And I sure wouldn't bet against one, either. I'm no expert in these things, but I think it's really difficult even for the experts to predict. This guy might argue with you.

https://www.hussmanfunds.com/comment/mc190805/

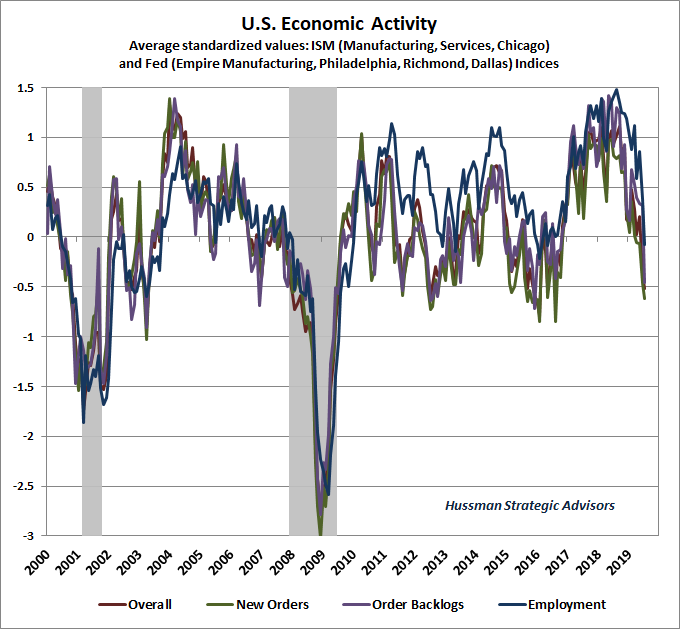

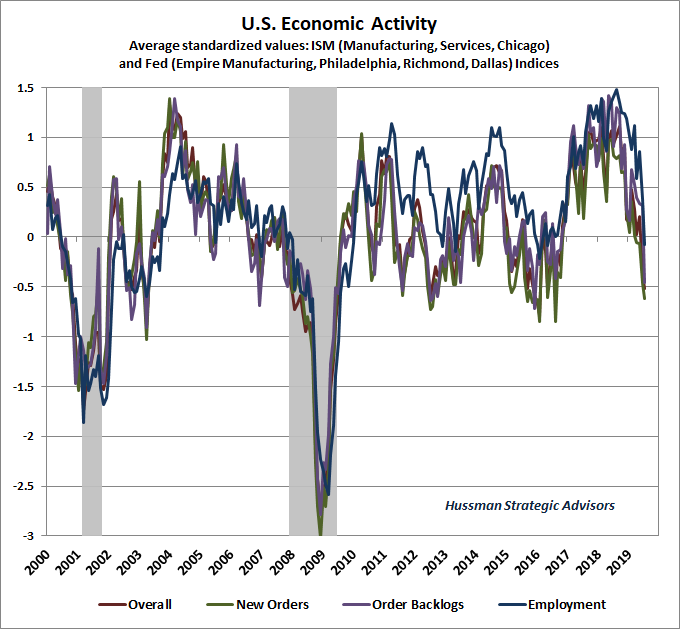

The chart below shows our economic composite drawn from standardized regional and national Federal Reserve and Purchasing Managers survey data.

You’ll notice that new orders (green) have experienced the strongest plunge in recent data, with the employment line (blue) slightly lagging that decline. That’s how the sequence of economic data typically evolves. New orders and backlogs, though volatile, generally lead. Production measures, not surprisingly, tend to coincide with broad movements in economic output. Finally, employment measures lag, sometimes considerably, because decisions surrounding job creation and layoffs tend to be careful and time-consuming.

As a result, if we think in terms of a 12 month year, we find that the 10-month change in our economic activity composite tends to be well-correlated with the employment “surprise” over the next two months – defined here as the difference between the actual change in non-farm payrolls and the average change over the previous 10 months.

The collapse we’ve observed in leading economic measures over the past 10 months is now consistent with monthly job creation falling nearly -350,000 jobs short of its 10-month average of 186,000, implying potential losses of as much as -164,000 jobs per month in upcoming reports. You’ll notice in the chart below that recent non-farm payroll data has clearly bucked these progressively deteriorating expectations. The last time we saw this sort of deviation was in October 2000, a month before the U.S. economy rolled into recession. Again, employment data lags, and month-to-month data can be noisy.

= new reply since forum marked as read

= new reply since forum marked as read