him right.

I was a senior in high school, and I was staring at NBA legend Red Auerbach. He'd coached the Boston Celtics to nine championships in 10 years, won seven more as an executive, and, a bit less notably, gotten his first coaching job at our school way back when. He was 85 years old, but he lived nearby and had finally agreed to come back to be feted.

We piled into the gym and buzzed as Auerbach ascended the make-shift stage at center court. There were introductions and congratulations and then it was his turn to talk. He was old, but still sharp. He regaled us with an embellished, if not apocryphal, story about how his proudest coaching victory had come at our school. That was back in 1941, and the score had been something like 10 to 8. There was also something about yelling at the son of a senator—this was a preppy, all-boys school in Washington D.C.—for trying an around-the-back pass.

Then Auerbach turned to life lessons. "Everybody always asks me how to gain a competitive edge," he said, "and I'm always surprised because the answer is so obvious." Eighteen-year old me knew where this was going. He was going to tell us to work hard, that successful people prepare for their luck, yada, yada, yada.

"You cheat."

Our teachers looked confused, then horrified. They kept waiting for Auerbach to say he was just kidding, that of course there's no substitute for hard work. He didn't. Instead, he calmly explained that if you're playing a better fast-breaking team, you should install nets so tight that the ball gets stuck. Or if you're playing a faster baseball team, you should water the basepaths till they turn into muddy quagmires that nobody can run on. But most of all, he wanted to make sure we didn't misunderstand him. He cleared his throat, and said, "So, if you want a competitive edge, just cheat." Then he walked off stage, and the mayor's mother, who was inexplicably there, led us in a solemn rendition of America the Beautiful.

That brings us to high-frequency trading (HFT) hedge funds. These funds use computer algorithms—a.k.a.: algobots—to buy and sell stocks at incredible speeds. We're talking milliseconds. The idea is to react to any market news or inefficiencies before actual humans can process them. And it's any idea that has taken over stock trading: algobots make up about half of all stock transactions in 2012 (which is actually down from its peak of 61 percent).

Demeter

(85,373 posts)How else would Karl Rove and Ollie North make a living?

xchrom

(108,903 posts)When I was in Vietnam last fall it occurred to me at one point that it was the longest I'd gone without seeing a McDonald's in possibly my whole life. And it was particularly strange because it's not as if Vietnam is a land free of American fast-food chains. They've even got Carl's Jr.

But we are now just a few hours away from the opening of the Ho Chi Minh City McDonald's.

What it took to get the store opened was a local partner, a company called Good Day Hospitality. Conveniently enough, the owner of Good Day Hospitality happens to be the son-in-law of Vietnamese Prime Minister Nguyen Tan Dung. So it should be a lucrative partnership for everyone involved. Vietnam is small compared to India or China, but its population of nearly 90 million people is much larger than most Americans recognize. It's a huge market, and it'll be interesting to see what local menu customizations they come up with. McPho? Mc Banh Mi?

xchrom

(108,903 posts)Scotland's independence referendum later this year hasn't gotten much coverage in the United States and most of the coverage I have seen has largely reflected the international community's knee-jerk hostility to the redrawing of borders.

But I have to say that my priors go in the other direction, and I'm favorably disposed. The main reason is that it seems to me that in the European context where everyone is a stable democracy with a mixed-market economy, the small countries (Netherlands, Denmark, Finland, etc.) are generally a lot better run than the bigger ones. For one thing, smaller countries have simpler institutional arrangements since you're not trying to accommodate size by embedding complicated federalism mechanisms into the already complicated framework of the European Union. But for another thing, I think the debate over welfare state design gets more sensible when you're talking about a small jurisdiction. A place like Scotland is a sufficiently small share of the United Kingdom that it makes sense for a Scottish political activist to be more focused on "how much money does this program bring to Scotland?" than on "how good is this program at generating social benefits in a cost-effective way?" An independent Scotland—like an independent Wallonia or other possible new European mini-states—would have politics that I think would ultimately be more constructive.

Of course maybe not. Don't mistake this for a thorough investigation of the ins-and-outs of independence for Scotland.

But if you think about the larger context of the "European Project" then I think it really does make sense to become more favorable to European independence movements in general. Creating a continent-wide zone of peace and market integration was enormously hard work. One of the major benefits of that work is to create an international landscape that's much friendlier to the interests of small nations. The kind of place where Belgium doesn't get trampled simply because it's sitting on the optimal invasion route into France. That people in Scotland and Catalonia and Flanders and elsewhere are pushing to take advantage of those gains seems very sensible to me.

xchrom

(108,903 posts)Harvard University pledged to ensure restitution for as many as 11,000 employees after two of its faculty pointed out the impact of a tax error by the school.

Harvard erroneously reported that about $20 million worth of payments for life insurance were taxable, resulting in possibly millions of dollars in overpayments for employees beginning in 2009, law professors Alvin Warren and Daniel Halperin, both of whom specialize in tax law, said Feb. 4 in a memo to staff and faculty obtained by Bloomberg.

The university, based in Cambridge, Massachusetts, said Jan. 21 that employees who bought the life insurance plan would have to apply for refunds from the Internal Revenue Service on the overpayments. After Halperin and Warren pointed out that the overpayments were the university’s responsibility and that some were made too long ago to dispute with the IRS, the college said it would either compensate the overbilled employees or assist them in getting refunds.

“We regret this mistake, offer our sincere apologies to those affected and are working to remedy the situation as comprehensively and swiftly as possible,” the university said in an e-mailed statement.

xchrom

(108,903 posts)U.S. Treasury Secretary Jacob J. Lew said U.S. borrowing authority may not last past Feb. 27 and urged Congress to extend the debt ceiling as soon as possible.

Extraordinary measures used by the Treasury to keep under the debt ceiling “are likely to be exhausted in less than three weeks,” Lew said today in a letter to House Speaker John Boehner, a Republican from Ohio.

“Congress is scheduled to be out of session for part of that time, and it would be a mistake to wait until the last possible minute to act,” he said.

“I respectfully urge Congress to move as quickly as possible, raise the debt limit, and provide certainty to the economy and to the financial markets.”

DemReadingDU

(16,000 posts)xchrom

(108,903 posts)The Spanish-led consortium working on a project to widen the Panama Canal has said that work at the site has been halted over a disagreement on cost overruns.

The construction group says it is owed $1.6bn (£1bn).

The Panama Canal Authority (ACP) said the demand amounted to blackmail.

The new lock, which was due to be completed next year, would allow the passage of larger cargo ships in one of the world's busiest maritime routes.

Demeter

(85,373 posts)Demeter

(85,373 posts)The founder and CEO of American Title Services in Centennial (COLORADO) was found dead in his home this week, the result of self-inflicted wounds from a nail gun, according to the Arapahoe County coroner...Richard Talley, 57, and the company he founded in 2001 were under investigation by state insurance regulators at the time of his death late Tuesday, an agency spokesman confirmed Thursday. It was unclear how long the investigation had been ongoing or its primary focus.

A coroner's spokeswoman Thursday said Talley was found in his garage by a family member who called authorities. They said Talley died from seven or eight self-inflicted wounds from a nail gun fired into his torso and head. Also unclear is whether Talley's suicide was related to the investigation by the Colorado Division of Insurance, which regulates title companies. The division is a part of the Department of Regulatory Agencies. DORA spokesman Vince Plymell confirmed that the investigation was focused on Talley and the company but would not provide additional details.

Before coming to Colorado, Talley was a former regional financial officer at Drexel Burnham Lambert in Chicago, where he met his wife, Cheryl, a vice president at the company. The two married in 1989. Talley had formed a number of companies, some now defunct, according to the Colorado secretary of state's office. Among them: American Escrow, Clear Title, Clear Creek Financial Holdings, Swift Basin, Sumar, American Real Estate Services, and the American Alliance of Real Estate Professionals. In addition to its headquarters in the Peakview Tower near Fiddler's Green Amphitheatre in the Denver Tech Center, American Title has offices in Pueblo, Brighton, Boulder, Westminster, Lakewood, Wheat Ridge and Fort Collins, according to its website...

Demeter

(85,373 posts)The decision by Yadkin Valley Financial Corp. to exit the wholesale-mortgage business will result in the elimination of more than 70 jobs, though none in the Triad...Mark DeMarcus, the chief banking officer of Yadkin Valley, said Tuesday that the restructuring will allow the bank to focus on handling retail mortgages internally.

A wholesale-mortgage business sells home loans in large quantities through outside brokers. The business can function as a division of a large bank or serve as a stand-alone operation. The line of business became popular in the past decade because of increased demand for mortgage and refinancing. However, as the recession lessened demand for mortgages, banks large and small have chosen to exit the wholesale business. The trend of exiting the wholesale-mortgage business is being driven by lack of consumer demand, banks' decision to tighten lending standards and recent regulatory changes affecting brokers, said Arnold Danielson, the chairman of Danielson Associates, a bank consulting company in Bethesda, Md.

Sidus' wholesale-mortgage operations in Bedford, N.H., Easley, S.C., and Midlothian, Va., are being closed. Back-office jobs associated with Sidus' wholesale-mortgage operations in Greenville also will be eliminated. DeMarcus said all wholesale-mortgage operations will cease by Sunday. Sidus will maintain its retail mortgage offices, including one in Greensboro, which operates as First Mortgage Corp. DeMarcus said those operations will be eventually folded into Yadkin Valley Bank and Trust Co., the banking subsidiary of Yadkin Valley Financial. As part of the restructuring, Spencer Cosby Jr., the chief executive of Sidus, will retire on Dec. 31. Lisa Rogers, the mortgage director for Yadkin Valley Bank and Trust, has taken over mortgage operations for both subsidiaries.

Tony Plath, a finance professor at UNC Charlotte, said more banks are "moving way far away from the wholesale mortgage-origination business in favor of the less-risky, more-controllable retail-origination business."

"Securitizations are all but dead right now, and this business has been totally tainted by the residential mortgage crisis of late," Plath said. "This is more a sign-of-the-times in the mortgage industry than anything else."

Demeter

(85,373 posts)Last month, former Congressman Otis Pike died, and no one seemed to notice or care. That’s scary, because Pike led the House’s most intensive and threatening hearings into US intelligence community abuses, far more radical and revealing than the better-known Church Committee’s Senate hearings that took place at the same time. That Pike could die today in total obscurity, during the peak of the Snowden NSA scandal, is, as they say, a “teachable moment” —one probably not lost on today’s already spineless political class.

In mid-1975, Rep. Pike was picked to take over the House select committee investigating the US intelligence community after the first committee chairman, a Michigan Democrat named Nedzi, was overthrown by more radical liberal Democrats fired up by Watergate after they learned that Nedzi had suppressed information about the CIA’s illegal domestic spying program, MH-CHAOS, exposed by Seymour Hersh in late 1974. It was Hersh’s exposés on the CIA domestic spying program targeting American dissidents and antiwar activists that led to the creation of the Church Committee and what became known as the Pike Committee, after Nedzi was tossed overboard. Pike was an odd choice to take Nedzi’s place—he was a conservative Cold War Democrat from a mostly-Republican Long Island district, who’d supported the Vietnam War long after most northern Democrats abandoned it, and who loathed do-gooder Kennedy liberals and Big Government waste. So no one expected Pike to challenge the National Security State and executive privilege so aggressively and righteously—and some argued, recklessly—as he wound up doing.

The reason is simple if you think in 1975 terms. Pike was an ambitious political animal—and in 1975, standing up to the secrecy-obsessed NatSec State like Warren Beatty and Robert Redford did on screen seemed like smart politics. Pike was looking to trade up to the Senate in 1976, just as Frank Church was looking to use the Church Committee hearings to springboard into the White House. Pike was less interested in sensational scandals like Church’s poison darts and foreign assassination plots than he was in getting to the guts of the intelligence apparatus, its power, its funding, its purpose. He asked questions never asked or answered since the start of the Cold War: What was America’s intelligence budget? What was the purpose of the CIA, NSA and other intelligence agencies and programs? Were they succeeding by their own standards? Were taxpayers getting their money’s worth? Were they making America safer?

Those were exactly the questions that the intel apparatus did not want asked. The Church Committee focused on excesses and abuses, implying that with the proper reforms and oversights, the intelligence structures could be set right. But as the Pike Committee started pulling up the floorboards, what they discovered quickly led Rep. Pike and others to declare that the entire intelligence apparatus was a dangerous boondoggle. Not only were taxpayers getting fleeced, but agencies like the NSA and CIA were a direct threat to America’s security and democracy, the proverbial monkey playing with a live grenade. The problem was that Pike asked the right questions—and that led him to some very wrong answers, as far as the powers that be were concerned. It was Pike’s committee that got the first ever admission—from CIA director William Colby—that the NSA was routinely tapping Americans’ phone calls. Days after that stunning confession, Pike succeeded in getting the head of the NSA, Lew Allen Jr., to testify in public before his committee—the first time in history that an NSA chief publicly testified. It was the first time that the NSA publicly maintained that it was legally entitled to wiretap Americans’ communications overseas, in spite of the 1934 Communications Act and other legal restrictions placed on other intelligence and law enforcement agencies. It was also the first time an NSA chief publicly lied to Congress, claiming it was not eavesdropping on domestic or overseas phone calls involving American citizens. (Technically, legalistically, the NSA argued that it hadn’t lied—the reason being that since Americans weren’t specifically “targeted” in the NSA’s vast data-vacuuming programs in the 1970s, recording and storing every phone call and telex cable in computers which were then data-mined for keywords, that therefore they weren’t technically eavesdropping on Americans who just happened to be swept up into the wiretapping vacuum.)

Pike quickly discovered the fundamental problem with the NSA: It was by far the largest intelligence agency, and yet it was birthed unlike any other, as a series of murky executive orders under Truman at the peak of Cold War hysteria. Digging into the NSA’s murky beginnings, it quickly became clear that the agency was explicitly chartered in such a way that placed it beyond legal accountability, out of reach of the other branches of government. Unlike the CIA, which came into being under an act of Congress, the NSA’s founding charter was a national secret. In early August, 1975, Pike ordered the NSA to produce its “charter” document, National Security Council Intelligence Directive No. 6. The Pentagon’s intelligence czar, Albert Hall, appeared before the Pike Committee that day—but without the classified NSA charter. Hall reminded Pike that the Ford White House had offered to show the NSA charter document to Pike’s committee just as it had done with Church’s Senate Committee members, who had agreed to merely view the charter at a government location outside of Congress, without entering the secret document into the Senate record. Officially, publicly, it still didn’t exist. Pike refused to accept that:

Assistant Defense Secretary Hall told an incredulous Pike that he hadn’t brought the NSA charter with him as he’d been told to, and that he couldn’t because “I need clearance” and the charter “has secret material in it.”

Pike exploded:

Pike’s investigations led him to believe that the combined intelligence agencies were massively understating their budgets, and that the true figure was in the area of $10 billion in 1975 dollars (about $43 billion today), with the NSA by far the largest intelligence agency of all. Broken down, he discovered that about one-fifth of the FBI’s budget went to counterintelligence, largely wasted except as it targeted and harassed leftist dissidents and political opponents. He estimated that the CIA spent about a third of its budget bribing or funding foreign political parties and foreign politicians, including in allied countries like Italy. And that the NSA was a powerful tool in some of the most nefarious—and illegal—domestic surveillance programs.

MUCH MORE....MUST READ!

Sources include: "Puzzle Palace" by James Bamford; "Challenging The Secret Government" by Kathryn Olmsted; archived articles in the New York Times, Washington Post, Newsweek]

Demeter

(85,373 posts)Intelligence officials investigating how Edward J. Snowden gained access to a huge trove of the country’s most highly classified documents say they have determined that he used inexpensive and widely available software to “scrape” the National Security Agency’s networks, and kept at it even after he was briefly challenged by agency officials.

Using “web crawler” software designed to search, index and back up a website, Mr. Snowden “scraped data out of our systems” while he went about his day job, according to a senior intelligence official. “We do not believe this was an individual sitting at a machine and downloading this much material in sequence,” the official said. The process, he added, was “quite automated.”

The findings are striking because the N.S.A.’s mission includes protecting the nation’s most sensitive military and intelligence computer systems from cyberattacks, especially the sophisticated attacks that emanate from Russia and China. Mr. Snowden’s “insider attack,” by contrast, was hardly sophisticated and should have been easily detected, investigators found.

Moreover, Mr. Snowden succeeded nearly three years after the WikiLeaks disclosures, in which military and State Department files, of far less sensitivity, were taken using similar techniques...

MORE...TALK ABOUT EGG ON ONES FACE!