Economy

Related: About this forumSTOCK MARKET WATCH -- Tuesday, 14 April 2015

[font size=3]STOCK MARKET WATCH, Tuesday, 14 April 2015[font color=black][/font]

SMW for 13 April 2015

AT THE CLOSING BELL ON 13 April 2015

[center][font color=red]

Dow Jones 17,977.04 -80.61 (-0.45%)

S&P 500 2,092.43 -9.63 (-0.46%)

Nasdaq 4,988.25 -7.73 (-0.15%)

[font color=green]10 Year 1.93% -0.03 (-1.53%)

30 Year 2.57% -0.02 (-0.77%)[font color=black]

[center][/font]

[HR width=85%]

[font size=2]Market Conditions During Trading Hours[/font]

[center]

(click on link for latest updates)

Market Updates

[/center]

[font size=2]Euro, Yen, Loonie, Silver and Gold[center]

[/center]

[/center]

[HR width=95%]

[font color=black][font size=2]Handy Links - Market Data and News:[/font][/font]

[center]

Economic Calendar

Marketwatch Data

Bloomberg Economic News

Yahoo Finance

Google Finance

Bank Tracker

Credit Union Tracker

Daily Job Cuts

[/center]

[font color=black][font size=2]Handy Links - Economic Blogs:[/font][/font]

[center]

The Big Picture

Financial Sense

Calculated Risk

Naked Capitalism

Credit Writedowns

Brad DeLong

Bonddad

Atrios

goldmansachs666

The Stand-Up Economist

The Automatic Earth

Wall Street on Parade

[/center]

[font color=black][font size=2]Handy Links - Essential Reading:[/font][/font]

[center]

Matt Taibi: Secret and Lies of the Bailout

[/center]

[font color=black][font size=2]Handy Links - Government Issues:[/font][/font]

[center]

LegitGov

Open Government

Earmark Database

USA spending.gov

[/center][font color=black][font size=2]Handy Links - Videos:[/font][/font]

[center]

Charlie Rose talks with Roubini

Charlie Rose talks with Krugman

William Black: This Economic Disaster

Bill Moyers with Kevin Drum and David Corn

[/center]

[div]

[font color=red]Partial List of Financial Sector Officials Convicted since 1/20/09 [/font][font color=red]

2/2/12 David Higgs and Salmaan Siddiqui, Credit Suisse, plead guilty to conspiracy involving valuation of MBS

3/6/12 Allen Stanford, former Caribbean billionaire and general schmuck, convicted on 13 of 14 counts in $2.2B Ponzi scheme, faces 20+ years in prison

6/4/12 Matthew Kluger, lawyer, sentenced to 12 years in prison, along with co-conspirator stock trader Garrett Bauer (9 years) and co-conspirator Kenneth Robinson (not yet sentenced) for 17 year insider trading scheme.

6/14/12 Allen Stanford sentenced to 110 years without parole.

6/15/12 Rajat Gupta, former Goldman Sachs director, found guilty of insider trading. Could face a decade in prison when sentenced later this year.

6/22/12 Timothy S. Durham, 49, former CEO of Fair Financial Company, convicted of one count conspiracy to commit wire and securities fraud, 10 counts of wire fraud, and one count of securities fraud.

6/22/12 James F. Cochran, 56, former chairman of the board of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and six counts of wire fraud.

6/22/12 Rick D. Snow, 48, former CFO of Fair, convicted of one count of conspiracy to commit wire and securities fraud, one count of securities fraud, and three counts of wire fraud.

7/13/12 Russell Wassendorf Sr., CEO of collapsed brokerage firm Peregrine Financial Group Inc. arrested and charged with lying to regulators after admitting to authorities he embezzled "millions of dollars" and forged bank statements for "nearly twenty years."

8/22/12 Doug Whitman, Whitman Capital LLC hedge fund founder, convicted of insider trading following a trial in which he spent more than two days on the stand telling jurors he was innocent

10/26/12 UPDATE: Former Goldman Sachs director Rajat Gupta sentenced to two years in federal prison. He will, of course, appeal. . .

11/20/12 Hedge fund manager Matthew Martoma charged with insider trading at SAC Capital Advisors, and prosecutors are looking at Martoma's boss, Steven Cohen, for possible involvement.

02/14/13 Gilbert Lopez, former chief accounting officer of Stanford Financial Group, and former controller Mark Kuhrt sentenced to 20 yrs in prison for their roles in Allen Sanford's $7.2 billion Ponzi scheme.

03/29/13 Michael Sternberg, portfolio mgr at SAC Capital, arrested in NYC, charged with conspiracy and securities fraud. Pled not guilty and freed on $3m bail.

04/04/13 Matthew Marshall Taylor,fmr Goldman Sachs trader arrested, charged by CFTC w/defrauding his employer on $8BN futures bet "by intentionally concealing the true huge size, as well as the risk and potential profits or losses associated."

04/04/13 Matthew Taylor admits guilt, makes plea bargain. Sentencing set for 26 June; faces up to 20 years in prison but will likely only see 3-4 years. Says, "I am truly sorry."

04/11/13 Ex-KPMG LLP partner Scott London charged by federal prosecutors w/passing inside tips to a friend in exchange for cash, jewelry, and concert tickets; expected to plead guilty in May.

08/01/13 Fabrice Tourré convicted on six counts of security fraud, including "aiding and abetting" his former employer, Goldman Sachs

08/14/13 Javier Martin-Artajo and Julien Grout charged with wire fraud, falsifying records, and conspiracy in connection with JP Morgan's "London Whale" trade.

08/19/13 Phillip A. Falcone, manager of hedge fund Harbinger Capital Partners, agrees to admit to "wrongdoing" in market manipulation. Will banned from securities industry for 5 years and pay $18MM in disgorgement and fines.

09/16/13 Javier Martin-Artajo and Julien Grout officially indicted on charges associated with "London Whale" trade.

02/06/14 Matthew Martoma convicted of insider trading while at hedge fund SAC (Stephen A. Cohen) Capital Advisors. Expected sentence 7-10 years.

03/24/14 Annette Bongiorno, Bernard Madoff's secretary; Daniel Bonventre, director of operations for investments; JoAnn Crupi, an account manager; and Jerome O'Hara and George Perez, both computer programmers convicted of conspiracy to defraud clients, securities fraud, and falsifying the books and records.

05/19/14 Credit Suisse, which has an investment bank branch in NYC, agrees to plead guilty and pay appx. $2.6 billion penalties for helping wealthy Americans hide wealth and avoid taxes.

09/08/14 Matthew Martoma, convicted SAC trader, sentenced to 9 years in prison plus forfeiture of $9.3 million, including home and bank accounts

[HR width=95%]

[center]

[font size=3][font color=red]This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.[/font][/font][/font color=red][font color=black]

Demeter

(85,373 posts)Sitting in a control center that helps ensure uninterrupted power for 82 million Germans, Gunter Scheibner is proving that renewable energy from the sun and wind can be just as reliable as fossil fuels. Scheibner, in charge of keeping flows stable over 6,200 miles (9,976 kilometers) of transmission lines in eastern Germany, must keep power from solar and wind in harmony whether it’s sunny or overcast, windy or still. In doing so, he’s overcoming the great challenge for renewable energy: how to keep supplies steady when the weather doesn’t cooperate. The system Scheibner manages has been so successful that Germany experiences just 15 minutes a year of outages, compared with 68 minutes in France and more than four hours in Poland. The model in Germany, the biggest economy in the world to rely so heavily on renewables, is being copied from California to China as wind and solar displace traditional fuels such as nuclear and coal.

“Our job has become much more complex,” Scheibner said in an interview from the control center outside Berlin owned by 50Hertz Transmission GmbH, one of Germany’s four main grid operators. “It’s not an easy mission, and it will cost money. But if you are doing it consciously, then it will be doable. We have already come so far.”

Fossil Backup

Providing grid stability means predicting as accurately as possible how much power solar panels and wind turbines will produce. To improve that, companies like 50Hertz use data from five different weather forecasters to fine tune its operations. Still, the perception of renewable power as a fickle source that must be backed-up by fossil fuels, usually coal, remains. The Edison Electric Institute, an industry group based in Washington, and incumbent producers claim that variable flows from renewables will destabilize the power grid. Germany’s decade-long 120 billion-euro ($127.1 billion) investment binge to shift toward low-polluting energy forms is proving critics wrong. The country has raised its share of renewable power for electricity to about 28 percent, more than any source including lignite. In Scheibner’s region, it’s more than 40 percent. When transportation and heating are included, 9 percent of Germany’s energy comes from renewables, triple the U.S. level and six time what the U.K. uses, according to BP Plc.

Higher Concentrations

Researchers studying the grid say that a much higher concentration of renewables -- 50 percent or more -- is possible. That will come at a cost. Germany needs to invest 6.1 billion euros a year in its grid by the end of this decade to cope with additional wind and solar farms, the German Institute for Economic Research in Berlin estimated.

“There’s a myth among opponents of renewable energy that you need 100 percent backup spinning all the time, and it’s utter nonsense,” said Michael Liebreich, founder of Bloomberg New Energy Finance. “Any grid needs flexibility. You can have a nuclear plant shut down by jellyfish or a coal plant closed because of a freeze and you can’t shovel in supplies fast enough.”

MORE

Demeter

(85,373 posts)Around the world, inefficient pricing of water is putting lives—not just landscapes—at risk

In response to the ongoing drought, California Governor Jerry Brown has set limits on urban water use—ordering cuts of as much as 25 percent. Cities across the state will stop watering highway median strips and rip up grass in public places. Golf courses and cemeteries will turn on the sprinklers less frequently, and water rates might rise.

In many ways, this is an odd response to a water problem that’s largely about agriculture. But in that, California is a microcosm of an increasing proportion of the world: underpriced water used mainly for agriculture driving shortages that have nasty side effects on urban areas. The difference between California and the world’s poorest regions is that the side effects aren’t browning fairways but diarrhea, dehydration, and tens of thousands of deaths.

California has plenty of water for the people who live there—it's the crops and gardens that are the problem. Agriculture accounts for about 80 percent of the state’s water use. The state’s urban residents consume an average of 178 gallons of water per day, compared with 78 gallons in New York City, in large part because of how much they spray on the ground: Half of California’s urban consumption is for landscaping.

The big problem with the 90 percent of California’s water used on soil is that it's frequently provided below cost and according to an arcane distribution formula. Angelenos do pay more for their water than New Yorkers—at 150 gallons per person per day, a recent water pricing survey suggests they would pay $99 a month for a family of four, compared with $63 in New York. But they’d use less on the garden if water were priced to reflect long-term cost. And thanks to a skewed system of water rights and underpricing, many of California’s farms are idling land while others are devoted to water-hungry crops like almonds, using wasteful systems. A little under one-half of California farms still use inefficient forms of flood irrigation.

MORE

Demeter

(85,373 posts)Lambert: Sure! Paying back debt with money that’s worth more than the money you borrowed. What could go wrong?

Claudio Borio, Head of the Monetary and Economic Department, Bank for International Settlements, Magdalena Erdem, Senior Research Analyst in the Research & Statistics unit of of the Monetary and Economic Department, BIS, Andrew Filardo, Head of Monetary Policy, Bank for International Settlements, and Boris Hofmann, Senior Economist, Monetary and Economic Department, Bank for International Settlements. Originally published at VoxEU.

Concerns about deflation – falling prices of goods and services – have loomed large in recent policy discussions (see e.g. Cochrane 2014, Muellbauer 2014, The Economist 2015). The debate is shaped by the deep-seated view that deflation, regardless of context, is an economic pathology that stands in the way of any sustainable and strong expansion. However, the almost reflexive association between deflation and economic weakness is not so obvious. Seen as a symptom, deflation need not only arise from an aggregate demand shortfall, but also from greater supply, which would boost output. And seen as a cause, while it may be damaging – by pushing up real wages and unemployment, raising the real value of debt (debt deflation), or inducing consumers to delay spending – it may also be beneficial, by raising real incomes and wealth and making export goods more competitive. The cost of deflation is ultimately an empirical question.

Moreover, while the impact of price deflations of goods and services is ambiguous a priori, that of asset price ‘deflations’ – falls in their nominal values – is not. As is widely recognised, for given prices of goods and services, asset price deflations, in the form of declines in equity and property prices, erode wealth and collateral values and can undercut demand and output. Goods and services price deflations often coincide with asset price deflations. It is possible, therefore, to mistakenly attribute to the former the costs induced by the latter.

Data limitations have so far made it difficult to answer these questions. In our recent paper (Borio et al. 2015), we take a step forward based on a newly constructed data set that spans more than 140 years, 1870-2013, and covers up to 38 economies. In particular, the data include information on equity and property (house) prices as well as debt, relying in part on Schularick and Taylor (2012) and, for house prices, Knoll et al. (2014). The results are quite revealing.

Price Deflations and Output Growth: Link or No Link?

We define deflation in the prices of goods and services simply as a fall in the corresponding price index (here, consumers prices is CPI). We further distinguish persistent from transitory price declines as the former should be expected to be more costly. We identify persistent deflations as periods in which prices remain below the previous peak for at least five years.1

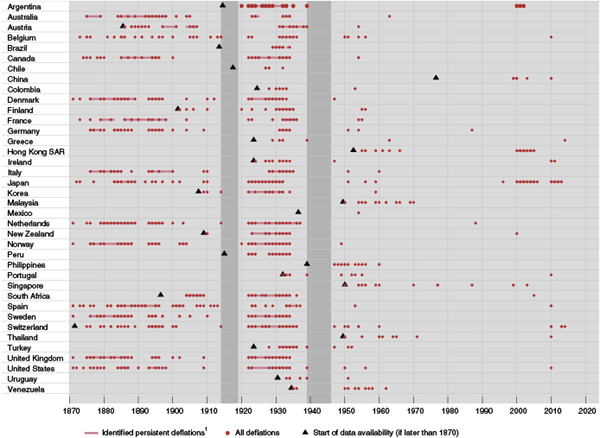

Figure 1 provides a bird’s eye view of the deflation record. Deflations are not so rare; in our sample, countries have been in deflation some 18% of the time (years). And, as is well known, deflations were very common before World War II. The bulk of persistent deflations took place then, only four have occurred postwar (in Japan (twice), China and Hong Kong SAR). That said, transitory deflations have not been that rare even in the postwar era; there have been well over 100 deflation years in our sample.

Figure 1. Deflations: Not so rare

EVER SO MUCH MORE AT LINK

Demeter

(85,373 posts)A Paris court on Monday found the heiress of the Nina Ricci perfume and fashion business guilty of tax fraud in a high-profile trial prompted by leaked lists of people who used the services of HSBC bank in Switzerland. Arlette Ricci, 73-year-old granddaughter of Nina Ricci, was sentenced to three years in jail, including two suspended, and ordered to pay a fine of 1 million euros ($1.05 million) in a verdict read out by a judge at a criminal court. She was tried on charges that she hid more than $22 million from the French tax authorities using accounts and offshore entities based in Panama.

HSBC's Swiss subsidiary is itself being pursued by French magistrates who suspect it of large-scale tax fraud. HSBC Holdings Plc was ordered last week to post a bail bond of 1 billion euros to cover possible fines in a move it said was legally groundless.

In an affair dubbed "Swissleaks", HSBC's Swiss private bank unit is being pursued along with scores of wealthy individuals whose names appeared on lists of some 3,000 client names leaked to French authorities by a former HSBC employee, Herve Falciani.

Demeter

(85,373 posts)schlag (shlahg)

Word Origin: noun, Viennese Cookery.

1.whipped cream, used especially as a topping for cake, coffee, etc.

http://www.reuters.com/article/2015/04/13/us-austria-heta-schelling-idUSKBN0N41LP20150413?feedType=RSS&feedName=businessNews

Austria is not prepared to provide unlimited help to the province of Carinthia as the region comes to grips with its debt guarantees for the "bad bank" Heta, Finance Minister Hans Joerg Schelling told the magazine Der Boersianer. A capital hole at Heta, which is winding down the remnants of defunct lender Hypo Alpe Adria, prompted the FMA financial watchdog to take control of the vehicle last month and freeze debt repayments until the end of May 2016.

Carinthia, Hypo's home province, holds more than 10 billion euros ($10.6 billion) in debt guarantees for Heta, and is trying to figure out how to handle them, given that its annual budget is only around 2 billion euros. No Austrian province has ever gone bankrupt and there is no legislation on how to handle such an event. Schelling reiterated his view that it would be a mistake to pass such a law now. Asked if that meant negotiations with creditors were in order, he said:

"Purely from a constitutional law perspective, the federal government is not obliged to back provinces. Only Carinthia as the (Heta) guarantor can take these steps, together with the FMA.

"What we can do is support and provide liquidity, but this will certainly not be unlimited, and will go primarily toward the orderly resolution of the provincial budget," he added.

The debt moratorium at Heta gives the FMA time to work out a plan to wind down Heta to ensure equal treatment of creditors. The FMA said last month it would not negotiate on the size of any losses it imposes on debtholders, the extent of which may become clear in about a year.

Demeter

(85,373 posts)Subzero rates have put some lenders in an inconceivable position: paying interest to those who have borrowed money from them...Tumbling interest rates in Europe have put some banks in an inconceivable position: owing money on loans to borrowers.

At least one Spanish bank, Bankinter SA, the country’s seventh-largest lender by market value, has been paying some customers interest on mortgages by deducting that amount from the principal the borrower owes.

The problem is just one of many challenges caused by interest rates falling below zero, known as a negative interest rate. All over Europe, banks are being compelled to rebuild computer programs, update legal documents and redo spreadsheets to account for negative rates.

Interest rates have been falling sharply, in some cases into negative territory, since the European Central Bank last year introduced measures meant to spur the economy in the eurozone, including cutting its own deposit rate. The ECB in March also launched a bond-buying program, driving down yields on eurozone debt in hopes of fostering lending.

In countries such as Spain, Portugal and Italy, the base interest rate used for many loans, especially mortgages, is the euro interbank offered rate, or Euribor. The rate is based on how much it costs European banks to borrow from each other. Banks set interest rates on many loans as a small percentage above or below a benchmark such as Euribor. As rates have declined, sometimes to below zero, some banks have faced the paradox of paying interest to those who have borrowed money from them. Lenders, hoping to avoid the expense of having to pay borrowers, are turning to central banks for guidance. But what they are hearing is less than comforting....

Demeter

(85,373 posts)Another day of beautiful weather....that makes 3!

Demeter

(85,373 posts)Last edited Tue Apr 14, 2015, 07:21 AM - Edit history (1)

and underneath those tender skies, pure madness reigns. THE TRASH TRUCK ARRIVED AT 7 am, THE FIRST SUCH ARRIVAL SINCE THE EARLY START OF A LONG WINTER...it is fortunate that I live on a dead end street, and thus get two chances.

Demeter

(85,373 posts)YOU MEAN, AIG ISN'T GOING TO DO IT?

http://www.bloomberg.com/news/articles/2015-04-13/financial-firms-move-closer-to-central-clearing-in-repo-market

Financial institutions in the almost $2 trillion a day market for borrowing and lending debt are close to unveiling centralized trade clearing systems to minimize risk in the essential wholesale funding mechanism. The Federal Reserve has been pushing firms to decrease the risk that a large dealer default, such as the collapse of Lehman Brothers Holdings Inc., triggers broad dislocations in the repurchase-agreement market, where banks typically borrow cash for a short time from investors using securities as collateral. The movement of repo transactions to clearing houses, which pool capital, would help ensure losses at one firm don’t harm all trading partners.

“A central clearing solution for repo is much more imminent now, with it likely just some quarters away,” said Darrell Duffie, a finance professor at Stanford University, who with the Federal Reserve Bank of Chicago, organized an April 10 symposium on clearing in Chicago. “This would improve transparency, create minimum standards and improve loss distribution because there would be more market participants that would share in counterparty losses should they occur.”

In 2008, the Fed was forced to create liquidity mechanisms to prevent the rapid dumping of debt, known as fire sales, and support its primary dealers. The inability to secure cash via the repo market was a catalyst for the demise of Bear Stearns Cos. and collapse of Lehman that sparked a near credit freeze.

Tri-Party Repo

The Depository Trust & Clearing Corp. said in October it was seeking regulatory approval to provide central clearing for government-related securities in the $1.66 trillion tri-party market. The Fixed Income Clearing Corp., a DTCC subsidiary, would guarantee securities such as Treasuries and mortgage securities backed by Fannie Mae and Freddie Mac...While the Fed has already succeeded through work with industry members to reduce the trillions in intraday credit that the tri-party market’s two clearing banks had previously extended daily to dealers, the potential for fire sales leaves the market still vulnerable, central bank officials including New York Fed President William C. Dudley have said. JPMorgan Chase & Co., which serves as one of the two tri-party repo clearing banks, is working with participants and infrastructure providers to create a central counterparty clearing house model that would provide benefits from both lenders and borrowers of cash, according to a person familiar with the work, who asked not to be identified because the system isn’t complete or yet public.

Swaps Clearing

After the 2008 crisis highlighted the threat posed by financial companies’ exposure to swaps, regulators including the Commodity Futures Trading Commission moved to require that most trades be guaranteed at clearinghouses including those owned by LCH.Clearnet Group Ltd., and CME Group Inc. Both are working on guaranteeing repo trades through their own clearing frameworks, according to two people familiar with each the development. One of main concerns about setting up a central counterparty for repo is whether it is possible to ensure that clearinghouses would have sufficient resources to meet a sudden surge in demand for cash upon a member default, possibly crippling its own ability to function. The resilience of CCPs, as the clearing houses are known, to withstand such extreme stresses has been the focus of regulators scrutiny this year.

“Central clearing doesn’t worsen the repo fire-sale risk, but so far there isn’t full clarity on how liquidity would flow into a CCP in the event that a lot of collateral needed to be liquidated quickly,” said Duffie, who is also a Bloomberg View contributor. “The Fed has not indicated it would be a lender of last resort to that market -- so you need private industry sources of liquidity. This is probably the biggest design problem to be overcome.”

SO IT'S A GAME OF HOT POTATO, COMBINED WITH OLD MAID, COMBINED WITH TIME BOMB...

THE MORE THEY REARRANGE THE DECK CHAIRS ON THE TITANIC, THE FASTER IT SINKS

Demeter

(85,373 posts)THE SPOILS OF EMPIRE....SPOIL THE EMPIRE

http://americasmarkets.usatoday.com/2015/04/13/risk-free-after-all-u-s-a-keeps-aaa-rating/

Fitch Ratings – one of the biggest providers of credit ratings for debt – affirmed its pristine AAA rating for the United States of America Monday. Getting the top rating from Fitch is a huge vote of confidence for the credit worthiness of the US of A. The U.S.’ longstanding gold-standard reputation as being “risk free” came into serious question in August 2011 when Standard & Poor’s took its rating on U.S. federal debt to AA+ from AAA. S&P is another of the biggest credit ratings agencies. S&P’s rating remains at AA+, one-notch below AAA. Fitch didn’t just reaffirm the USA as a AAA credit, but also said the outlook is “stable.” That word is extremely important with bond investors who aren’t just concerned about a creditors current financial situation, but more importantly, how it looks in the future. Fitch put a “negative” outlook on U.S. debt in November 2011.

The strong dollar was a part of Fitch’s rating. “The U.S.’ AAA rating is underpinned by the sovereign’s unparalleled financing flexibility as the issuers of the world’s pre-eminent reserve currency,” according to the Fitch rating note. Add to that – the federal government’s deficit is expected to fall in 2015 and 2016 from the 2.8% of gross domestic product last year, Fitch says. Government debt is seen falling from 100% of GDP in 2014, Fitch says. Meanwhile, foreign demand for U.S. debt remains strong. Foreign holdings of U.S. Treasuries rose 10%, or $560 billion, since October 2013, Fitch says.

Fitch’s rating is stable – but risks remain. A big runup in deficits and debt would be a problem. And then there’s Congress … and the risk of a “deterioration in the coherence and credibility of economic policy making.”

And that could never happen, right?

Demeter

(85,373 posts)Australia has been approved as a prospective founding member of the Asian Infrastructure Investment Bank (AIIB), China's Ministry of Finance said on Monday.

This brings the number of prospective founders to 47. Founding members of the AIIB have the right to make the rules of the bank. Countries that applied to join after March 31 will be ordinary members with voting rights only, and less say in the rule-making process. Founding membership will be finalized on April 15.

The AIIB will provide financing for roads, railways, airports and other infrastructure projects in Asia. It is expected to be established by the end of this year.

Demeter

(85,373 posts)TRYING TO PUMP UP THE PRICE FOR SUMMER DRIVING

http://www.bloomberg.com/news/articles/2015-04-13/shale-oil-boom-seen-ending-in-may-after-price-collapse

The shale oil boom that pushed U.S. crude production to the highest level in four decades is grinding to a halt. Output from the prolific tight-rock formations such as North Dakota’s Bakken shale will decline 57,000 barrels a day in May, the Energy Information Administration said Monday. It’s the first time the agency has forecast a drop in output since it began issuing a monthly drilling productivity report in 2013.

Deutsche Bank AG, Goldman Sachs Group Inc. and IHS Inc. have projected that U.S. oil production growth will end, at least temporarily, with futures near a six-year low. The plunge in prices has already forced half the country’s drilling rigs offline and wiped out thousands of jobs. The retreat in America’s oil boom is necessary to correct a supply glut and rebalance global oil markets, according to Goldman.

“We’re going off an inevitable cliff” because of the shrinking rig counts, Carl Larry, head of oil and gas for Frost & Sullivan LP, said by phone from Houston on Monday. “The question is how fast is the decline going to go. If it’s fast, if it’s steep, there could be a big jump in the market.”

West Texas Intermediate crude for May delivery climbed 32 cents to $52.23 a barrel in electronic trading on the New York Mercantile Exchange at 10:41 a.m. in London. Prices are down 50 percent from a year ago. The decline in domestic production will come just as U.S. refineries start processing more oil following seasonal maintenance, easing the biggest glut since 1930. The withdrawal from U.S. oil stockpiles is expected to bring relief to a market that’s seen prices drop by more than $50 a barrel since June. The relief may prove temporary as U.S. drillers are building a backlog of drilled wells that they plan to hydraulically fracture and place into service as soon as prices rebound. Analysts including Wood Mackenzie Ltd. have estimated that the inventory has grown to more than 3,000 uncompleted wells.

“U.S. production can return quickly with any price recovery,” Adam Longson, an analyst at Morgan Stanley in New York, said in an April 13 research note. “A backlog of uncompleted wells, falling service costs, hedging opportunities and plenty of capital on the sidelines should all support investment, perhaps more than the market expects.”

A BIT MORE..GOOD TO THE LAST DROP!

Demeter

(85,373 posts)Bill Ackman says the biggest risk in the credit market is student loans.

“If you think about the trillion dollars of student loans we have outstanding, there’s no way students are going to pay it back,” Ackman, who runs $20 billion Pershing Square Capital Management, said today at 13D Monitor’s Active-Passive Investor Summit in New York.

The balance of student loans outstanding in the U.S. -- also including private loans without government guarantees -- swelled to $1.3 trillion as of the second quarter 2014, based on data released by the Federal Reserve in October. The rising level has prompted investors and government officials to draw parallels to the subprime mortgage market before housing collapsed starting in 2006.

About $100 billion of federal student loans are in default, 9 percent of outstanding balances, according to a Treasury Borrowing Advisory Committee update on student lending trends released in November.

Ackman, 48, said “young people are the kind of people that protest” and predicted that one administration or another will forgive student debt.

MORE

antigop

(12,778 posts)DemReadingDU

(16,000 posts)Demeter

(85,373 posts)GREAT IDEA! LET THE NSA ROAM THROUGH YOUR MACHINES AT WILL...LET RUSSIAN AND OTHER HACKERS MAKE MINCEMEAT OF YOUR FINANCIAL FILES--ALL FOR A FEW CENTS OF UNDESERVED PROFITS FOR INFERIOR SOFTWARE FROM THE LAOWAI...

THIS IS WHY THEY WANT THAT TPP SO BADLY!

www.reuters.com/article/2015/04/13/us-china-security-letter-idUSKBN0N423X20150413

Business associations from the United States, Japan and Europe told Chinese officials on Monday they still have "strong concerns" about bank information technology rules and urged Beijing to formally suspend them.

The joint letter, from 31 trade associations, increases pressure over rules pushing China's state-owned banks to buy technology from domestic vendors, which the U.S. trade office has said could breach China's international trade commitments.

The "buy domestic" rule is one of several recent moves by China that have antagonized the U.S. and its top technology companies, including a draft anti-terrorism law assailed by President Barack Obama last month.

The groups, including the U.S. Chamber of Commerce, the European Services Forum and the Japan Chamber of Commerce and Industry, said the rules and other policies discriminate against foreign providers of internet and information and communications technology (ICT) products, solutions and services...

THAT'S THE BEAUTY OF IT! THAT'S A FEATURE, NOT A BUG!

Demeter

(85,373 posts)A former Rabobank Groep trader pleaded not guilty to U.S. charges that he participated in a scheme to manipulate Libor, the benchmark for trillions of dollars of securities. Anthony Conti, 46, of Essex, England, who didn’t fight extradition to the U.S., was released on a $500,000 bond secured by $40,000 in cash, permitted to keep his passport so he could return home and received permission to vacation in France.

Conti may go on trial in Manhattan federal court on Oct. 5, with Anthony Allen, Rabobank’s former global head of liquidity and finance, who pleaded not guilty to similar charges last month. They’re charged for their roles in an alleged scheme to artificially influence the U.S. dollar and yen London interbank offered rates to make money for Rabobank on derivatives tied to the benchmarks.

Rabobank agreed to pay $1.1 billion in October 2013 to settle investigations in the U.S., U.K. and the Netherlands into its involvement in manipulating Libor and related benchmark interest rates. Libor is used to determine the value of more than $300 trillion of securities, including interest rate swaps, mortgages and student loans.

Aaron Williamson, Conti’s lawyer, told U.S. District Judge Jed Rakoff that his firm received about 290,000 documents from the U.S. as part of the government’s “wide-ranging investigation.”

Rakoff said he wasn’t inclined to discuss any possible delay. “I know you’ll be working night and day,” the judge said.

Lee Stewart 51, who was a derivatives trader at the Dutch bank’s London desk from 1993 to 2009, pleaded guilty to a single count of conspiracy to manipulate the rate last month.

Allen made an initial appearance last month in federal court in Manhattan and was released on bond. He was allowed to return to the U.K. while he awaits trial.